How gold can help in creating a more optimal portfolio allocation

How gold can help in creating a more optimal portfolio allocation

The role of gold in investment portfolios: Part II

Updated analysis supports an optimal portfolio allocation to gold of 20%.

Editor’s note: A revised and updated version of this article can be found here.

Editor’s note: Flexible Plan Investments, an active money manager and provider of risk-managed investment services, first authored an extensive analysis of the role of gold in investment portfolios in 2013. This white paper has been recently updated for 2022 and is being presented as a guest commentary in two parts in Proactive Advisor Magazine. Part I examined broad issues related to how investing in gold performed in specific market environments.

We are pleased to present Part II here, which looks more closely at gold’s performance in classic market regimes and offers broad conclusions on optimal gold allocations for investment portfolios. This analysis suggests an optimal gold allocation of 20%, which produced higher risk-adjusted returns than any other portfolio alternative.

Performance of gold in different economic regimes

It is clear from the examples and analysis presented in Part I that gold can provide favorable returns and act as an important counterbalancing portfolio component under a variety of very specific market and economic conditions that worry investors. But how does gold perform under different classic economic regimes?

A popular concept in modern portfolio theory is the “All Weather” approach to economic regime investing, with four different “states of the world” characterized by either rising or falling inflation and/or rising or falling economic growth. Bridgewater Associates, the large and very successful hedge fund mentioned in Part 1, has developed a simple conceptual graph to capture this idea (Figure 10).

Figure 10: Economic Regimes

Source: Adaptation of All Weather chart by Bridgewater Associates

In our analysis, we considered the different environments that could be characterized by the change in both inflation and economic growth, and then adopted Bridgewater’s identifying labels:

- “Normal”: Real economic growth rate (GDP) is rising and inflation (CPI) is rising.

- “Ideal”: Real economic growth rate (GDP) is rising and inflation (CPI) is falling.

- “Stagflation”: Real economic growth rate (GDP) is falling and inflation (CPI) is rising.

- “Deflation”: Real economic growth rate (GDP) is falling and inflation (CPI) is falling.

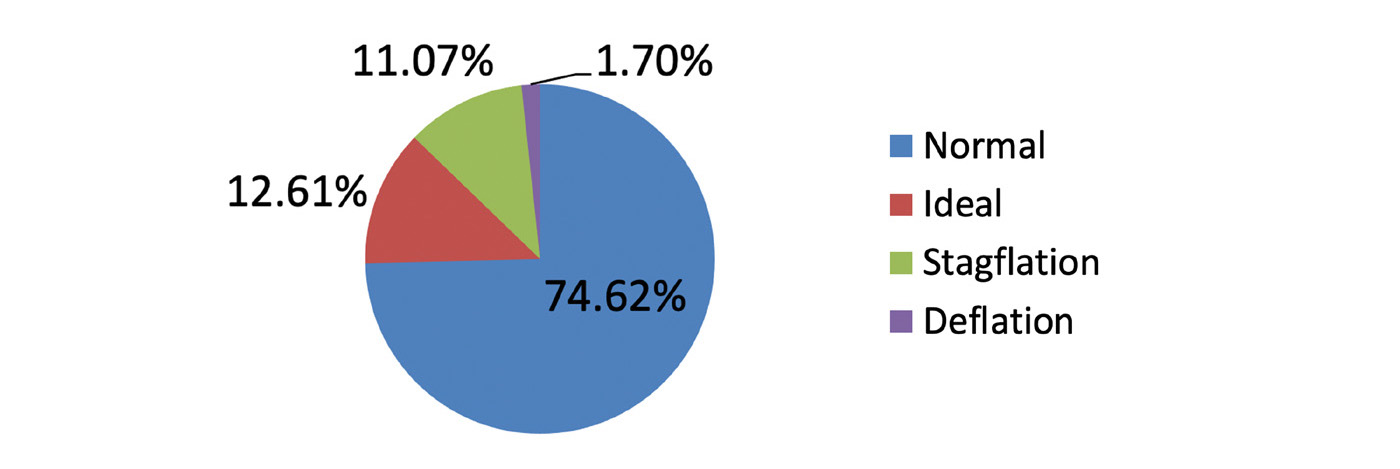

Figure 11 shows the relative frequency of these different economic regimes over the time frame of our study. As you can see, the most frequently occurring economic state (74.62%) was what we call “Normal,” characterized by rising economic growth and rising/moderate inflation. This is to be expected as most central banks around the globe tend to target a 2%–3% annual inflation rate, and governments and private industry obviously attempt to achieve economic growth over time.

Figure 11: Historical Frequency of Different Economic Regimes (1973–12/31/2021)

Source: Flexible Plan Investments

In contrast, the extreme opposite situation, “Deflation,” fortunately, has occurred relatively infrequently (1.70%). This is the destructive situation where both economic growth and inflation are falling. Japan is a modern case study of the deleterious effects of deflation. (The longest and most notable period of deflation in the U.S. was during the Great Depression, which is outside of the time frame of our study.) Governments generally attempt to avoid this situation at all costs, even if that means printing money and creating temporary excess inflation.

“Stagflation” is when inflation is rising and growth is falling. This has occurred just over 11% of the time. The most notable example of stagflation was during the 1970s when inflation was high, partially due to the energy crisis, and the economy endured some difficult times. We returned to this condition in the spring of 2022.

Finally, “Ideal” conditions are when inflation is falling but economic growth is robust and rising. This regime was present just under 13% of the time. This is a great environment for business expansion and for investors in many asset classes. The best example in recent U.S. history of an “Ideal” period is the 1990s. Ideal conditions also occurred as recently as 2019.

