Millennials and risk management

Millennials and risk management

Millennials, those roughly between the ages of 18 and 34, might be especially receptive to actively managed strategies. This younger generation—reared during the Great Recession and now considered to be almost as conservative as the generation that lived through the Great Depression—will want to be as proactive as possible to protect their growing assets.

Millennials, born between 1980 and 2000, have faced significant financial and employment challenges due to coming of age after a financial crisis and resulting recession—heavy college debt, fewer job prospects, stagnant wages, and a growing distrust of conventional institutions. Such hardships have created a new generation of prudent savers and cautious risk-takers, particularly in the eyes of their baby boomer parents, who believe the younger generation will have a tougher economic road to navigate than they did.

But millennials have also been shaped by paradigm-shifting concepts about their potential power on the world stage and how institutions can be molded to fit their visions, particularly through the use of social media and other forms of technology. Such dichotomies will sort themselves out as millennials progress in their careers—and inherit wealth from their parents. Their improving financial situation and attitudes about asset protection should make them prime prospects for risk-mitigating investment strategies.

Active management also fits in with millennials’ penchant to use technology, as they are already early adopters of sites that use algorithms and systematic decision-making to determine investment allocations. Many are now expressing a desire for combining technological tools with more hands-on interactions with advisors, and the generation raised to take charge of their own lives will likely prefer advisors who are more willing to collaborate with them.

Whoever wins the business of millennials in the future will reap great dividends, as their net worth is projected to increase greatly over the next several decades, partly due to increased numbers within that generation receiving college degrees and partly due to inheriting wealth from their parents. Indeed, according to the World Economic Forum, millennials and their older counterparts, Gen Xers, could potentially inherit roughly $41 trillion from their parents over the next 40 years.

But even now, more millennials have started saving for retirement in their early 20s than did baby boomers, who on average didn’t start saving until they were 35, according to a recent Transamerica Institute study. For those millennials who were offered 401(k) or similar plans by their employer, 71% participated, contributing 8% of their salaries, on average.

The younger generation is also particularly receptive to so-called robo-advisor startups such as Wealthfront, Betterment, Future Advisor, and SigFig, automated money management sites that use algorithms to daily monitor and, if necessary, rebalance allocations in indexed funds based on modern portfolio theory and individual investors’ ages and objectives.

Then there is Motif Investing, a new online brokerage that looks “for trends, ideas and world events that could create an investment opportunity,” and then builds portfolios of related investments weighted to those opportunities. The concept is an extension of the growing trend of college students participating in “impact investment clubs,” as well as the increased popularity of socially responsible investing overall.

Hands-on advice still matters

However, even with the rise of many different flavors of online investment management, many millennials are also signaling that they will likely use more traditional financial advisors once they accumulate more assets. According to a July 2014 Investment News survey, 84% of millennials currently without an advisor said they would use one when they got older, while 68% who already have an advisor said they would prefer “more direct, personalized advice” in the future.

Moreover, the survey found that 78% would prefer advisors who offer online services, as part of their preference for “holistic advisory services.” Millennials are expressing a desire for more frequent contact from their advisor both in person and digitally via text messaging, email, video conferencing, and social media.

Millennials might be especially attracted to an advisor from their own generation—or close to it. A number of advisors in their 20s and 30s say they feel more like “financial coaches” who guide their younger clients through the planning process to reach specific objectives, or even “financial therapists,” who help clients work through their fears over investing.

Such advisors help their young clients understand how much risk would be appropriate for them to take within their portfolios, particularly by helping them to overcome anxieties created by the 2008-2009 financial crisis and resulting recession. Many millennials have not reaped the benefits of the current bull market in equities, but advisors who practice active management may help them see the wisdom of participating via risk-managed strategies.

But advisors should also be prepared for millennials to not just take them at their word, as the younger set will likely also conduct independent research on any investment strategy, as well as consult with other experts—even other advisors—before they sign off on any particular strategy.

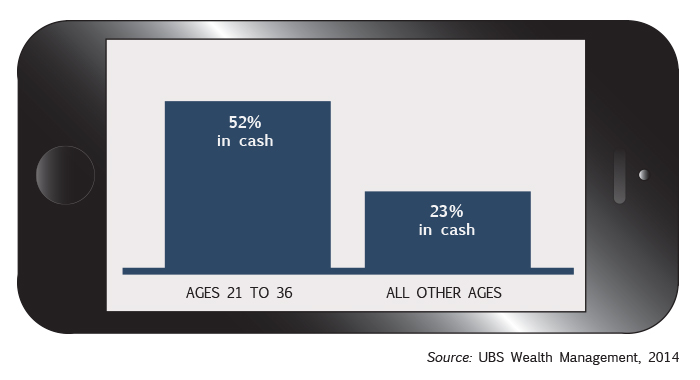

SAVINGS BREAKDOWN: MILLENNIALS VS. EVERYONE ELSE

Active management may present a competitive edge

Advisors who use active investment management will likely fit well within the mindset of millennials, as this generation is more prone to favor technology, models, logarithms, and systematic decision-making to continually monitor and adjust portfolios as needed. Such advisors can also work closely with their clients in assessing appropriate risk profiles within a long-term investment plan, to determine the best course of action to help meet specific life goals.

Advisors offering investment solutions based on proven risk-management principles should be well-suited to serving as coaches for millennials, especially in helping to overcome those anxieties regarding financial markets.

They have the tools to demonstrate that there is a way to achieve favorable risk-adjusted returns in any market environment, as sophisticated algorithms and models are employed to capture a fair share of gains and protect against deep losses in a wide variety of sectors and asset classes. This should sit well with a generation that challenges conventional thinking by nature and has had to overcome the long-lasting effects of the Great Recession—and likely present such advisors with a powerful competitive edge.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.