5 facts common to stress and investment risk

5 facts common to stress and investment risk

Stress is common for almost everyone in their daily lives. When it comes to investing, employing dynamically risk-managed strategies can help alleviate the emotional stress that inevitably arises during a complete market cycle.

For most of us, “stress” is considered a bad word (and maybe an ever-present word these days). When we stress about work or relationships, we usually feel miserable.

In the same way, “risk” is viewed as bad by investors. I think many would agree that when we think of risk in relation to our investment portfolios we can feel miserable as well. The loss of a significant part of our investments can have a severe impact on the rest of our lives.

The National Institute of Mental Health has published a list of five facts you should know about stress. When I saw the list, I was struck by how applicable the items on it were to investors and their relationship to risk.

Stress is how the brain and body respond to any demand. Every type of demand or stressor—such as exercise, work, school, major life changes, or traumatic events—can be stressful. As these are common experiences, it is hard to imagine anyone who has not been affected by them.

In the same way, risk is ubiquitous. As I often say, it is always with us. It is hard to imagine an event that does not have some risk.

Similarly, no matter what form our investing takes, it, too, carries some risk. Sitting in a money-market fund or certificate of deposit comes with the risk of being overrun by the ravages of inflation. Buying bonds can cause loss of principal and stock-like volatility when interest rates rise. And when a financial crisis is upon us, one’s portfolio of stocks can melt down to half of its value in a relatively short time.

While we know that everyone deals with stress, we also know that some people have learned coping mechanisms to deal with stress. Those that have may be able to better withstand a substantial amount of stress, while those who haven’t may suffer from the presence of even minor stressors.

In the same way, some investors seem able to handle the risks of investing better than others. For this reason, professional financial advisors spend time trying to assess their clients’ suitability for various investment options. In turn, we work closely with financial advisors to help them better match clients’ investment strategies with their emotional and financial ability to stick with their investment plan over the long term.

Stress not only affects people differently, but it also appears in different forms. For example, we can experience both short-term stress and long-term stress.

When my dog Molly comes running into my house with a possum in her mouth, it creates a great deal of short-term stress. But that stress is nothing compared to the stress my family felt when my elderly mother struggled for months with pneumonia. Thankfully, she did eventually recover.