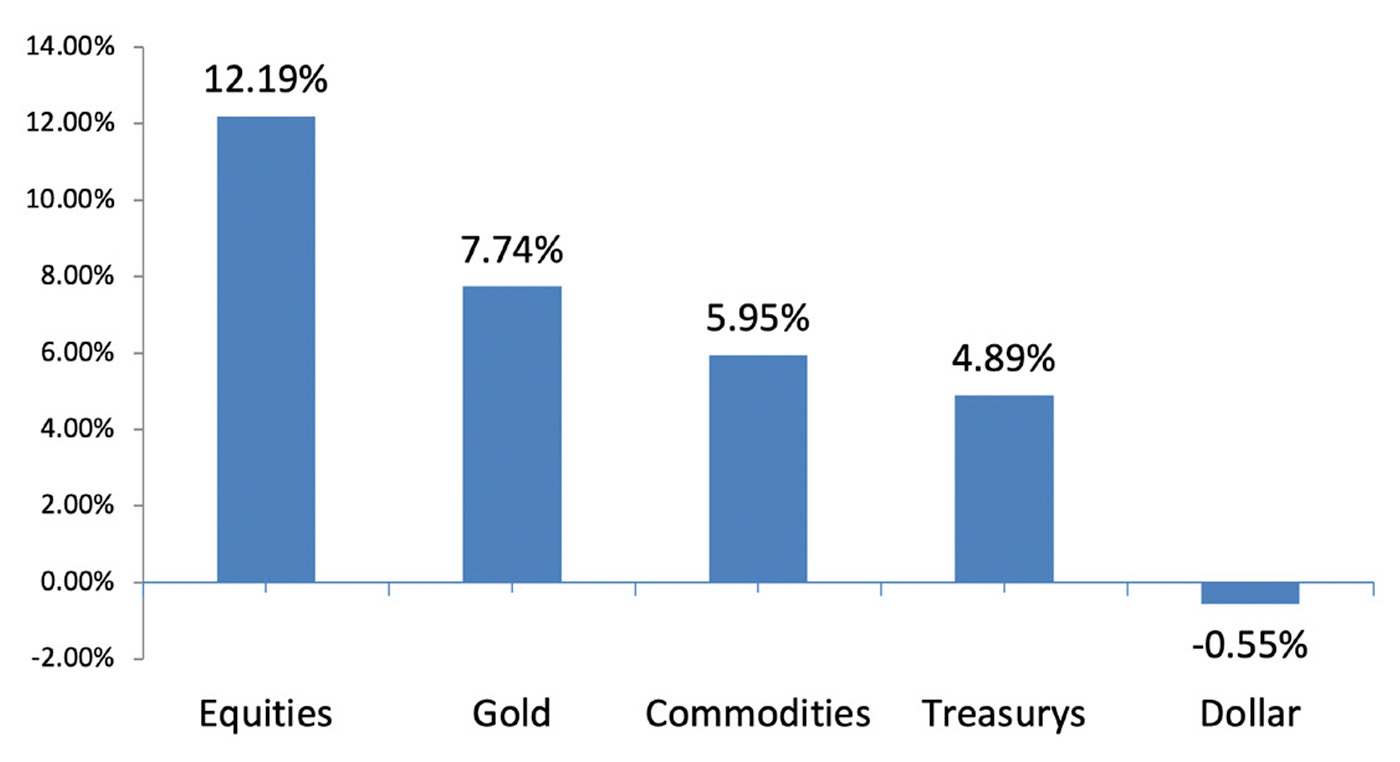

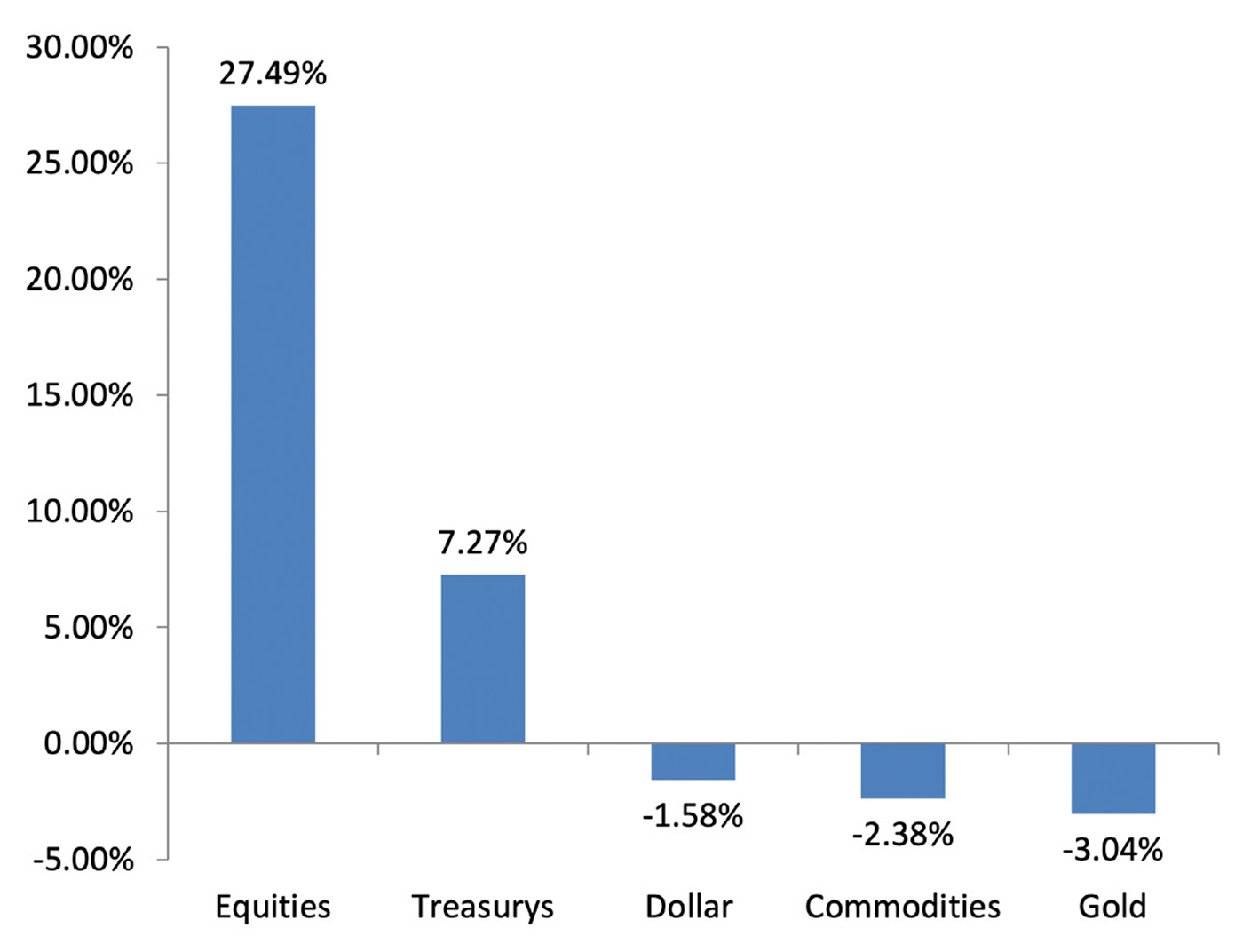

Figures 12 through 15 summarize the performance of our previously referenced asset classes