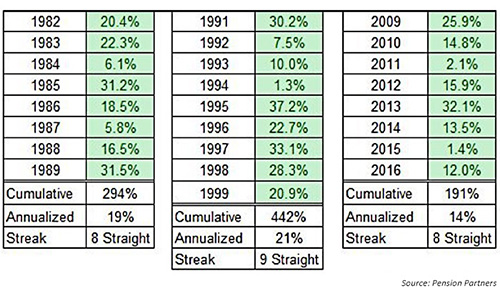

According to analysis by Pension Partners’ Charlie Bilello, the streak of total return gains from 2009 through 2016 was surpassed in only one prior period for the S&P 500, 1991–1999, and was tied by the run from 1982 to 1989 (Table 2).

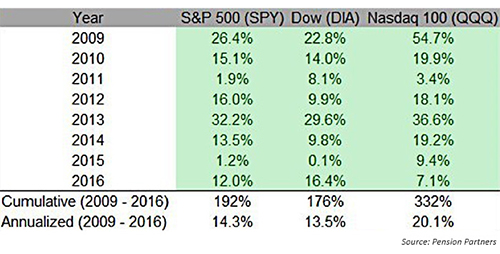

TABLE 1: MAJOR INDEX TOTAL RETURNS (2009–2016)

TABLE 2: S&P 500—LONGEST CONSECUTIVE CALENDAR-YEAR WINNING STREAKS (1928–2016)

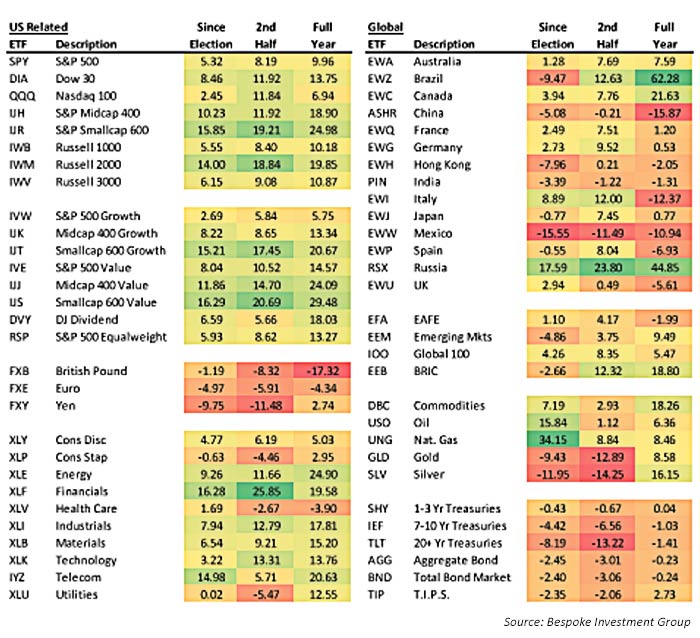

Bespoke Investment Group’s 2017 outlook provided a thorough look at how various market indexes, sectors, and geographies performed in 2016 (Table 3). Their analysis covers the post-election period, the second half of 2016, and all of 2016. They note,

“After the worst start to a year on record in 2016, equities staged a monumental rebound, quickly erasing the declines and moving firmly into positive territory. And that was just the first quarter! … Rocky start was definitely an understatement, but the bull market definitely did see a revival in 2016 with the DJIA knocking on the door of 20K and the S&P 500’s market cap north of $20 trillion!

“Small caps wildly outperformed large caps for the full year, while Energy, Financials and Telecom gained the most of the main S&P 500 sectors. The Dow (DIA) also doubled the gain of the Nasdaq 100 (QQQ). Consumer Discretionary, Consumer Staples and Health Care were the worst sectors on the year, with Health Care posting the only decline.

“Outside of the US, Brazil (EWZ) gained the most, followed by Russia (RSX) and Canada (EWC). China (ASHR), Italy (EWI), Mexico (EWW) and Spain (EWP) fell the most. Commodities posted gains across the board on the year, although metals have really taken a hit in the second half. And after posting gains in the first half, US Treasury ETFs got smoked in the second half and especially since the election.”

TABLE 3: 2016 ASSET-CLASS PERFORMANCE (POST-ELECTION, 2ND HALF, FULL YEAR)

The consensus of major analysts is mildly bullish for the markets in 2017, with the average forecast for the S&P 500 calling for gains around 5%. Bespoke Investment Group cites several positive factors for the market entering 2017, including a pro-business administration in Washington, the potential for corporate earnings improvement, and a U.S. economy that has made significant progress on several fronts.

However, Bespoke notes that valuations may be a headwind for the markets, and that overly positive market sentiment usually leads to some disappointment. Their overall “more-cautious-than-usual tone” might also be partially attributed to a historical political cycle trend that has not been totally favorable:

“Full Republican control has been positive for equities in the past, but we would note that in the four times since 1928 that a Republican has replaced a Democratic President, the S&P 500 declined at least 6.5% in the first year each time. It may just be a statistical anomaly, but it is something to keep in mind.”