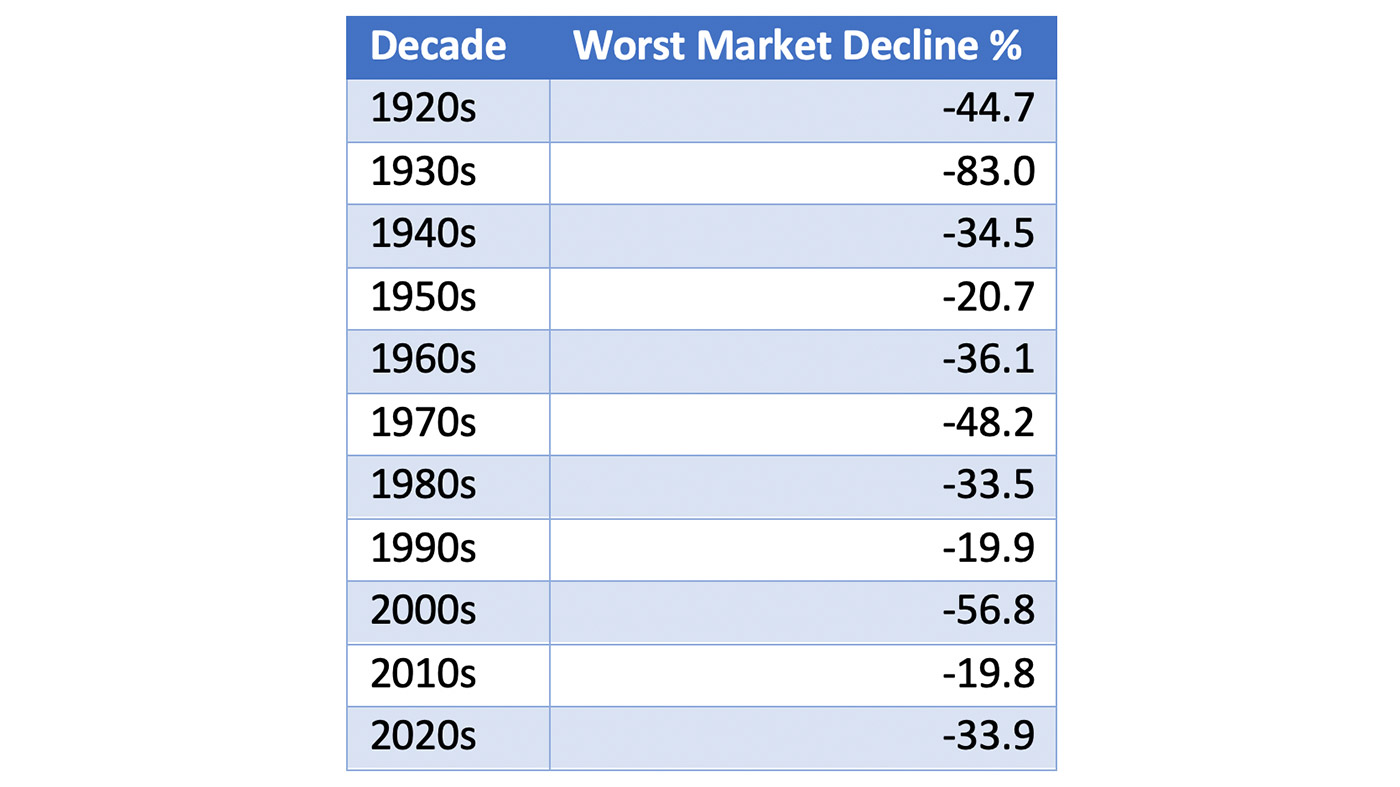

In investing, heightened periods of risk can emerge for both long and short periods as well. “Baby bear” markets, markets characterized by short-lived declines of less than 20%, appear to be just blips on a stock price chart when compared to the “super bears” (persistent declines of more than 20%) that can go on for two or three years.

While still stressful, most investors can generally handle baby bears from an emotional perspective. Super bears can not only do serious damage to investors’ sense of well-being, but–in the absence of effective portfolio risk management—they can also significantly impact their long-term investment and retirement plans.

Note: Declines measured from peak to trough of the correction period for the S&P 500 Index.

Sources: Yardeni Research, Standard & Poor’s Corporation, Haver Analytics

As world-famous sports medicine doctor Kevin R. Stone of the Stone Clinic wrote,

“Performance stress drives us to deliver our best. We push ourselves out of pride and fear, desperately wanting to deliver the best outcome and frightened of failing. We use stress to work harder, to show up early and leave late, to double check our work, and go the extra mile to get the job done. We use stress to train harder, to lift more weights, ride more miles, hit the gym with more vigor, and enjoy the pain of exertion.”

Stress increases the secretion of the stress hormones adrenaline and adrenal cortisone, which causes us to take in more oxygen. Stress causes these physical changes in a “fight or flight” reaction that, in many instances, can be the difference between harm and survival.

Risk, too, can be both bad and good. It is a general maxim in finance that as risk rises, so does return. Risk is often a necessary ingredient for opportunity.

Contrarian investing is based on the premise that investor perceptions of high risk occur at a time when risk is small because the crowd is usually wrong. We often hear that the market is oversold (there are more sellers than buyers), but at those moments, risk tends to be lower, not higher.

Similarly, at bear market bottoms, the average investor thinks that risk is high when in hindsight it turns out to be very low. What is perceived as risk at such times is really opportunity.

As I mentioned previously, stress can be inflicted for long periods of time, and bear markets of heightened risk can last for years. Yet, perhaps the most debilitating stress is routine stress.

When stress becomes constant in our lives—be it mental, emotional, environmental, or physical—the continual state of hypervigilance of our bodies and cells can be detrimental to our health. As the National Institute of Mental Health puts it,

“Routine stress may be the hardest type of stress to notice at first. Because the source of stress tends to be more constant than in cases of acute or traumatic stress, the body gets no clear signal to return to normal functioning. Over time, continued strain on your body from routine stress may contribute to serious health problems, such as heart disease, high blood pressure, diabetes, and other illnesses, as well as mental disorders like depression or anxiety.”

I think that this can also be the case for some investors. What turns off many to investing is having to deal with the daily stresses or risk of owning investments. Whether it’s the increased volatility evidenced in today’s markets, the perceived need to monitor the results daily, or the clash of conflicting views by the media talking heads, many investors feel shell-shocked after dealing with the risk of the typical market day.

