Advisors value third-party active management

Advisors value third-party active management

Financial advisors favor third-party active investment management for a wide variety of reasons: access to modern analytical strategies, emphasis on risk mitigation, and the ability to be responsive to current market conditions and deliver high levels of client satisfaction over full market cycles.

Proactive Advisor Magazine is in its fourth year of publication in 2017 and is proud of its position as the investment industry’s only weekly magazine for fee-based advisors focusing on active investment management. This would not be possible without the insights from top financial and investment advisors.

Our editorial staff has interviewed dozens of successful financial advisors from every region of the nation. Their advisory firms represent many different business models in the industry and come in all “sizes and shapes.” But these advisors all share a commitment to bringing leading-edge portfolio management strategies and approaches to their clients.

They also share a strong desire to find investment solutions for their clients that will stand the test of time. Simply put, this means employing strategic approaches that can generate competitive returns in both bull and bear markets through the use of strong risk-management techniques. It also means adopting a planning and investment philosophy that can accommodate investors all along the risk spectrum and with varying levels of financial sophistication.

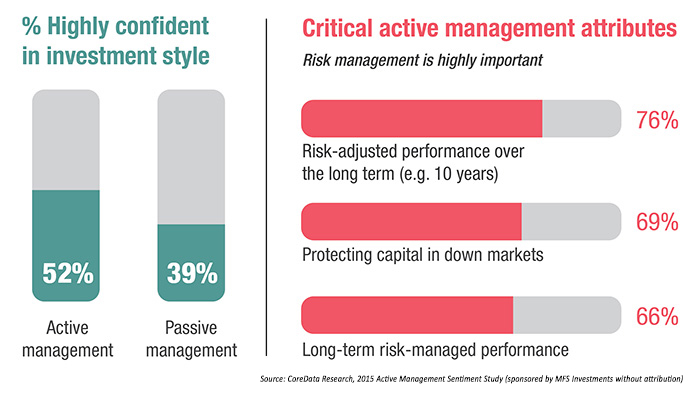

CoreData Research, an independent third-party research provider, conducted a commissioned study of more than 1,000 financial advisors, institutional investors, and professional buyers in the first half of 2015. The survey found that active management is the preferred broad investment approach for professionals—despite some significant investor flows into passive mutual funds in recent years.

According to the survey, close to 60% of U.S. professional investors surveyed said that actively managed strategies will play a significant role in their portfolios in the future. Fifty-two percent of the sample said they are “highly confident” in active strategies; the combination of “highly confident/confident” attributes averaged better than 90% for those surveyed. In comparison, only 39% said they were “highly confident” in passive strategies.

An updated version of the study, fielded by CoreData Research in 2016, shows that the percentage of assets under management allocated by investment professionals to active strategies is more than three times greater than their allocation to passive strategies, 74% to 20%.

FINANCIAL ADVISOR AND INSTITUTIONAL ATTITUDES

While such research is extremely informative, how do financial advisors and wealth managers express their philosophical and pragmatic beliefs in active management for client portfolios … in their own words?

Periodically, Proactive Advisor Magazine features excerpts from interviews that highlight advisor responses to a specific question about their attitudes regarding an aspect of active investment management. Complete versions of these advisors’ interviews can be found by clicking their names.

For this issue, we looked at how several advisors addressed the topic:

How has third-party active management added value to advisors’ practices?

It is an interesting investment environment today, especially for clients with a focus on income, future wealth distribution, and the potential tax consequences. I am looking for the growth of assets for clients, of course, but with a strong emphasis on asset protection and capital preservation.

One of the things I say in my client meetings is that everybody wants three things out of an investment: they want it to be completely liquid, they want their assets to grow, and they want a high degree of safety or stability. There is no such thing as an investment strategy that will provide an absolute guarantee on all three of those factors. But I explain to clients that I believe an actively managed portfolio can deliver a nice balance between all three. I like to fully educate clients as to the theory behind active money management, without getting overly technical. It has been a successful process since just about all of the long-term growth assets of my clients are in managed money strategies. I explain that this is a quantitative approach, not dependent upon a manager’s personal beliefs about the markets or economy.

One of the growing trends in our industry is the availability of self-directed investment options within retirement plans. Most people believe their only viable investment choices are within the usually pretty limited menu of funds offered by their plan. My “two-step” message is that they can take more control over their retirement planning and investments, and combine a self-directed option with professional active money management. A self-directed option opens up hundreds of investment options within a retirement account. We couple that with active investment strategies that are monitored by a team of professionals watching over portfolio strategies constantly, which creates an entirely new dynamic.

