Says Bloomberg, “Rising hawkishness from the ECB has helped the euro rally from lows last seen near the start of the millennium, with investors expecting tapering to start in the new year and pricing in a 10-basis-point rate hike by September 2018.”

According to CNBC, comments by Federal Reserve Board Chair Janet Yellen before Congress on July 12–13 added to the dollar’s decline:

“The dollar’s decline Thursday is a continuation of a weakening that started last week after Fed Chair Janet Yellen voiced concerns about low inflation and talked about a lower than historic neutral rate. That drove down the dollar, and bond yields moved lower, as expectations for another Fed interest-rate hike this year faded.”

FIGURE 1: EURO VERSUS U.S. DOLLAR (EUR/USD SPOT EXCHANGE RATE)

Bespoke Investment Group recently noted,

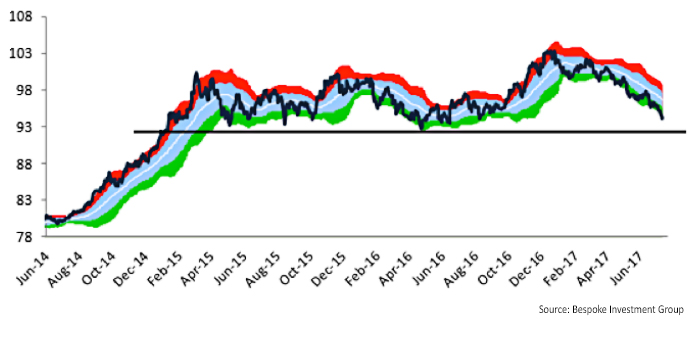

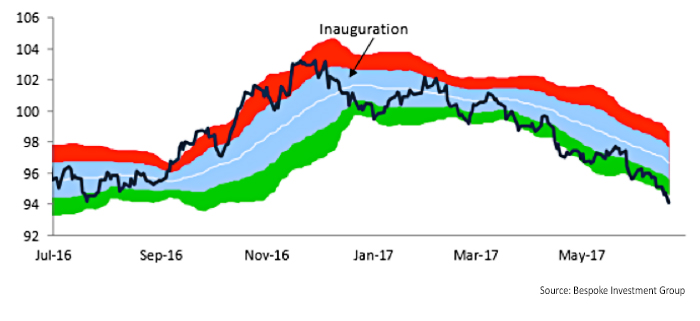

“Trump ran on a platform of ‘Make America Great Again,’ and promoting a strong dollar was part of that. But things haven’t worked out so well for the dollar since Trump was sworn in [Figure 2]. … Looking at a longer-term chart of the dollar [Figure 3], the currency is stuck in a nasty short-term downtrend, but it’s still above key long-term support around 93. We’ll be tracking this closely to see if the support holds or breaks down when it’s likely tested in the coming months.”

FIGURE 2: U.S. DOLLAR INDEX (LAST YEAR)

FIGURE 3: U.S. DOLLAR INDEX (LAST THREE YEARS)