Up over their skis

Marketing the value of active investment management in an extended bull market.

I was recently pitching my active investment approach to a 73-year-old attorney who still has a quite healthy lifestyle and practice. I started the conversation by asking how he felt about current market conditions and the extent to which his existing investments coincided with that view. Immediately, he quipped that he feels “up over his skis and getting ready to fall off the cliff.” Believing that he was ready to be “saved,” this was music to my ears.

But, that was not the case. Notwithstanding his age, education, and profession, the attorney was unaware of—and unwilling to consider—any investment alternatives beyond simply investing in stocks and bonds on a long-only basis. Moreover, although he felt “up over his skis,” he wasn’t currently in pain.

Expecting your portfolio to drop is quite different from experiencing the fall in real time. Perhaps it’s a part of human evolution to restrict the pain of loss from entering one’s frontal cortex.

This led me to ponder the obstacles and challenges of marketing the value of active investment management in the midst of a long, extended bull market in which a great number of investors have blocked out how it feels to watch their life savings dissipate.

Do we need a serious market correction and real-time pain for prospects to devote their time and attention our way? Do they need to be scared so that they listen and heed our advice to do what is ultimately best for them? Do six years of a bull market make active managers irrelevant? Will vindication only come after the market corrects? How do we most effectively sell our value proposition when so few people are in pain after so many spectacular innings of a bull market?

Compounding these difficult questions is the widely held notion that no one can realistically “beat the market,” and even more importantly, the belief now rampant that although markets will correct as they always have, the impact will probably be short lived.

I was not an investment advisor in the 1970s when interest rates exploded into the high double digits. I can only imagine how difficult it would have been to have encouraged clients and prospects to invest in anything with more risk and uncertainty than money market funds or certificates of deposit when these stable investment vehicles were yielding 18%, while the stock and bond markets were tanking.

To learn, one has to be receptive to becoming educated. Too many investors rely on soundbites from the media to serve as their source for investment education, and they are satisfied with that amount of knowledge, or lack thereof. Pain is a powerful motivator to change course and become better educated. As the bull market continues on, the sense of complacency strengthens, the pain from distant losses fades, and the desire to be educated on investment strategies in general, but on safeguards in particular, diminishes further.

“Every market cycle and every generation present a new set of challenges. Investors’ short-term perspectives, biases, and behaviors underlie each challenge.”

I truly wish success for the average investor, but it pains me to consider the ramifications to the general population’s retirement years if it remains unprepared for the next inevitable correction. As happens each and every time, I do know that the frequency of prospects reaching out to me will substantially increase after the next major bear market. The message of active management that I consistently broadcast will resonate far more after the euphoria created over the last six years wanes.

Active investment management has been criticized by many in the financial press who only count the positive innings in the game, while conveniently overlooking or forgetting about the losing innings. Now that index losses from the Great Recession have been restored, some average investors who had the resources and favorable time frames to stick it out feel “really smart.” In fact, a common refrain is that passive index investing has generated better performance than active money management—with lower expenses to boot.

4 problems with the passive index investing perspective

Ignores the fact that while this bull market has had a remarkable run since 2009, the purely mathematical average annual return (without dividends) of the S&P 500 for the past 15 years has been in the low single digits, just over 2%. A very good thing to be in the green, but hardly impressive. While the historical annual average return of the S&P 500 is far more compelling, in the neighborhood of 7% (inflation-adjusted) through 2014, few acknowledge that those numbers were largely driven by the great bull run of 1983–2000.

Disregards the reality that even that relatively low 15-year annualized return has been very hard for the average self-directed investor to achieve, given the propensity to sell at panic bottoms and increase exposure near market tops. DALBAR’s research underscores this fact, showing that over the past 10, 20, and 30 years, retail investors have achieved less than half of the returns of major indices, “due to bad investor decisions at critical points, the first in the face of severe market declines and the second when the equity market surged.”

Overlooks the issue of the “sequence of returns.” Life happens—including starting a family, buying a home, job loss, illness, relocation, divorce, payment for college tuitions, and the income reduction that generally comes with retirement. With buy-and-hold passive investing, there is always the risk of major periods of loss coming at just the wrong time.

Discounts the fact that active money managers have absolutely no issue with making money in a bull market. Quite the contrary, as the overriding objective of quantitatively based active management is usually centered on following trends and on achieving competitive returns in bull markets while mitigating losses in bear markets. The big difference is that active managers have a full array of diverse portfolio strategies, asset classes, and tactical tools at their disposal, and are far more interested in compounded returns over time than the returns of any one given year.

Many critics of active management have never invested during a tightening or rising interest rate environment. In fact, many have never experienced a lengthy bear market. Although it is somewhat unfortunate, the ultimate vindication of active, tactical investment management comes during the losing innings and corrections.

“Keep the active management message consistent and persistent.”

I often think about an interview I heard during the peak of the recession with the CEO of a major U.S. consumer goods company. He said that in recessions, he increases his advertising efforts. He was well aware that during weak economic times his sales would be down, but he wanted to remain top of mind once the recession cleared.

Similarly, I am reaching out to and “dripping” active management ideas to more (not fewer) prospects today, not so much because I think it’s going to necessarily lead to an immediate appointment, but rather an opportunity to be there when they again become receptive.

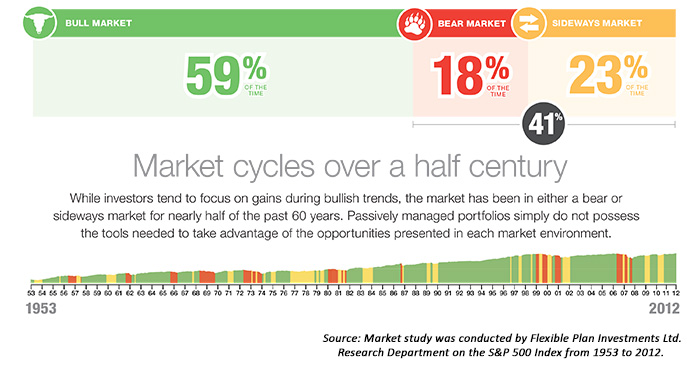

Just like that CEO who consistently puts out his messages whether it will lead to an immediate prospect conversion or not, I persistently espouse the reasons for active investment management and its potential safeguards to my prospects. One day interest rates will normalize. Markets will rise on good data, but they will also fall when it is weak. Trends will reverse and we will face recession again in the future. We know for a fact that markets historically spend over 40% of the time in either bear or sideways patterns—there is little reason to believe this will change.

Market cycles over a half century

History repeats because human beings do not adequately learn from their mistakes. I do not wish the pain of losses for prospects who are not currently receptive to my message. But I firmly believe that basic buy-and-hold investors could be “up over their skis” today. The tenacity, consistency, and professionalism of an active management message is essential for them to hear in this—or any—market environment. They will hopefully reach out when they are ready to get back on their skis.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The opinions expressed in this material do not necessarily reflect the views of LPL Financial. Securities offered through LPL Financial, Member FINRA/SIPC.

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com