during each of these economic regimes.

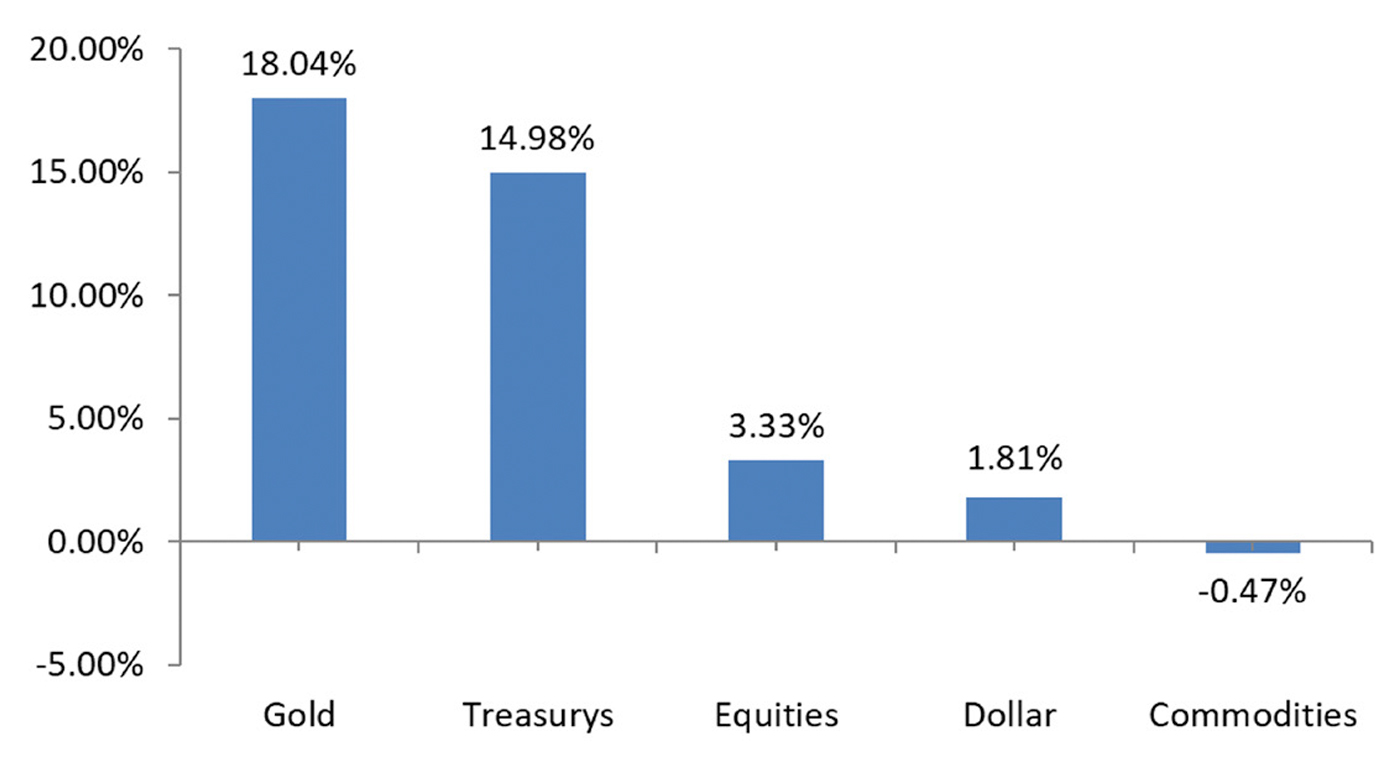

Figure 12: Performance of Various Asset Classes in ‘Normal’ Economic Conditions (1973–12/31/2021)

