Technology companies in the S&P 500 fell 1.9% last Friday, bucking the overall moderately positive trend for the rest of the market. According to The Wall Street Journal, “Many of the industry’s leading companies have followed up a rocky start to the year with weak earnings reports and are warning of more bleeding to come.”

For the week ending April 22, the Dow and S&P 500 both registered modest increases (up 0.6% and 0.5%, respectively), while the tech-heavy NASDAQ fell 0.7%.

The picture shows even more divergence for YTD 2016: The Dow and S&P 500 were firmly in the green through the end of last week (up 3.3% and 2.3%), while the NASDAQ Composite and the NASDAQ 100 were down 2.0% and 2.6%, respectively.

Clearly, the earnings picture has been the chief culprit for technology weakness, along with continued global growth concerns. CNBC called the cumulative Q1 2016 earnings performance so far a “tech wreck”—perhaps a bit of an overstatement, but directionally correct.

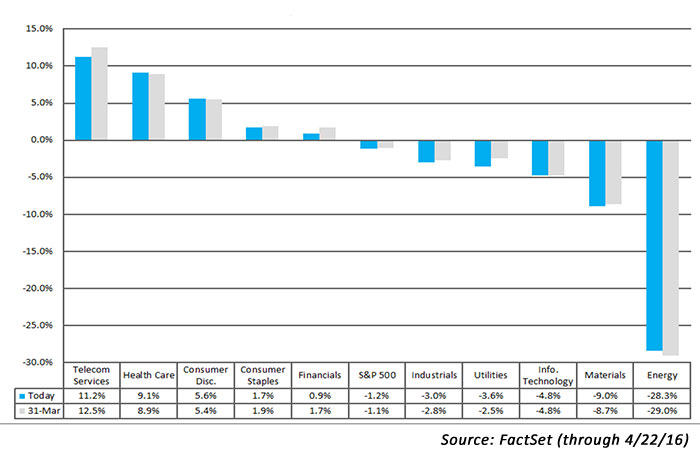

As can be seen in Figure 1, FactSet is currently projecting negative Q1 revenue growth for the Information Technology sector, down almost 5% compared to the previous year. This would position the sector as the third-worst performing for the quarter.

FIGURE 1—S&P 500 REVENUE GROWTH (Q1 2016)

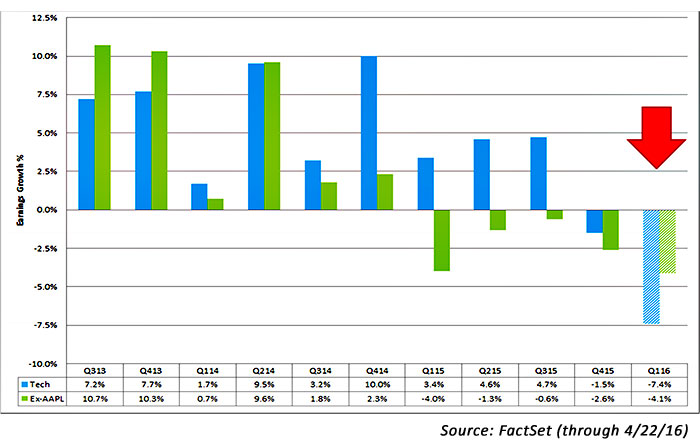

Perhaps more troubling for the sector is the quarter-over-quarter downtrend for EPS growth. As Figure 2 shows, Q1 2016 will likely represent the second consecutive quarter of negative EPS performance for Information Technology.

As usual, Apple’s (AAPL) performance in this and following quarters is all-important. Figure 2 shows the expected blended earnings decline for the Information Technology sector including Apple (blue), and excluding Apple’s results (green).

(Editor’s note: Apple’s earnings results, which were released after the market close on 4/26, missed on both EPS and revenue vs. analyst expectations. Earnings of $1.90 per share fell short of the average analyst estimate of $2 per share, according to Thomson Reuters. Revenue of $50.56 billion missed expectations of $51.97 billion, due in part to a year-over-year decline in iPhone sales.)

FIGURE 2—S&P TECHNOLOGY SECTOR EARNINGS GROWTH (Q3 2013–Q1 2016)

Morningstar data, according to The Wall Street Journal, shows that investors withdrew a net $4.5 billion from technology mutual funds and ETFs through the end of March 2016. This follows three years of net inflows. The Journal’s analysis further states that both old-line tech stalwarts, such as IBM and Intel, and relatively newer tech giants, such as Microsoft and Google/Alphabet, are facing increasingly challenging business conditions. This may adversely impact the pace of growth investors have come to expect from the sector.

Says Bespoke Investment Group of the outlook for technology stocks (through 4/22):

If the NASDAQ can hold its 200-day (moving average), tech’s impact on the broad market will probably be contained, but we’d say that so far it’s safe to classify this earnings season as a rough one for the NASDAQ. On a strict technical basis, momentum for the NASDAQ 100 is decidedly negative, with the MACD and the 14-day RSI in downtrends.

FIGURE 3—NASDAQ 100: EARNINGS STUMBLE