6 misconceptions about alternative investments

6 misconceptions about alternative investments

Alternative strategies provide a valuable tool to help investors manage risk in their investment portfolios, but this growing investment category is often misunderstood.

The investment category of alternative investments is perhaps one of the most challenging for both professionals and everyday retail investors to fully grasp. However, despite varying levels of misunderstanding of the category by many investors, it continues to show impressive growth over recent years.

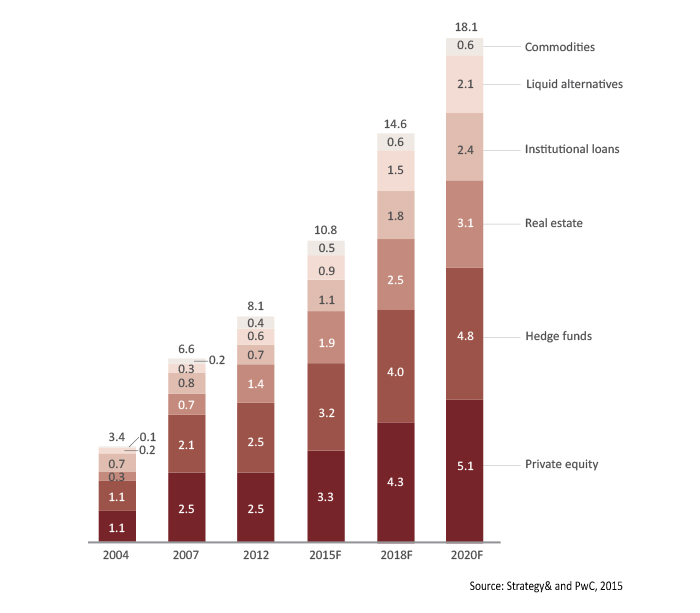

According to an in-depth study by PwC’s Strategy& group in 2015, “Alternative investments are growing dramatically, creating a major opportunity for asset managers and servicers. … By 2020, global assets in alternative investments will grow to U.S. $18.1 trillion, from $10 trillion today. … The market has seen an 11 percent compounded annual growth rate (CAGR) over the last decade.”

FIGURE 1: GLOBAL ALTERNATIVE ASSETS BY ASSET CLASS TYPE (U.S. DOLLARS IN TRILLIONS)

What accounts for this strong growth trend for alternatives?

Alternative strategies have the potential to be a viable way for investors, whether institutional or retail, to either create alpha or to reduce risk in their investment portfolios. My broad definition of an alternative investment includes those parameters. In my opinion, there are three characteristics that define a true alternative investment:

- It is an investment that can perform independently from stocks and bonds.

- It has a relatively low correlation to traditional investments.

- It can be added to portfolio allocations to mitigate risk and/or add alpha to the overall portfolio.

There are numerous money managers and financial advisors that use alternative investment strategies as a way to mitigate downside risk within an overall portfolio. Institutions have used alternative strategies for quite some time as a way to “smooth out the ride.” In addition, some investment managers using sophisticated tactical strategies have incorporated leverage and shorting strategies as alternative ways to either hedge or add alpha to a portfolio.

However, the mistaken assumptions about alternatives remain prevalent for many individuals, advisors, and institutions. I will review some of the most commonly stated misconceptions about alternative investments, followed by brief explanations.

Misconception #1: Alternative strategies are too volatile and only suited for aggressive investors.

Both financial advisors and investors tend to use alternative strategies as a way to mitigate risk, and these strategies have displayed the ability to dampen volatility when added to traditional stock and bond portfolios. Using alternatives could potentially be just as suitable for a conservative investor as a more aggressive investor. Many investment firms tend to include alternative strategies as part of a client’s overall asset allocation regardless of risk profile. In fact, many institutions have incorporated the use of alternatives within their portfolios partly for capital preservation.

Misconception #2: All alternative investment strategies are created equal.

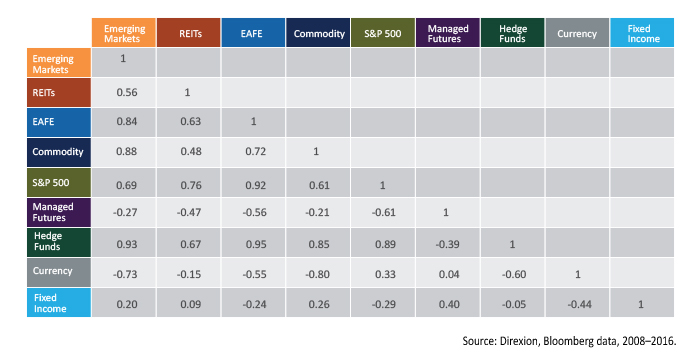

It is important to recognize that certain alternative strategies might have different risk/return characteristics. This means that certain alternatives and their appropriate allocations depend on the individual investor’s risk profile. In a number of cases, some alternative strategies have a low correlation to each other as well as to stocks and bonds. This is why many investment firms’ asset-allocation models recommend allocating across multiple alternative investment categories.

FIGURE 2: CORRELATION OF SELECTED ASSET CLASSES

Misconception #3: Alternative investments are only geared toward high-net-worth and institutional investors and are off-limits to retail clients.

Although this might have been true for most alternative strategies some time ago, different types of alternative investments have been made available to retail clients within mutual funds, ETFs, and the strategies of third-party money managers over the last several years. Alternative strategies such as absolute return/hedge funds, managed futures, currencies, commodities, long/short equity strategies, and global macro strategies have become available to the retail investor, either directly or through their financial advisor.

The liquidity, transparency, and regulatory oversight of alternative mutual funds and ETFs have made investing in alternative strategies more palatable to both retail and institutional clients. In fact, the emergence of alternative strategy mutual funds was made evident by Morningstar and Lipper creating distinct categories for different alternative strategies. Tactical strategies used by third-party active managers have gained new, more sophisticated tools that can now be used on behalf of clients with relatively modest portfolios, not just high-net-worth clients.