Source: Flexible Plan Investments

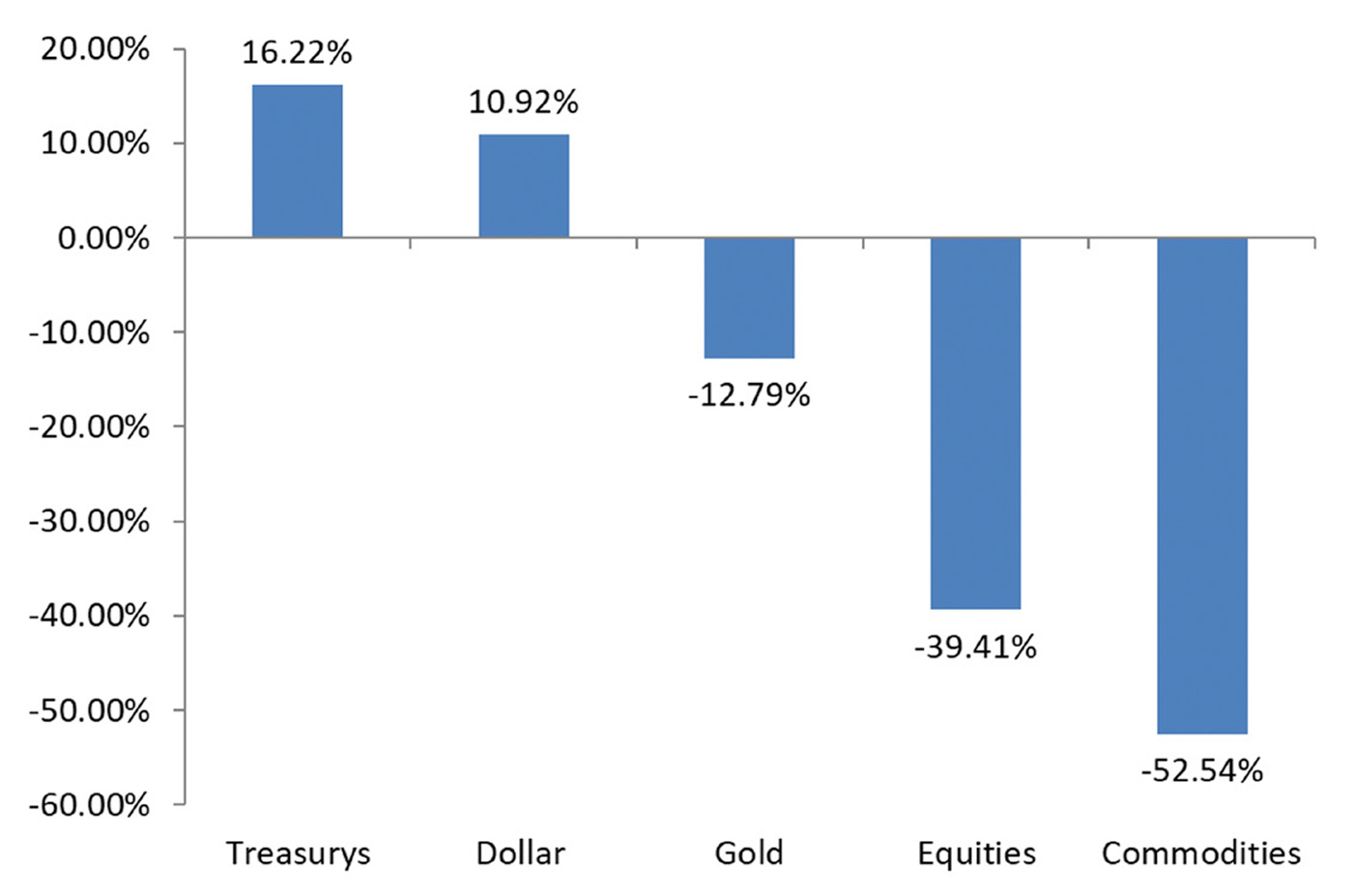

Figure 13: Performance of Various Asset Classes in ‘Ideal’ Economic Conditions (1973–12/31/2021)

Source: Flexible Plan Investments

Figure 14: Performance of Various Asset Classes in ‘Stagflation’ Economic Conditions (1973–12/31/2021)

Source: Flexible Plan Investments

Figure 15: Performance of Various Asset Classes in ‘Deflation’ Economic Conditions (1973–12/31/2021)

Source: Flexible Plan Investments

There are several takeaways from this analysis pertinent to gold:

- In the most commonly occurring circumstance of “Normal” economic conditions, gold finished second to equities in terms of average annual return.

- In “Ideal” conditions, equities provided the best performance.

- In times of “Stagflation,” gold provided superior returns to any other asset class.

- “Ideal” economic conditions occur slightly more frequently than “Stagflation” (13% vs. 11%). In all regimes other than “Ideal,” gold ranks in the top three among the asset classes. Gold underperformed equities significantly during “Ideal” conditions. Yet, during periods of “Stagflation,” gold’s 18.04% annualized gain versus the gain for equities of 3.33% is certainly a compelling statistic.

- Deflation was the worst of times for gold, although it did outperform both commodities and equities.

This, once again, reinforces the case for gold as an important portfolio diversifier. Gold provided positive returns under most market conditions. Gold was either number one or number two in performance 86% of the time during the time frame of our study. Gold may not outperform equities in times of normalcy and growth, but it has greatly outperformed equities in times of market stress and certain inflation scenarios. Because such times have had among the greatest negative returns for traditional equity portfolios, gold can have a significant effect on long-term portfolio volatility.

The role of gold in

investment portfolios

This two-part guest commentary

by Flexible Plan Investments explores

why investors should reconsider

their portfolio’s allocation to gold.

Part I: Understanding gold’s performance under different market scenarios

Gold as a diversifier versus other asset classes

The analysis presented illustrates that gold can provide diversification in several different economic regimes, each of which lies somewhere on the future economic horizon. But how does gold move in relationship to traditional asset classes such as stocks and bonds?

