Between the continued uncertainty over the Fed’s next move, Brexit fallout, a low growth/low interest rate environment, and negative headlines surrounding several big names in the industry, the banking sector continues to experience a volatile 2016.

Said The Wall Street Journal on October 1, commenting on third-quarter market trends:

“The KBW Nasdaq Bank Index climbed 9.2% over the past three months, its best quarter in nearly three years. … But in a sign of the pressure on the sector, the index remains down 3.1% for the year. …”

FIGURE 1: KBW NASDAQ BANK INDEX (YTD 2016)

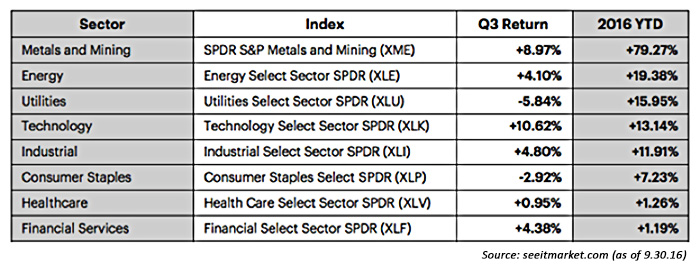

While the financial sector has many components other than banking, the banking industry’s recent equity price advance did not help lift financials from their last place position in 2016 performance among S&P sectors through the end of the third quarter. Earnings reports for several of the major U.S. banks will be released on October 14 and October 17, and it will be interesting to see how financials fare both after earnings season and into a potential Fed rate hike in December. The financial sector as a whole is expected to show a year-over-year third-quarter earnings (EPS) gain of 3.9% and revenue growth of 1.3%, according to Zacks analysis.

FIGURE 2: Q3 AND YTD PERFORMANCE OF S&P SECTORS

The two banking stocks garnering the most recent attention have obviously been Deutsche Bank and Wells Fargo—with the former facing what appear to be far deeper issues than the latter.

Deutsche Bank’s stock has been on a roller-coaster ride, mostly to the downside, since stories surfaced regarding the U.S. Department of Justice (DOJ) seeking $14 billion to settle investigations related to mortgage-backed securities. The bank’s stock, according to CNBC, had been under fire even before the DOJ reports due to “exposure to the energy sector and a possible cash crunch.” Zero Hedge reported back in June 2016, noting the bank’s huge derivative exposure, “…none other than the IMF disclosed that Deutsche Bank poses the greatest systemic risk to the global financial system, explicitly stating that the German bank ‘appears to be the most important net contributor to systemic risks.’”

In response to the concerns on overleverage for Deutsche Bank, Reuters quoted the bank’s Chief Risk Officer, Stuart Lewis, who recently told German newspaper Welt am Sonntag, “The risks in our derivatives book are massively overestimated. … We are trying to make our business less complex and are paring back our derivatives book. Parts of it were transferred into a non-core unit some years ago.”

The stock continues to react to various points of market speculation and rumors, including stories related to (a) the prospects of major capital infusions, (b) the reporting of large short positions in the stock either being lifted or selling pressure increasing, (c) how the German government will ultimately react if a state-sponsored “bailout” is required, and (d) the state of possible negotiations with the DOJ.

FIGURE 3: DEUTSCHE BANK AG (NYSE: DB) FIVE-YEAR PRICE TREND