Why it’s smart to focus on female clients

Why it’s smart to focus on female clients

Women have enormous power in the economic and investment landscape, but their financial needs are often underserved by financial advisors—which is why it’s smart to actively court female clients.

In fact, some financial advisors even make a niche out of targeting female clients, with specialized websites, podcasts, educational programs, and events that appeal to the specific financial needs of women.

“In many ways, women control the financial markets, both through their wealth and their direct and indirect buying influence,” says Jay Blanchard, a financial representative with Peak Brokerage Services, LLC, in Williamsville, New York. “The economy is run by women’s choices.”

Women are responsible for the majority of household purchases and also heavily influence the purchases of men in their household, Blanchard says. “As an advisor, you’ve got to appeal to one of the major powers in the marketplace,” he says. “So how could you not address that?”

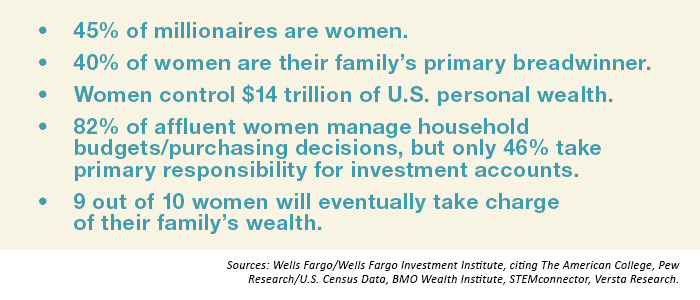

FINANCIAL INFLUENCE OF WOMEN IN THE U.S.

Wealth to Women

Blanchard has developed the Wealth to Women website, which features an educational program “to empower women to attract wealth, success, and beneficial relationships.” This program seeks to provide guidance to clients at all levels of investment knowledge—from the sophisticated investor to the novice.

“The biggest difference that needs to be addressed with this segment is that women tend to live longer than male clients, and that requires adjustments to most financial-planning decisions,” Blanchard says. “For this reason, it’s also important for financial advisors to encourage wives of male clients to participate in the financial-planning process if they are not currently involved. Understanding what practices we need to improve and how to best address the financial needs of female clients should be a priority for financial advisors. This should apply to all female clients—at every stage of their personal and professional lives. ”

When developing investment plans for female clients, Blanchard uses both strategic and tactical investing as a form of diversification. “I believe a strategic approach is very efficient and very cost-effective,” he says. “Tactical is not guaranteed, but it’s a method that historically has dampened losses.”

“$mart Women Invest”

Michelle McKinnon, CFP and senior wealth advisor at Payne Capital Management in New York City, and her colleague, financial advisor Jennifer Angell, offer a weekly “$mart Women Invest” podcast. The two financial advisors started it three years ago to be a source of business and investment information for women.

Within the podcast, guests and the hosts discuss not only best practices for investing but also “how to be smart in general,” such as best practices in building a network, says McKinnon.

“We often focus on entrepreneurs as guests, but we also have other types of professionals—anyone that has built something and has a great story,” McKinnon says. “In investing terms, we have found that women are less focused on specific performance data on their investments. But they are very concerned with knowing how to achieve their goals—and why an investment approach should work toward that end. Every female client has a different goal, so specific portfolio allocations are based on how to achieve what they need—we’re very goal-based,” she says.

In serving her female clients, McKinnon has seen that women tend to think more about the long-term than men typically do. She says that when it comes to investing, that is critical. McKinnon continues, “I’ve found men tend to be more focused on the day-to-day moves, while women acknowledge volatility as short-term and move past it. Men tend to be more emotional in this context.”

Women want—and also provide—better feedback

Janice Hammond, founder and CEO of Sunrise Financial Services in Burien, Washington, says her team devotes 50% of its marketing efforts to attracting female clients, while the other half is geared toward attracting couples. The firm has many clients who are same-sex couples.

“Female clients are great—they are generally nice to work with, which makes our job more enjoyable,” Hammond says. “They also tend to be more vocal than men, who often hold in their feelings and thoughts. If I don’t receive feedback from my clients, it makes it difficult to know where I stand.”

Sunrise Financial conducts many client events aimed at women, and while some are educational and feature informative speakers, others—such as the firm’s client-appreciation event—are designed for their clients’ enjoyment, she says. “Our clients love our events, but it’s also a unique opportunity to deepen our relationships with not only them but their friends as well,” Hammond says. “To that end, our events have been a great way to attract new female clients.”

Sunrise Financial conducts many client events aimed at women, and while some are educational and feature informative speakers, others—such as the firm’s client-appreciation event—are designed for their clients’ enjoyment, she says. “Our clients love our events, but it’s also a unique opportunity to deepen our relationships with not only them but their friends as well,” Hammond says. “To that end, our events have been a great way to attract new female clients.”