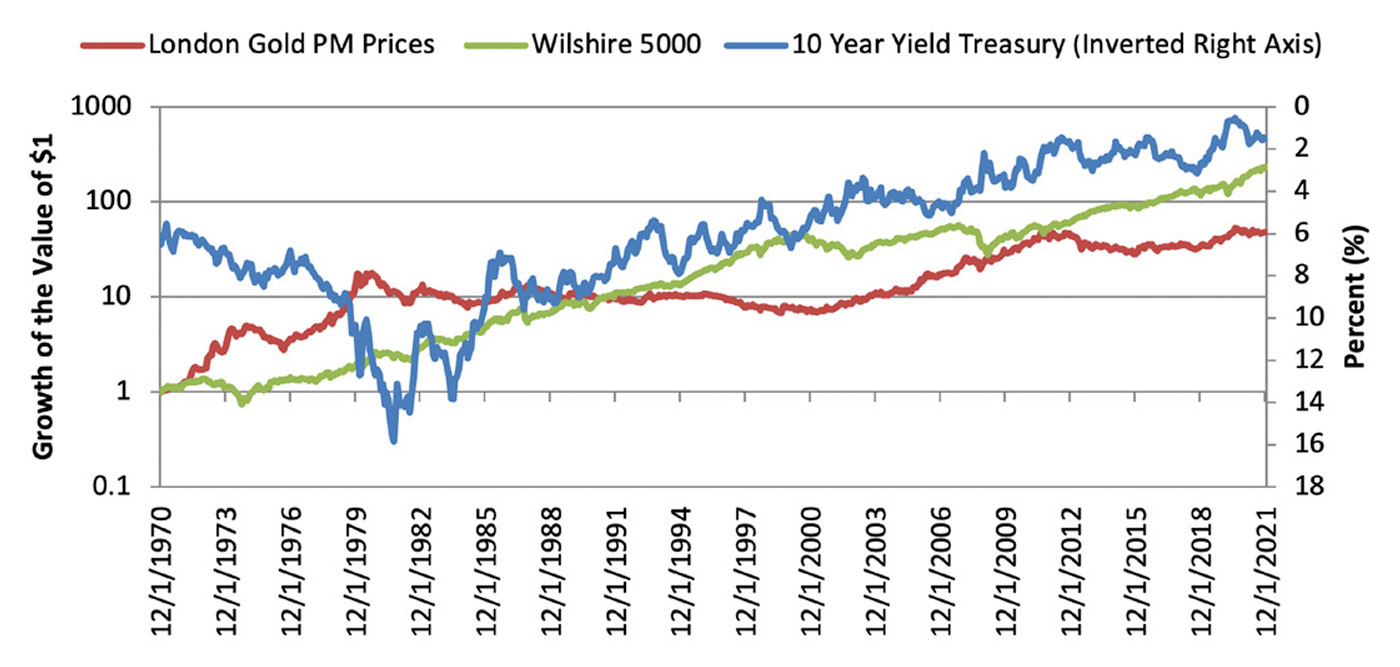

As Figure 16 illustrates, gold has provided a low correlation to both stocks and bonds and has not moved in tandem with traditional asset classes.

Figure 16: Gold vs. Stocks vs. Bonds (12/31/1970–12/31/2021, Adjusted for Inflation)

Source: Flexible Plan Investments

One of the statistical measures used to capture this relationship is the correlation coefficient, which ranges between 1 and -1. A coefficient of 1 indicates that the assets move in perfect tandem, while -1 indicates that the assets move in an opposite or alternating fashion. Table 1 shows the correlation of gold for a basic set of institutional asset classes.

Table 1: Gold as a Diversifier—Correlation Matrix for Basic Assets (February 1973–December 2021)

Source: Flexible Plan Investments

Gold had an average correlation of 0, indicating virtually no relationship/dependency with other basic asset classes. Gold had the highest correlation to the CRB Futures Index, which is to be expected because this represents exposure to the commodities sector, which includes gold. The second-strongest relationship between gold and another asset class was with the U.S. dollar, which should also be expected as gold is priced relative to the value of the dollar. When the value of the dollar decreases, gold becomes more valuable, and vice versa. Clearly, gold has been an excellent diversifier for a basket of basic institutional asset classes.

Capturing exposure to gold in an investment portfolio

Gold mining stocks, or shares of companies that primarily work in the business of mining gold ore, are often more accessible—and more popular in investment portfolios—than physical gold itself. A generally accepted relationship exists between gold mining stocks and gold ore because gold mining companies own the rights to the minerals inside the earth. There are significant costs to mining and refining gold, however, and the price of gold can and often does dictate profitability for gold mining stocks. This relationship means that gold mining stocks are significantly more sensitive to the price of gold. This section will examine the relationship between gold and gold mining stocks over more than two decades.