Misconception #4: Alternative investments should be viewed as stand-alone investments.

Although some alternative strategies have different risk/return profiles, when looking to add them to a portfolio, they should be viewed more as part of an overall portfolio mix. Institutions have used this idea for some time now, but retail advisors have only done so relatively recently. Many of the larger advisory firms are doing a good job of educating their advisors about the need for alternatives and the impact they can have within portfolios. Similarly, third-party investment managers who employ active, tactical strategies that can address various types of market environments find that alternatives offer a relatively noncorrelated risk-management tool as part of a total portfolio mix.

Misconception #5: Absolute-return strategies must show positive returns in every calendar year.

Although the mandate of an absolute-return strategy is to try to generate positive returns regardless of market environment, there are periods of time when these strategies might produce negative returns, albeit less so on a relative basis. For example, in 2008, although the broader hedge-fund benchmarks were all down for the year, absolute-return types of strategies were down significantly less than the S&P 500 and other major benchmarks. (According to Morningstar, absolute-return hedge funds reported an average loss of 19.1% in 2008, compared to a loss of 41% for the MSCI World Index.)

This relative outperformance was also true for certain other categories of alternatives, especially gold, which had positive single-digit price appreciation in 2008. One should look at an alternative investment over a sustainable period and full market cycles to really determine its value. No investment that is part of a longer-term solution should be viewed on a short-term window.

Misconception #6: Incorporating a small percentage of alternatives investments within a portfolio constitutes an adequate level of diversification.

Several academic studies have substantiated the belief that at least a double-digit percent allocation is necessary for alternatives to have a meaningful impact on an overall portfolio. Although this will vary depending on a client’s objective, on average, most investment firms recommend anywhere from a 10% to 30% allocation to various alternative strategies within an overall portfolio. This will work more effectively toward the objective of reducing the overall risk of the portfolio and potentially enhance returns over time. (The March 2017 issue of Barron’s Penta Magazine cited a survey of 40 top wealth-management firms, finding an average portfolio allocation to alternatives of 16.9%.)

Several academic studies have substantiated the belief that at least a double-digit percent allocation is necessary for alternatives to have a meaningful impact on an overall portfolio. Although this will vary depending on a client’s objective, on average, most investment firms recommend anywhere from a 10% to 30% allocation to various alternative strategies within an overall portfolio. This will work more effectively toward the objective of reducing the overall risk of the portfolio and potentially enhance returns over time. (The March 2017 issue of Barron’s Penta Magazine cited a survey of 40 top wealth-management firms, finding an average portfolio allocation to alternatives of 16.9%.)

One of the more admired endowment investing models, that of Yale University, was profiled by Bloomberg in 2015. The Bloomberg article said, “The success of the Yale investment strategy led to a transformation of almost every large college portfolio over the past two decades, from a simple mix of stocks and bonds to heavy weightings of alternative investments.”

For financial advisors dealing with mass affluent clients, especially those of the baby boomer generation, alternatives can play an important role in the strategies available to their clients through third-party managers who employ holistic portfolio solutions and tactical strategies. When a tactically-oriented money manager is making determinations on what asset classes to include, or which to over- or underweight, it is important for them to be able to take advantage of market fluctuations regardless of market direction. By incorporating alternative strategy tools such as leveraged and inverse ETFs, commodities, or managed futures, for example, it gives them the ability to potentially profit in any market cycle. And alternatives most certainly provide additional tools to mitigate portfolio risk. The ability to use a wide variety of investment choices is one factor separating successful long-term tactical managers from long-only managers who generally do not have the investment tools to benefit clients outside of a bull market.

Said PwC Strategy& in its 2015 analysis of the alternative investment landscape:

Alternative assets used to be a hidden corner of the financial world. Until the financial crisis, many investors thought that sticking to traditional equities and fixed-income investments was just fine. Alternative assets were a black box, expensive to invest in and hard to understand. No longer. … Greater access means that alternatives are becoming mainstream. The surge of investment in alternative assets has made them a central focus in asset management.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

An investor should consider the investment objectives, risks, charges, and expenses of the Direxion carefully before investing. The prospectus and summary prospectus contain this and other information about Direxion. To obtain a prospectus or summary prospectus, please contact the Direxion at 800.476.7523. The prospectus or summary prospectus should be read carefully before investing.

An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are nondiversified and include risks associated with concentration that results from the Funds’ investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts, forward contracts, options and swaps are subject to market risks that may cause their price to fluctuate over time. The funds do not attempt to, and should not be expected to, provide returns which are a multiple of the return of the Index for periods other than a single day. For other risks including leverage, correlation, compounding, market volatility and specific risks regarding each sector, please read the prospectus. Distributor for Direxion Shares: Foreside Fund Services, LLC.

Edward (Ed) Egilinsky is managing director, head of sales and distribution, and head of alternative investments at Direxion. He focuses on global product implementation, promotes ETF education and strategy, and manages the Direxion ETF sales team. As head of alternative investments, Mr. Egilinsky drives the firm’s product development initiatives, messaging, and support of product delivery. Mr. Egilinsky previously worked in leadership roles at Price Asset Management and Rydex Investments.

Edward (Ed) Egilinsky is managing director, head of sales and distribution, and head of alternative investments at Direxion. He focuses on global product implementation, promotes ETF education and strategy, and manages the Direxion ETF sales team. As head of alternative investments, Mr. Egilinsky drives the firm’s product development initiatives, messaging, and support of product delivery. Mr. Egilinsky previously worked in leadership roles at Price Asset Management and Rydex Investments.