Women like “a story,” she says. If the firm is sending out a marketing piece, Hammond recommends that advisors should not fill it with investing jargon, but rather use language that provides context and links investing behavior with goals. For example, instead of saying “invest for a better return,” the firm might write something like “ways to have a stress-free retirement.”

Hammond says “risk management definitely plays a large role” in her investment philosophy for client portfolios.

“Even if they have all or most of their money in the stock market right now and they’re happy with the growth they have, my number one concern is protecting them and their assets,” she says. Hammond likes to engage in “a blend of both active and passive investment strategies for clients.”

“My philosophy, for the most part, is that if they are going to need money within the next 10 years, it’s critical to put it in something that’s going to tame the downside potential,” she says.

A national survey from LPL Financial found that, for women, achieving financial peace of mind is “over seven times more important than accumulating wealth.”

The LPL study says,

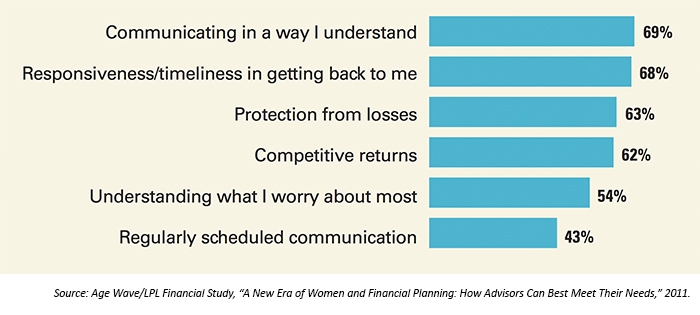

“They (women) see their investments as a way to protect and support their families and, as a result, they look for advisors who will listen to their concerns. They are deliberative and collaborative in making their decisions. They may take a long time to do research before they settle on a course of action, and often consult with a pool of experts. Just as important, they value good communication and service, focusing more on finding a partner they can trust rather than on obtaining short-term results.”

WHAT IS IMPORTANT FOR WOMEN IN AN ‘IDEAL’ ADVISOR?

Women want to be educated and part of the investment decision-making process

Nancy M. Hairsine, CFP, RFC, and founder of Lifetime Planning in Pittsburg, California, does not focus on serving women as a niche, but women have become a large percentage of her practice—over 60% of her clients are women.

“Women are becoming more involved in their finances and want to be understood,” Hairsine says. “Most importantly, they want to know they will be OK, and you will be there to guide them and direct them to meet the life changes and challenges that come their way.”

Women want to know that their advisors care—that they have their best interest at heart, she says. They want to be educated and part of the investment decision—but it’s not just about finances, it’s about getting to know all facets of their life, understanding their fears and concerns.

“You become their go-to person for advice about many issues—not just investment or money issues,” Hairsine says. “For my female clients, it’s about being able to maintain their lifestyle and do the things that are important to them. This could include family, traveling, volunteering, philanthropic endeavors, and being able to fulfill their dreams and their passions.”

Hairsine finds new female clients by getting involved in numerous associations that are geared toward women or have many women members, including her local Chamber of Commerce, the VFW Auxiliary, and her church. “The community needs to know you care, know you are involved,” she says. “It is important to let people know what you do. Be a resource, and the referrals will come.”

Risk management is a very important component of Hairsine’s investment philosophy for client portfolios. “It is important to plan for the what-if scenarios—what happens in a market downturn, change in health, relocating, downsizing, or a number of other life-changing events that can happen,” she says. “A portfolio needs to be flexible and fit those parameters. I want my clients to sleep at night and not worry about their portfolio.”

A portfolio might consist of both passive and active management styles, depending on the goals and risk tolerance of each individual client, Hairsine says.

“My clients depend on me to communicate and educate them on market expectations and setting realistic goals,” she says. “Having a strategy in place to protect the downside is critical, as this could have an impact on their lifestyle in retirement.”

Greg Gann, president of Gann Partnership LLC, based in Baltimore, Maryland, and a certified divorce financial analyst, similarly believes that the message of an actively managed investment approach that mitigates risk should resonate with female prospects and clients.

Gann says, “Because the female client is underserved, and because women, as the research so clearly indicates, are more averse to risk and very concerned with capital preservation, their characteristics make them in many ways the perfect clients for any financial advisor who practices active investment management. The tenets of active investment management also dovetail perfectly with an interest in securing self-sustaining retirements while also preserving a family legacy.”

***

It’s smart to court women clients, and even create a niche around them, these successful advisors and experts say. Tools and events geared toward educating female clients on how they can achieve their specific financial goals should be used, as well as finding ways to deepen relationships and further build trust. The payoff: more loyal female clients who are also more likely to refer friends and family—a strong foundation for a successful advisory business.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only. Views expressed by interviewees represent their personal opinions and do not necessarily represent the views of any firm or organization they may work with.

Nancy Hairsine is an investment advisor representative offering securities and advisory services through Foresters Equity Services, Inc., a registered investment advisor and member FINRA/SEC. Lifetime Planning and Foresters Equity Services are separate, unaffiliated entities.