Are we living in an ‘acey-deucey’ world?

Are we living in an ‘acey-deucey’ world?

Risk is high in an investment environment driven by low rates and financial engineering.

Excessive debt is the problem in today’s world. It cannot be rectified unless you either have hyperinflation or a hard-debt deflation similar to the 1930s.

Corporations have taken advantage of borrowing at ultra-low rates and have used that money to purchase their stock—financial engineering at its best. Yet earnings are in decline here and globally. A concerning combination. Call me crazy, but I’m of the belief that an influx of fresh new capital (a global rush to dollars/safety) may propel U.S. stocks even higher.

With negative interest rates in Europe and a Fed edging ever closer to lifting U.S. rates (expectations range from June to early 2016), the advantage goes to the U.S. dollar with U.S. assets the beneficiary of global capital flows. That’s my thesis for now as we watch the equity market step higher, though not without volatility.

Remember the card game acey-deucey? You are dealt two cards and you split them. The dealer would then flip a third card. If that card number fell between your two cards, you’d win the pot. If you lost, you’d have to double the amount of money in the pot and the turn would move to the next player. The best combination was an ace and a deuce (2). This gave you the best odds to win, but it was a risk nonetheless and nerves were tested—especially as the pot grew bigger.

Why the first rule of investing is also the second rule.

Today’s investment environment kind of feels a bit like a version of acey-deucey, except we are holding a 5 and a 10—some opportunity but not a lot of room for error. As much as I know about global currency flows, valuation, supply and demand dynamics, and human behavior, I can’t help but wonder what it is that I don’t know. We live within a highly complex system with many moving parts.

Bullish market bets may still pay off, but recessions happen (often two times every decade) and risk is elevated. When the bubble is fully inflated, bear market declines can be at their greatest. Similar to 2000 and 2007, now is the time to have a stop-loss or hedged risk-management plan in place.

I was interviewed on a radio program recently, and the host asked, “What keeps you up at night?” I think, globally speaking, we need to face the hard reality of unmanageable debt. It involves restructure (some form of default), which in turn means underfunded pensions will become even more underfunded. Banks will take hits, investors will take hits, and economies will slow.

In the meantime, all of this is confusing to individuals who are not living every day in our professional investment world. Lack of planning can prove painful, and it is far easier to feel good and project yesterday’s returns forward—it is just so emotionally difficult to stay disciplined.

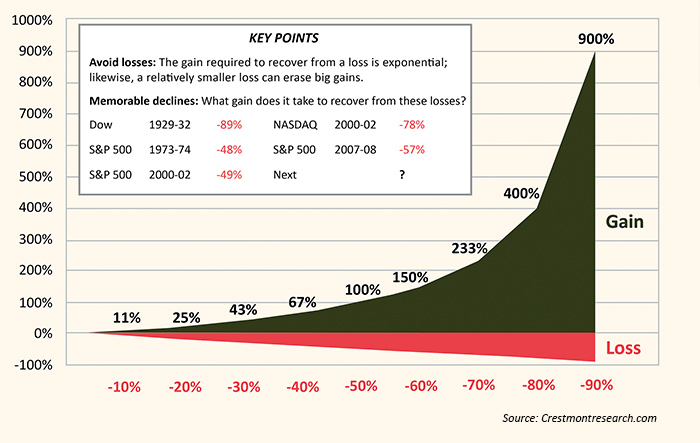

When valuations are high (like today), history tells us to expect very low forward 10-year returns. The bigger challenge, and coming opportunity, is to prepare investors for a period of high forward 10-year returns after a bear market occurs. Their confidence to invest will be challenged, so some advance prep work is required. It rarely feels like an opportunity during 40%-plus bear market declines (times of stress). That 40% decline can hurt more than you realize.

According to Ned Davis Research, during the average buy-and-hold stock market, an investor spends 77% of his or her time recovering from cyclical downturns in the market. 77% of the time! That is telling. It’s in the mathematics of loss: Remember, it takes a 100% gain to overcome a 50% decline.

