Oil prices have been on a bit of a run recently, with prices rising for the third consecutive week through March 4—and up 37% from the 13-year low reached in January. West Texas Intermediate (WTI) crude settled last Friday at $35.92 per barrel, the highest price since early January (see Exhibit 1).

EXHIBIT 1: CRUDE OIL WTI (NYMEX)

Four major factors, other than mean-reversion price action, are being cited for the rebound:

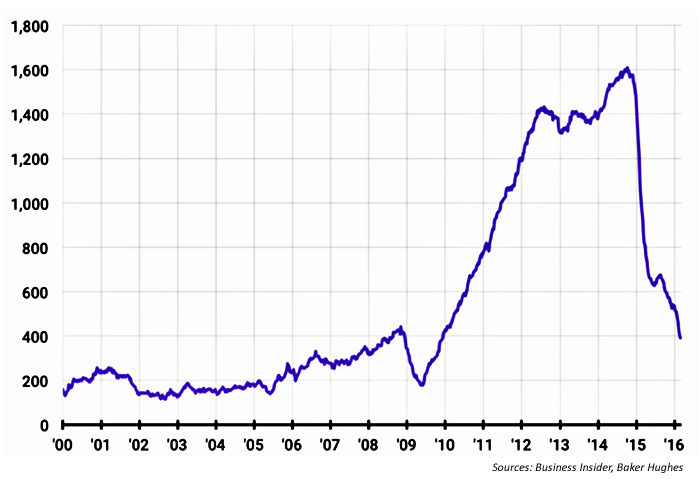

- A drop in the number of rigs drilling for crude in the U.S. The rig count, according to Business Insider’s reporting of Baker Hughes data, hit the lowest level since 2009 (see Exhibit 2).

- Continued speculation that Russia and Saudi Arabia will take more concrete actions after their February 16 meeting, which included the oil ministers of Qatar and Venezuela. At that time, according to Newsweek, they had all agreed to freeze oil output at January levels. More recently, Reuter’s reports that Iran’s oil minister has stated that his country “supports a production ‘ceiling’ to stabilize oil prices.” The trillion-dollar question is whether or not these intentions will truly play out in real actions by oil-producing countries.

- Improving economic data in the United States, perhaps best represented by the second round of data for Q4 2015 GDP released on February 26. Year-over-year growth was revised upward to 1.0%, versus a consensus outlook for a 0.4% gain. Further, last week’s surprisingly strong jobs report and an upturn in Institute for Supply Management (ISM) manufacturing data has helped further fuel some optimism, though wage growth remains disappointing and the ISM index still resides just below the important 50 level. Bespoke Investment Group commented over the weekend on the improvement in the manufacturing outlook: But the combination of strong sub-indices and back-to-back increases on a m/m basis as well as improved “hard” manufacturing data suggest that this sector of the economy is emerging from what we think could accurately be described as a recession in 2015.

EXHIBIT 2: US OIL RIG COUNT

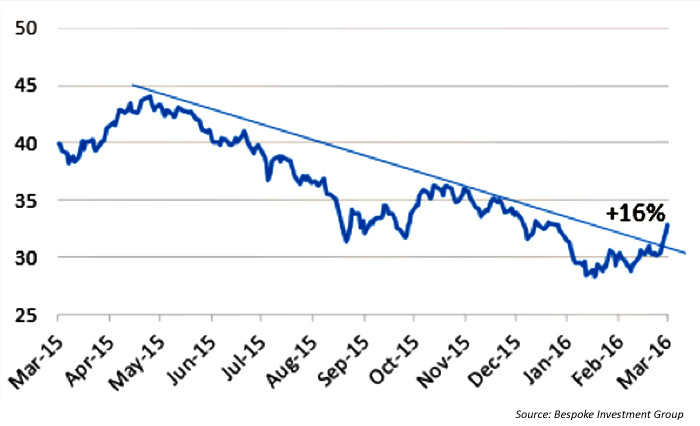

- A notable improvement in the mood and substantial rebound of equity markets around the globe. The S&P 500 is up more than 10% from its February lows and breadth, according to Bespoke, has improved considerably. Through March 4 more than 80% of stocks in the S&P 500 were trading above their 50-day moving averages—a vastly different picture than just a few weeks ago. Further, emerging-market stock markets have generally staged a comeback this year. Through the end of last week, the EEM ETF was up 16% from its recent lows (Exhibit 3). BRIC markets (Brazil, Russia, India, China) have mixed results YTD, but their combined ETF was up 10% last week. Both Brazil and Russia have been particularly strong in 2016.

EXHIBIT 3: EMERGING MARKETS ETF (EEM) LAST YEAR

However, Moody’s Investor Service now estimates that capital expenditures in the U.S. oil industry may fall by 20–25% in 2016, adding to the already deep cuts in prior years. 24/7wallstreet.com asks, therefore, if it is realistic or not for an imminent change in the “lower for longer” mantra regarding global oil prices.