Then there is the torture of making buy and sell decisions. Every day, the news on Wall Street makes it seem like a decision has to be made. Not only are these difficult decisions to make, but each carries with it some risk. For every good reason advanced to buy or sell, there is an equally compelling reason to take the opposite course of action. For every action, there is an associated risk.

Of course, like stress, these decisions can lead to depression and anxiety … but the risk encapsulated in a financial decision can also lead to a substantial loss of money.

Among other stress-managing recommendations, the National Institute of Mental Health suggests that the following can help many manage stress:

- Getting regular exercise. Just 30 minutes per day of walking can help boost your mood and reduce stress.

- Trying a relaxing activity. Schedule regular times for coping programs, which may incorporate meditation, yoga, tai chi, or other gentle exercises.

- Setting goals and priorities. Decide what must get done and what can wait, and learn to say no to new tasks if they are putting you into overload. Note what you have accomplished at the end of the day, not what you have been unable to do.

- Staying connected with people who can provide emotional and other support.

There are many ways to manage risk in investing as well.

Perhaps the most universally agreed upon risk-management methodology is diversification. Owning shares of multiple companies in a mutual fund or ETF is a simple example of this.

As we move to higher orders of diversification, we can own a number of these mutual funds or ETFs in our portfolios. Even more diversification can be obtained by holding different asset classes. This, too, can be done with ETFs and mutual funds.

In my opinion, the ultimate form of diversification is strategy diversification. By creating a portfolio of different strategies and asset-allocation methodologies, investors benefit from all of the various layers of diversification. Using mutual funds and ETFs, they can create a portfolio of strategies that diversify by asset classes and management approaches to deal with all types of market risks.

Of course, one of the strategies that can be employed in such a strategy-diversification plan is “buy and hold” investing. Many financial practitioners think this is the only one to consider.

“Buy and hold” investing allows individuals to remove themselves from the day-to-day monitoring and the buy and sell decisions. “Buy it and forget about it,” they say.

The problem with this reasoning is that we cannot divorce ourselves from the world. We are always being made aware of market risk, whether through various forms of media, our friends, relatives, or acquaintances. Even if someone is a buy-and-hold investor, he or she still quite naturally frets and stresses about it. That can cause him or her to take actions that are detrimental to their financial health.

Of course, the most damaging part of buy-and-hold investing is not the psychological stress. It’s that it doesn’t just expose investors to the risk of a “super bear” market and its potential 50%–75% losses in the popular stock indexes, but it guarantees that they will go through these financially deadly markets if history is any guide. (Omitting the distortion of the 1929 crash, the “average” bear market has seen S&P 500 prices drop by 36.1%, with 3.6 years needed to get back to “breakeven.”)

These super bears don’t just cause a few months of drawdown. Instead, these market events can require buy-and-hold investors to spend many years just trying to return to breakeven!

Employing dynamic, risk-managed strategies in a portfolio of strategies provides options to help defend against these super bears. These strategies employ not just diversification for risk management, but also hedging techniques, money-market investments to provide a safe harbor during market turndowns, and market monitoring with a view toward taking action rather than sitting and hoping.

We all need to become aware of and recognize bodily signs that we are under stress. Are you having difficulty sleeping, drinking or using other substances excessively, becoming easily angered, feeling depressed, or experiencing low energy? If trying to manage these warning signs yourself isn’t working, ask for help from friends, family, and community or religious organizations. Ultimately, if you are still suffering, the National Institute of Mental Health recommends that you talk to your doctor or health-care provider.

In the investment arena, if investors are overwhelmed by risk, they also should seek out help. If they find themselves paralyzed by market risk, unable to cope with the day-to-day onslaught of market news and views, sitting on the sidelines while the stock market soars, grinning and bearing it when interest rates rise and bond prices tumble, or holding on for dear life when a new financial crisis or recession surfaces and stocks grind lower daily for what seems like forever, they should seek out an asset manager that can help.

Such a professional should have a plan of action, the disciplined ability to follow it, and multiple tools to defend against the many forms of risk inspired by the various types of market environments investors will be exposed to sooner or later. Investors need such a professional, not just for good times or bad times, or only in times of low risk or high risk, but to deal with the different types of risk that arise during a complete market cycle.

Stress and risk are always with us. They each bring opportunities as well as deleterious long- and short-term effects. Through it all, we must remember that both can be managed and that help is available when either becomes too much to bear.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com