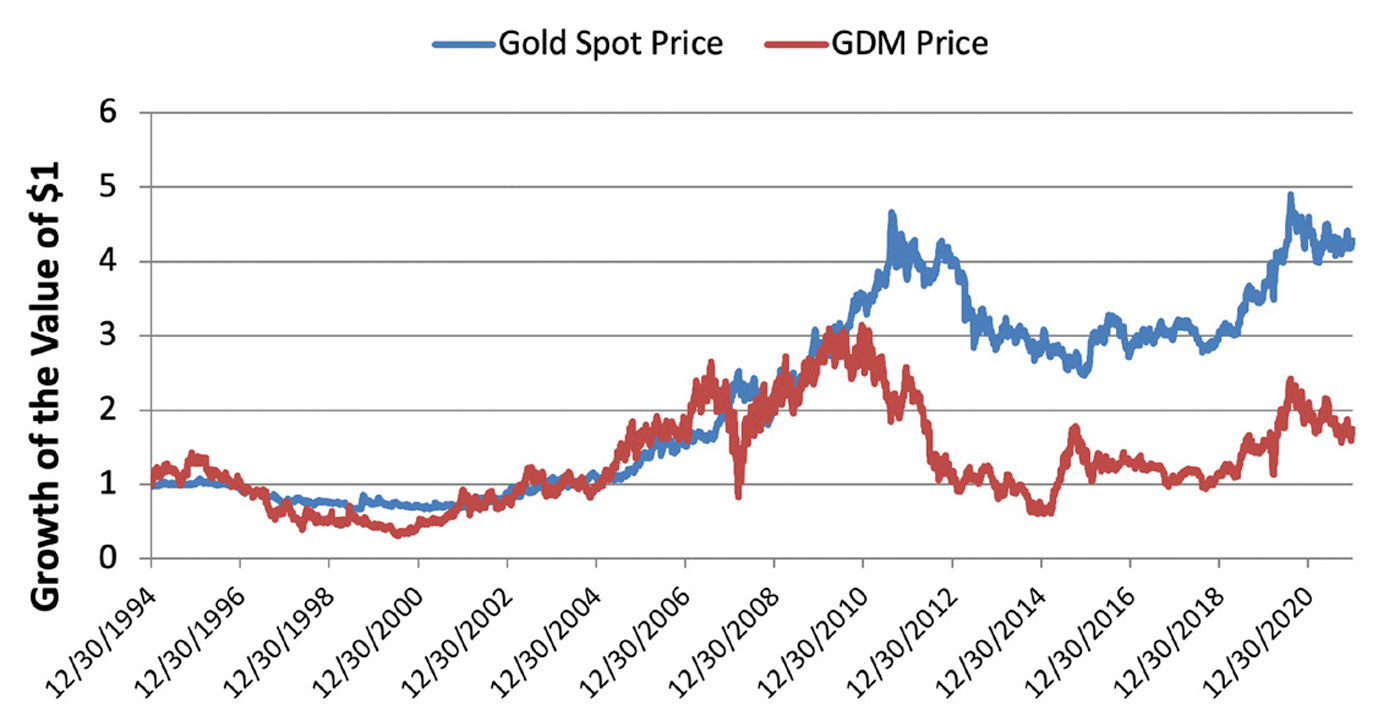

First, the relationship between gold spot prices and the returns of gold mining stocks must be examined through the scope of correlation. The two have a positive relationship: When the price of one rises, the price of the other rises as well. The extent to which one rises as a function of the other rising, however, is worth examining. From 1994 to 2021 the correlation between gold and the NYSE Arca Gold Miners Index was less than 10%, indicating little to no correlation. The relationship between the Gold Miners Index and gold may not be as strong as conventionally thought. Additionally, returns over the same period were drastically different. Figure 17 illustrates the growth of one dollar from 1994 (the first year of the gold mining share ETF) to 2021 for gold and the Gold Miners Index.

Figure 17: Gold vs. Gold Miners Index

Source: Flexible Plan Investments

It is clear that gold has been the more valuable investment over more than two decades. Table 2 displays several statistics used for observing risk and return in a portfolio context. The table shows just how much more beneficial it is to hold gold over gold miners.

Table 2: Gold vs. Gold Miners Index—Statistics (1994–2021)

Source: Flexible Plan Investments

The annualized return exposure to gold miners in an investment portfolio may be beneficial in pursuit of diversification, but holding gold instead of gold mining stocks can be a way of capturing additional upside potential while reducing risk. When compared to gold mining stocks, gold has less than half the annualized risk and an annualized return that is more than four percentage points higher over 28 years, making it the clear choice to hold in a portfolio.

Optimal portfolio allocations to gold

The World Gold Council released a study in 2022 that showed that institutional investors have embraced alternative investments to achieve better diversification, and gold has benefited from this shift. The study claims that global investment demand has grown on average 10% per year. The study adds, “Our analysis illustrates that adding between 4% and 15% in gold to hypothetical average portfolios over the past decade, depending on the composition and the region, would have increased risk-adjusted returns.”

But has gold boosted risk-adjusted returns for a more typical portfolio? What has the optimal allocation to gold been for such a portfolio? These are more important questions than finding the optimal allocation across a broad universe of asset classes that are more commonly held in large pension portfolios.

First, we define “typical”: The most common portfolio is one that contains a 60% allocation to equities and a 40% allocation to bonds, or what the literature might refer to as a traditional “balanced portfolio.”

As a test of gold’s possible diversifying power, we can use this typical portfolio and add a varying percentage allocation to gold to determine whether we can increase risk-adjusted returns. We will represent stocks in the portfolio with the Vanguard Total Stock Market Index, and for bonds, we will use the 10-year Treasury Total Return Index.

