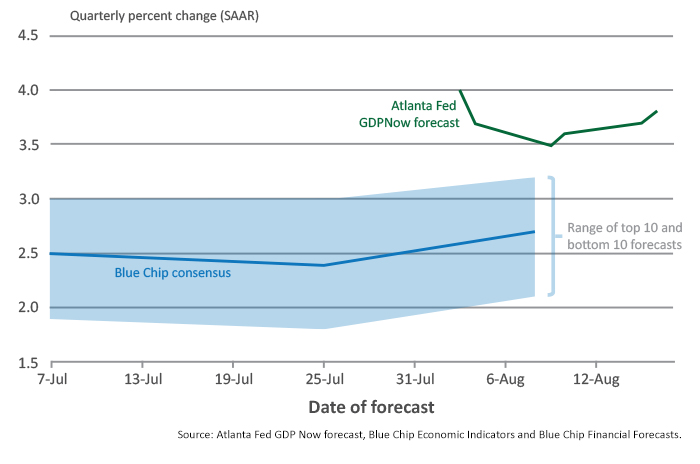

Real gross domestic product (GDP) increased at an annual rate of 2.6% in the second quarter of 2017, according to the “advance” estimate released by the Bureau of Economic Analysis (BEA) on July 28. In the first quarter, real GDP increased 1.2%.

While the preliminary number for the second quarter was within economists’ expected range of 2.2% to 3.2%, the report was viewed positively. The BEA noted the following in their press release:

Barron’s observed,

“The second quarter was healthy, growing at an as-expected 2.6 percent annualized rate with the consumer spending component also healthy and as expected, at a 2.8 percent rate. Business investment, at 5.2 percent, was once again very strong and offset a bounce lower for residential investment, which fell at a 6.8 percent rate. Inventories were slightly negative for the quarter while net exports improved and proved a slight positive. Government purchases added slightly to the quarter. Inflation was very weak, at only a 1.0 percent rate. The core is similar, at 1.1 percent and down from 2.4 percent in the first quarter.”

FIGURE 1: REAL GDP—PERCENT CHANGE FROM PRECEDING QUARTER

The question, of course, is whether Washington can actually act upon some growth-inducing policies to help U.S. GDP break out of the 2% annualized growth range. Several of the major agenda items Wall Street is looking for are no surprise:

- Continuation of the Trump administration’s aggressive deregulatory efforts.

- Health-care reform to lessen the cost burdens on both businesses and individuals.

- Government and private infrastructure expenditures to stimulate the construction sector, provide jobs, and enhance transportation-related and other facilities around the U.S. According to the Brookings Institution, “Donald Trump has proposed up to $1 trillion over a decade on building roads, bridges, ports, schools, and hospitals to make America’s infrastructure ‘second to none.’”

- Incentives via revised tax policy to encourage business spending on production capabilities, technology, research, and development.

- A balanced approach to international trade deals, helping the export stance of U.S. businesses.

- Further job expansion and an accompanying pickup in wage growth, which will flow through in terms of consumer spending.

- An accumulated effect of all of the above to increase household wealth and the continued revenue and profit expansion of U.S. corporations.

The Federal Open Market Committee (FOMC) last week released the minutes from its July 25–26 meeting. The outlook for the Fed on further improvement in the GDP growth rate was cautiously optimistic:

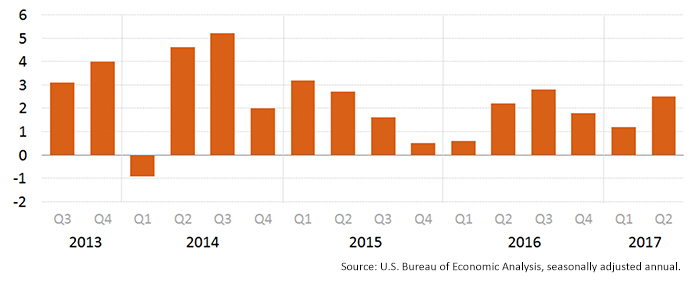

However, despite this cautious statement by the FOMC, the Atlanta Fed is projecting a more robust growth path for U.S. GDP. Their projections for the third quarter are calling for year-over-year GDP growth of 3.8%, substantially above the consensus of about 2.7%.

It should be noted that the Atlanta Fed GDPNow forecast is “a model-based projection not subject to judgmental adjustments.” They point out that “it is not an official forecast of the Atlanta Fed, its president, the Federal Reserve System, or the FOMC.”

FIGURE 2: EVOLUTION OF ATLANTA FED GDPNOW Q3 2017 GDP FORECAST