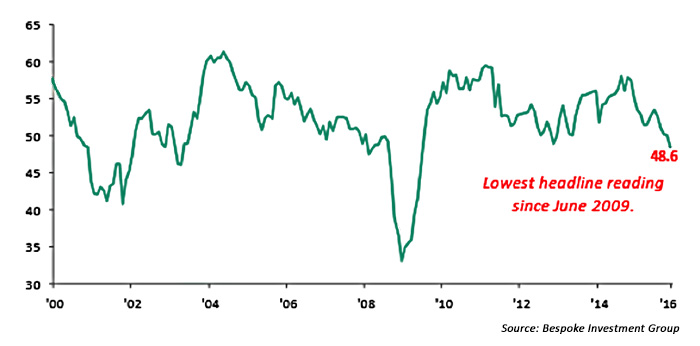

That said, the national ISM Manufacturing report added to some continuing concerns among fundamentalists, with the data showing the weakest reading since June 2009. The Chicago PMI report was also disappointing, with a sub-50 result of 48.7. Further, while the Dallas Fed analysis of current business conditions exceeded expectations (less bad than expected), its hard-hit manufacturing base contracted for the 11th straight month—not helped by struggling energy companies so important to the region

Regarding the national ISM figures, Bespoke Investment Group said:

Tuesday’s (12/1) report for the month of November was a big disappointment as not only did the headline number miss expectations (48.6 act. vs. 50.5 est.), but it also dropped below 50 (dividing line between expansion and contraction). It should surprise no one that the manufacturing sector in the U.S. has been struggling and is no longer the behemoth that it once was in the U.S. economy. However, when you have to go back to the last recession to find a time when any economic indicator was as bad as the current reading, it raises concerns.

Markets continue their obsession with all things interest-rate related, whether the prospects of the ECB and other central banks becoming more dovish, or the U.S. Fed more hawkish. But the diminishing prospects for U.S. and global growth are coming to the forefront.

Therefore, analysts and investors have several items on their holiday wish lists:

- A positive jolt to U.S. business investment, manufacturing activity, and consumers’ wage growth.

- A Q4 earnings season not overshadowed by energy sector drag, with that group’s earnings off 58.6% for Q3. (FactSet now projects an S&P 500 earnings decline of 4.3% for Q4, with materials and energy again the primary negative components.)

- GDP growth for Q4 that delivers a pleasant surprise versus the consensus estimate of 2.5%, and especially against the considerably more pessimistic forecast of the Atlanta Fed for 1.5% growth.

- A brightening of the tone for Street 2016 market forecasts, which to date have largely called for lackluster performance. Goldman Sachs, for example, sees the S&P 500 at 2100 by year-end 2016 and says markets “will continue to tread water for the second consecutive year.”

- And, perhaps most importantly, a decrease in global macro tensions, armed conflict, and violence of all kinds.

The question is, will Santa deliver?