The impact of losses

My belief is that many investors have come to expect 9% to 11% annual returns again, yet we currently live in a world where 4% to 5% returns might be a more reasonable expectation. If you are an older dog like me, you’ll remember investors expecting 18% gains per year or more in the late 1990s and 2000. One of my clients left our firm in December 1999 after her account had grown 30% over the prior two years. She was ultra-conservative and positioned accordingly.

The problem, of course, was that 30% paled in comparison to the 51% the S&P 500 gained in 1998-1999 or the 159% the NASDAQ gained over those two years. She told me she was going to a traditional broker and was investing in “safe stocks.” Her $1 million account fell to less than $500,000. Had she stayed, the same $1 million would likely have grown to over $1.3 million. It is tough to compare a conservative bond strategy to stocks, but I showed her the forward return probabilities back then, and I wrote frequently about a technology bubble. Unfortunately, it didn’t help. She was in her mid-60s then. Safe stocks. Right.

As a quick aside: Do you remember those NASDAQ gains in 1998 and 1999? An interesting data point is that more than three-quarters of all of the money invested in Fidelity mutual funds was concentrated in their technology funds. The NASDAQ crashed some 75% by mid-2002 and has only just recently surpassed those early 2000s levels. It took about 15 years to get back to even, but who was really able to stay with that bumpy ride back? The bigger question is, who took advantage of the buying opportunity that the dot-com crash created?

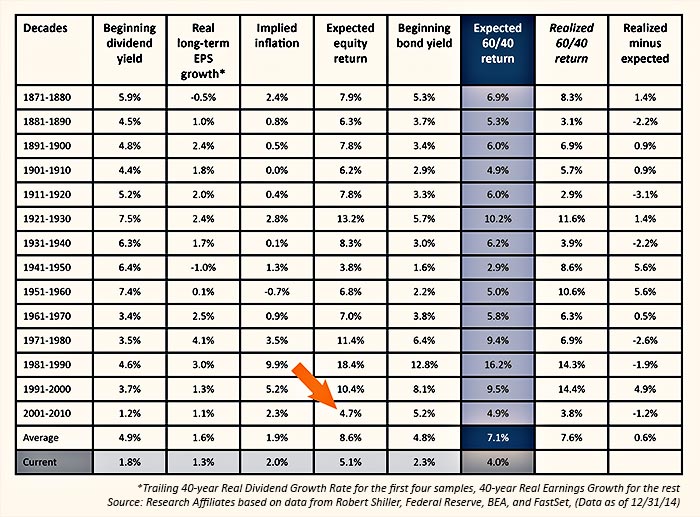

I believe we can get a good fix on what forward returns will be. Take a look at the following from Research Affiliates, which shows that by knowing the beginning dividend yield, EPS growth, and implied inflation, one can fairly accurately predict the expected equity return over the coming 10 years.

Take a look at the expected equity return for the 2001-2010 period. In 2001, the expected forward 10-year annual return was 4.7% per year (orange arrow in the chart). Not 9%, 11%, or the 18% many hoped for. The actual compounded annual growth rate, or return, using the source calculator for the S&P 500 Index, was just 1.4%.

Maybe: future returns are a shadow of the past

Expected return model for a 60% equity/40% bond portfolio

What can investors do? When there is a richly priced market, especially in a very low yield environment, investors need to be more defensive with their portfolios and incorporate more of a tactical approach.

For example, this might be a 30% equity/30% fixed-income mix, and then 40% to what I call “tactical alternative.” Mix in some tactical strategies that complement each other but don’t correlate. If the market gets hit, they can pivot from equities to fixed income, from more aggressive to less aggressive. Being tactical provides the option to act when markets change.

What’s hard for investors is that the market’s been up and they compare everything to the S&P 500, getting really concentrated in their risks. Now is the time for all investors to be seriously diversified and to incorporate risk management within their portfolios. While it is OK to play the occasional game of acey-deucey, it is wise to pick your spots and your wagers carefully and always have an exit plan.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.