Supporting the turtle

Supporting the turtle

Reducing volatility to improve long-term returns.

The investment world is all about returns. Is the S&P 500 up or down for the day? What is the top-performing stock or mutual fund this month, this quarter, or this year? How have the top managers performed?

While the obsession with short-term returns and market moves is natural, it has a tendency to overshadow the reality that steady, consistent returns can produce better long-term results than short-term gains.

The first time that really hit home was back in 1994 when Barron’s published an article by John Liscio titled “Timing the Bear.” Liscio asked, “How long did it take someone with $10,000 in the Value Line Index on December 1, 1968, to catch the guy with $10,000 in cash on the same date? Answer: He is still trying.”

There have been substantial periods of time when volatility has depressed returns in the equity markets.

In USA Today, a January 2012 article by Matt Krantz asked, “Why are bonds outperforming stocks over the long term?” Krantz noted that “Despite a reputation for being a slow-growing alternative to stocks for the risk-averse, bonds just passed stocks’ long-term performance over the past 30 years.” According to Liscio’s analysis, cash had outperformed stocks for a 25-year period.

How can cash and bonds outperform over relatively long time periods? As the studies to the left illustrate, there have been substantial periods of time when volatility has depressed returns in the equity markets.

These times are the motivating driver behind the growth of active investment management. If the portfolio manager can minimize losses in periods of extreme market volatility, the opportunity can exist to outperform the equity markets at risk levels much closer to those of holding bonds or cash.

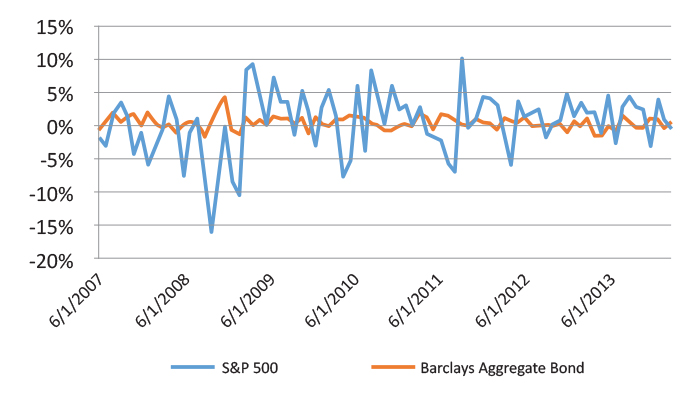

Chart A: Monthly Returns

June 2007–April 2014

One of the most overlooked factors in the performance of an investment portfolio is the effect of volatility. And the financial markets are a lot more volatile than many investors realize. Chart A shows the monthly return volatility of the S&P 500 and the Barclays Aggregate Bond Indices since mid-2007.

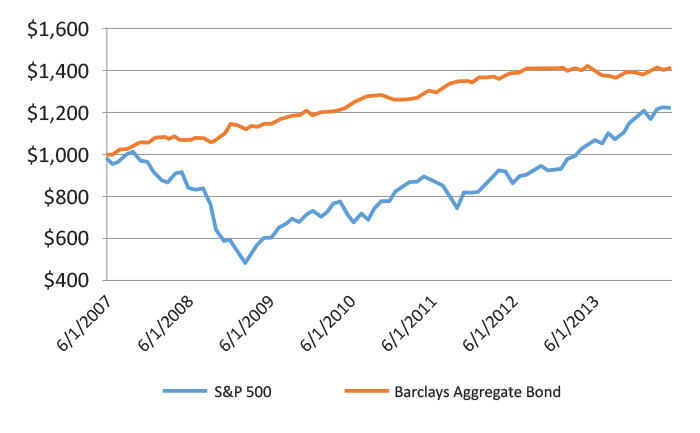

The S&P 500 has had a rough ride, but investors ended the first quarter of 2014 with a gain for the overall period. The Barclays Aggregate Bond Index was a lot less exciting, and monthly returns look relatively anemic compared to the S&P 500 during many months of the period. But as an investor, which cumulative growth line on Chart B would you prefer?

Chart B: Growth of $1,000

Invested June 2007–April 2014

Will the S&P 500 catch up with the performance of the Barclays Aggregate Bond Index? History says yes. But for the nearly seven-year period from mid-2007, as in the time periods covered by the Barron’s and USA Today articles, investors were better off with the turtle’s pace of the conservative, lower-volatility bond index.

Is there a better way?

The goal of active management is to combine the equity market’s ability to produce bursts of appreciation with the bond market’s lower-volatility and more-consistent, albeit typically lower, gains. In its earliest form of “market timing,” active managers alternated portfolio positions between stock and bond funds based on the current market trend.

With the growth of investment alternatives and more-sophisticated data-crunching capacities, active managers have gained the ability to dynamically allocate portfolios among multiple investment options. That has evolved to the use of multiple asset classes (not just equities and bonds) and multiple strategies within one portfolio.

While techniques, investment classes, and indicators have changed over the last 30 years, the challenge of active management continues to be to reduce volatility, particularly negative volatility, and put upward volatility to work. At times, this may produce results that look like a turtle’s pace. But turtles can be winners in the longer race.

Active management may get that turtle moving faster than one might expect.

It helps to start with the math. With a 32% total return, 2013 was a great year for the S&P 500, according to Morningstar. Taking just that one year, it’s easy to say buy-and-hold investing is the way to go. After all, the market’s decline in 2008 was only slightly more at -37%. Except … it didn’t take a 37% gain to erase a 37% loss; it took a 59% gain and more than three years to recover.

An active management approach doesn’t have to outperform a rising market to produce better returns than a buy-and-hold approach. It has to outperform in declining markets. Avoiding the majority of the loss and the subsequent recovery is actually building value from a higher plateau, instead of making up lost ground.

Add to this the ability to access investment strategies across the investment horizon—from tactical tools to leveraged strategies to alternative investments—and active management may get that turtle moving faster than one might expect.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com