One of the growing trends in our industry is the availability of self-directed investment options within retirement plans. Most people believe their only viable investment choices are within the usually pretty limited menu of funds offered by their plan. My “two-step” message is that they can take more control over their retirement planning and investments, and combine a self-directed option with professional active money management. A self-directed option opens up hundreds of investment options within a retirement account. We couple that with active investment strategies that are monitored by a team of professionals watching over portfolio strategies constantly, which creates an entirely new dynamic.

It doesn’t matter if the market is trending up or down; clients have the potential for more peace of mind and better returns over their lifetime. In comparison, a passive investment is rarely monitored or adjusted, which can lead to both unsatisfactory performance and the sense of helplessness in the face of volatile markets. … If we can build in active money management and those institutional-level investing strategies today, when a client has some number of years left until retirement, why wouldn’t they want to take advantage of that?

Remember that we set the bar for a client’s success as we design their financial plan. Our goal is not to beat the market, but to achieve what they need for their risk tolerance and time horizon for each of their financial objectives. Using active money managers is an important tool that provides additional diversification and risk management. Over time, I believe this provides the opportunity for improved portfolio management and can help to smooth out volatility.

Remember that we set the bar for a client’s success as we design their financial plan. Our goal is not to beat the market, but to achieve what they need for their risk tolerance and time horizon for each of their financial objectives. Using active money managers is an important tool that provides additional diversification and risk management. Over time, I believe this provides the opportunity for improved portfolio management and can help to smooth out volatility.

Active strategies can help provide the opportunity for improved portfolio management and to smooth out volatility. Everyone can do well when the market as a whole goes up, but what happens when the market gets rocky? What happens to your portfolio at those critical times is extremely important, and that is when active management can really shine. This is not only important for the actual performance of a client’s portfolio, but also for a client’s emotional outlook. Knowing that we use managers who have quantitative models that are prepared to deal with market declines is reassuring for clients—it helps to keep them committed to their financial and investment plan.

How has third-party active management added value to advisors’ practices?

Our philosophy on managing money and wealth is really pretty simple: to protect against the downside and let upside gains run. We try to build portfolios that can reduce risk and volatility while focusing on the available long-term growth opportunities. Risk and volatility management is essential in helping clients to have success over the long term. Without a proper allocation, most people will have a lower return than is acceptable for the amount of risk they are taking.

Our philosophy on managing money and wealth is really pretty simple: to protect against the downside and let upside gains run. We try to build portfolios that can reduce risk and volatility while focusing on the available long-term growth opportunities. Risk and volatility management is essential in helping clients to have success over the long term. Without a proper allocation, most people will have a lower return than is acceptable for the amount of risk they are taking.

Active management, through the use of sophisticated strategies from money managers and some of our own proprietary work, has been taking hold at our firm over the past few years and should accelerate going forward. Far too often, I think, financial advisors have been limited in their investment strategy choices for clients. They are not necessarily doing anything wrong or not suitable, but we have ended up with an industry that essentially offers plain vanilla investment choices. Classic allocation strategies are like the cliché of driving while looking through the rear-view mirror. With quantitative, rules-based strategies, we think we can offer a new, more modern investment approach to clients.

I think I can bring value to clients around their investments in two major ways. The first is in the structure of their investment plan, making sure they are taking an appropriate amount of risk based on their profile for each of the various elements. The second is in selecting and employing professional money managers for their more growth-oriented assets that have longer time frames. The combination of both of these ties together two aspects of risk management and diversification that can provide a higher probability of success over the long haul.

I think I can bring value to clients around their investments in two major ways. The first is in the structure of their investment plan, making sure they are taking an appropriate amount of risk based on their profile for each of the various elements. The second is in selecting and employing professional money managers for their more growth-oriented assets that have longer time frames. The combination of both of these ties together two aspects of risk management and diversification that can provide a higher probability of success over the long haul.

That said, no investment approach is perfect, and there are always trade-offs involved. Actively managed portfolios with a strong risk component shine when markets go into pronounced downturns—that is where they really prove their value. During bull market periods, risk-managed strategies generally tend to underperform—that is their nature and a function of how they are designed. My role as an advisor is to make sure clients are educated on and understand those general performance characteristics. Within the broader context of an overall investment plan, active management can add significant value for my clients and value to my practice.