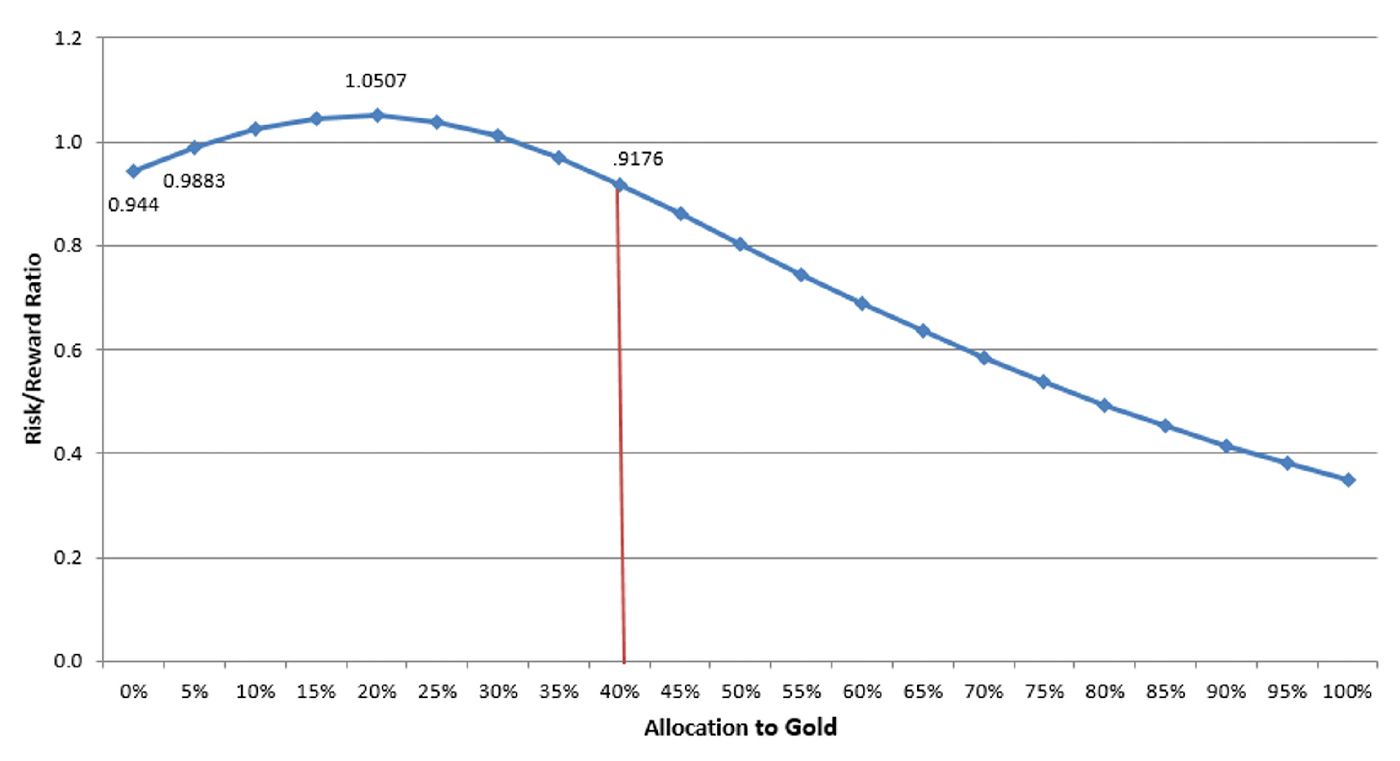

Figure 18 shows the risk-adjusted return ratio (Sharpe) as a function of the allocation to gold from 1973 to 2021. For reference, a balanced portfolio consisting of 60% stocks and 40% bonds has a Sharpe ratio of 0.944 over the time frame.

Figure 18: Risk-Reward Ratio as a Function of Allocation to Gold for a Balanced Investor (1973–12/31/2021)

Source: Flexible Plan Investments

Therefore, all of the “dots” left of the vertical line are portfolios that dominate a balanced portfolio in terms of risk-adjusted returns. In finance parlance, these portfolios are considered to lie on the “efficient frontier.”

Table 3 shows a more complete breakdown, providing data points for various levels of allocation to gold and the resulting total portfolio risk-reward ratio. All portfolios with allocations to gold ranging from 5% to 35% have been superior to a traditional balanced fund in terms of risk-reward ratio.

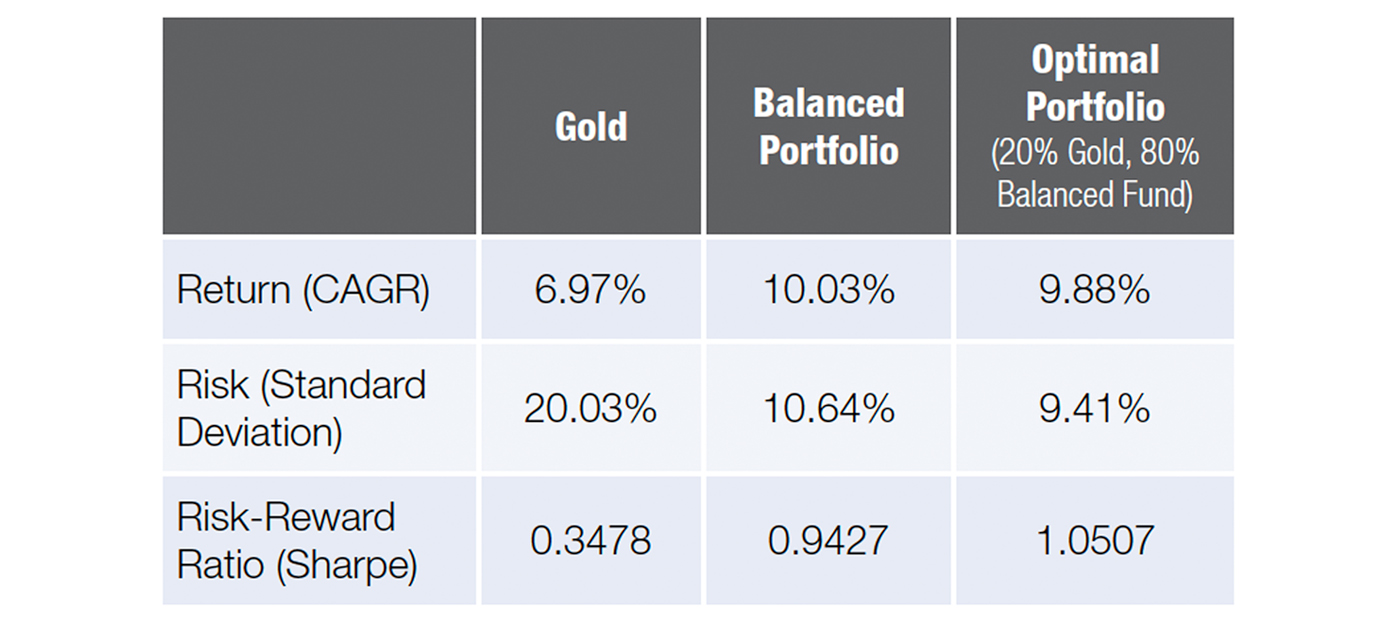

As Table 3 demonstrates, it has been possible to allocate as much as 35% to gold in a portfolio and still have a superior risk-reward ratio to a portfolio that holds only a balanced fund. This also shows that the optimal allocation from a risk-reward standpoint has been to allocate 20% to gold and 80% to a balanced portfolio.

