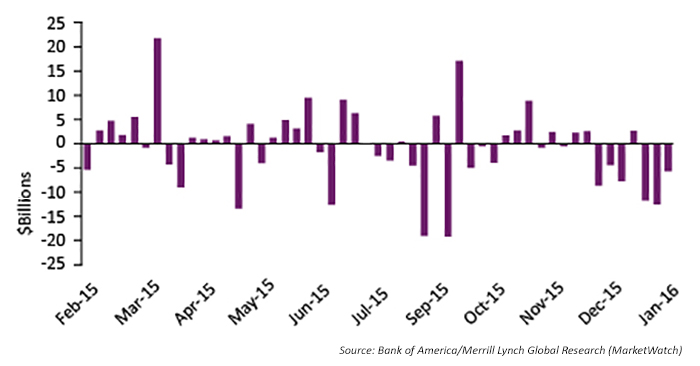

Despite the year’s first positive weekly close, Bank of America reported that U.S. investors pulled $24 billion from equity funds in 2016 (through 1/20). The rout has been deepest in emerging-market equities, said MarketWatch, as funds have seen outflows every week in the past three months.

WEEKLY EQUITY FUND FLOWS

However, global markets now appear to have three very important players (and maybe a fourth) on their side—far more than when 2016 was ushered in. Strategist David Moenning, of Sowell Management, recently summed it up as follows:

- The PBOC has provided the largest infusion of liquidity to the Chinese banking system seen in three years (this in response to the de facto tightening the drop in the yuan has created). … There [has also been recent] talk of a ramp up in easing measures in Japan.

- Draghi basically said last week that much had changed since December, that oil was becoming a problem, that the risks were now skewed to the downside, that the ECB stood ready, willing, and able to take additional action, and that the bank would be reviewing its monetary policy at the next meeting.

- Speaking of central bankers, the bulls could also point to a host of folks suggesting that Ms. Yellen may soon begin to publicly rethink the idea of raising rates every other time the FOMC meets in 2016. And if history is any guide, traders would probably welcome such news. (Editor’s note: This held true yesterday, with the FOMC taking no action and issuing more dovish comments.)

Although having the major central bankers of the world on your side is certainly a heartening development for bulls, there is major damage yet to overcome. Zero Hedge posted the following on 1/22:

It’s official. More than 50% of the “wealth” effect created from the 2011 lows to the 2015 highs has been destroyed (despite the world’s central banks going into money-printing overdrive over that period). Almost $17 trillion of equity market capitalization has evaporated in just over 6 months, with over 40 global stock indices in bear markets. … Nineteen countries with $30 trillion (in market cap) have declined between 10 percent and 20 percent, thereby entering a so-called correction, according to data compiled by Bloomberg.

For U.S. equity markets, it is at least good news that last week ended with the two most substantial back-to-back up days in more than three months. And, says strategist John Kosar of Asbury Research, “The benchmark S&P 500’s successful test of underlying support at 1821 last week, amid an historically high CBOE Put/Call Ratio, an aggressive rush of investors into the money market, and bearish extremes in investor sentiment, collectively suggest that the U.S. stock market is within weeks of an intermediate-term bottom.”

Mr. Kosar remains cautious, however, and cites needed reinforcement for the market from three areas: (1) narrowing corporate bond spreads, (2) a decline in market volatility, and (3) a sustained expansion in investor asset flows to indicate that last week’s bounce off of underlying support is sustainable. Until then, he says, “Near-term market risks remain to the downside.”