Table 3: Risk-Reward Ratios of Portfolios with Different Allocations to Gold and a Balanced Fund

Source: Flexible Plan Investments

This is 5% lower than was optimal when we first released this paper in 2013—falling from 25% to 20%. Diversification has become relatively less important than returns in creating the best risk-adjusted portfolio, the bulk of that attributable to the relative strength in equities (excluding 2018, in which the S&P returned negative performance). Table 4 compares this “optimal portfolio” with both gold and a balanced portfolio.

Table 4: Gold vs. a Balanced Portfolio vs. an ‘Optimal Portfolio’

Source: Flexible Plan Investments

Looking at Table 4, we see that this optimal portfolio that includes gold has almost the same return as the balanced portfolio, lower risk on an annualized basis, and higher risk-adjusted return than either a “gold-only” or a traditional “balanced portfolio.”

In 2022, many commentators have declared the balanced portfolio dead. Their reasoning is that, with an aggressive Federal Reserve raising rates, both stocks and bond prices are falling. Therefore, it is noteworthy that the traditional balanced portfolio (as defined above) had a drawdown of 11.37% for the first five months of the year, while an optimal portfolio had a drawdown of only 9.81%.

Concluding thoughts on the evidence

Our study demonstrates that adding gold to a typical balanced portfolio has been beneficial across a wide range of allocations in terms of boosting risk-adjusted returns. Over the time period studied, the optimal allocation in a balanced portfolio has actually been 20% to gold and 80% to a balanced portfolio, representing a result of roughly 50% stocks, 30% bonds, and 20% gold. In fact, investors could have allocated as much as 35% to gold based on historical analysis and still placed higher on the frontier of efficient portfolios than a purely balanced fund.

Both the optimal (20%) and upper range of efficient portfolios (35%) may seem to include a fairly high percentage of gold compared to the 5% rule-of-thumb allocation to which a large number of financial advisers seem to subscribe. But there is a precedent. The “permanent portfolio” by Harry Browne recommends an equal weighting (25%) across stocks, bonds, cash, and gold as being optimal across different economic regimes. We believe the evidence presented in this white paper strongly suggests that the currently prevailing “conventional wisdom” greatly understates the potential role of gold in portfolios for a typical investor over the long term.

2020 and 2021 updates for gold

In 2020, the London Gold PM Price gained about 24.6% while the Federal Reserve cut the benchmark interest rate from 1.55% at the start of 2020 to 0% in response to the COVID-19 crisis. Equities had a stellar performance in 2020, with the S&P returning just over 18%. In 2021, the Federal Reserve kept the rates at 0% and gold returned -4%, while equities returned over 28%.

As Ray Dalio mentions in his LinkedIn post from 2019, investors need to rethink their strategy from what worked in the 12-year bull run. As interest rates had remained low since the financial crisis, the Federal Reserve had boosted risk-taking so that holders of financial assets were compensated well. However, also during that time, the amount of corporate and government debt surged, requiring central banks to keep interest rates low. These trends have only recently begun to reverse. Keeping this in mind, Dalio thinks monetization of debt and currency depreciation is on the horizon, and gold has typically been a good hedge during these market environments.

Every investor should reconsider their portfolio’s current allocation to gold

Based on our study, it appears most investors are likely underinvested in a full range of investment alternatives, and specifically in gold as a long-term asset class. Research suggests that an allocation to gold over the long term can be as high as 35%, while still providing better risk-adjusted returns in various market environments as compared to the traditional “60/40 balanced” investment portfolio.

Investors concerned about capital preservation in times of macroeconomic risk and optimized returns in favorable times should strongly consider gold as a key portfolio element. Over the long term, gold offers the broad benefits of (a) ongoing marketplace demand in the face of limited supply; (b) historic protection from extreme market events, high periods of inflation, and devalued currencies; (c) a time-tested component of portfolio diversification; and (d) liquidity and versatility in terms of the many forms of ownership possible for an investor.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article presents an excerpt of the white paper “The Role of Gold in Investment Portfolios.” The complete paper—including a list of source data—can be found here.

Past performance does not guarantee future results. Inherent in any investment is the potential for loss as well as profit. A list of all recommendations made within the immediately preceding 12 months is available upon written request.

This white paper is provided for information purposes only and should not be used or construed as an indicator of future performance, an offer to sell, a solicitation of an offer to buy, or a recommendation for any security. Flexible Plan Investments, Ltd., cannot guarantee the suitability or potential value of any particular investment. Information and data set forth herein have been obtained from sources believed to be reliable, but that cannot be guaranteed. Before investing, please read and understand Flexible Plan Investments’ ADV Part 2A and Part 2A Appendix 1.

The original white paper, published by Flexible Plan Investments in November 2013, was written by David Varadi, David Wismer, and Jerry C. Wagner. The updated white paper, published in July 2022, was revised by Jerry C. Wagner, Jason Teed, Tim Hanna, and Sam Sheeran. flexibleplan.com

Since 1981, Flexible Plan Investments (FPI) has been dedicated to preserving and growing wealth through dynamic risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine FPI’s many risk-managed strategies within a single account. FPI’s fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. FPI also offers advisors the OnTarget Investing tool to help set realistic, custom benchmarks for clients and regularly measure progress. flexibleplan.com