Managing assets in a low-return market environment

Managing assets in a low-return market environment

With investment returns continuing to face challenges in the foreseeable future, strategies that manage risk and minimize drawdowns play an important role in client portfolios.

The question for investors is whether this presidential election was truly a game changer or if the rationale behind the low-return forecasts still holds true. Will the ignition of “animal spirits” driving market gains continue? Can the new administration’s presumably pro-growth policies spark a move out of cash to productive business investments that create market value?

Barron’s annual December survey of “prominent strategists at major investment banks and money-management firms” reported a mean projected increase of 5% for the S&P 500 next year, which would bring the index close to 2,400.

This was a far cry from a similar Barron’s pre-election survey in September 2016, which was featured on September 3, 2016, with the headline, “Barron’s Survey: Strategists Say Beware the Bear.”

Barron’s attributes the optimistic change of heart for these major-firm strategists to forecasts of “a significant boost to profits from anticipated lower corporate taxes, infrastructure spending, and reduced regulations under a Republican-dominated federal government that takes office next year,” as well as expected accelerated job growth.

Not very long ago it seemed that a preponderance of the big names in the investment industry were forecasting an extended period of low returns for the stock market—with total returns from both stock and bonds potentially lagging for the next 20 years. Whether called the “New Normal,” the “Age of Secular Stagnation,” or a “2% world,” an economy and investment market characterized by low growth, low interest rates, and relatively low returns would dramatically impact the investment advisory industry and its clients for the foreseeable future.

The range of firms voicing concern about a low-return market environment has been both broad-based and influential over the past year:

“We are living in a low-return world, with future market returns likely to be lower than in recent history. Monetary policy has been a key driver of asset prices—but its effectiveness looks to be waning.”—BlackRock Mid-Year 2016 Global Investment Outlook

“Flat is the new up.”—Goldman Sachs chief U.S. equity strategist David Kostin, in a July 2016 CNBC interview

“We are doubtful of the potential for equities to continue to deliver outsized returns.”—PIMCO February 2016 Asset Allocation Outlook

“Like GMO and Research Affiliates, Morningstar Investment Management’s return expectations for U.S. stocks and bonds are low, if not downright discouraging. Highlights: 4.5% 10-year nominal returns for U.S. stocks; 2.6% 10-year nominal returns for U.S. bonds (January 2016).”—Morningstar Investment Management, January 2016

“‘Occam’s Razor Redux: Establishing Reasonable Expectations for Financial Market Returns’ projects U.S. stocks to gain about 6% over the next decade. Bonds figure to make half as much, 3%. Both of those figures are in nominal terms—that is, they are not adjusted for inflation.”—Jack Bogle and Michael Nolan Jr. (Business Insider summary)

“Years of yield-seeking speculation have already driven stock valuations to levels where prospective 10- to 12-year total returns for the S&P 500 are likely to be no different than the near-zero yields available on Treasury securities.”—John Hussman, Hussman Investment Trust, August 2016

In one of the most detailed forecasts, McKinsey Global Institute, the business and economics research arm of McKinsey & Company, published a 60-page research report in April 2016 titled “Diminishing Returns: Why Investors May Need to Lower Their Expectations.” The report sets forth the firm’s opinion on why total returns from both stocks and bonds in the United States and Western Europe are likely to be substantially lower over the next 20 years than they were over the past three decades. It also looks at repercussions for institutional and individual investors, pension funds, and governments around the world.

“Equity and fixed-income returns over the past 30 years were lifted by falling inflation, declining interest rates, strong GDP growth, and even stronger profit growth.”

— McKinsey Global Institute

Here is a summary of its major points:

- Exceptional returns over the last 30 years were driven by a confluence of economic and business trends that have run their course, including sharp declines in inflation and interest rates from the unusually high levels of the 1970s and early 1980s; strong global GDP growth, lifted by positive demographics, productivity gains, and rapid growth in China; and even stronger corporate profit growth, reflecting revenue growth from new markets, declining corporate taxes over the period, and advances in automation and global supply chains that contained costs.

- Business and economic conditions are changing. With interest rates at record lows, a steep drop in interest rates cannot continue. An aging world population means that one of the twin engines that powered growth over the past half century—the growing number of working-age adults—has stalled. Businesses face a more competitive environment that could reduce margins. Global economies are slowing and labor costs and corporate taxes are increasing.

- To bring returns back to the same level investors enjoyed between 1985 and 2014 would require sweeping technological change that lifts corporate productivity and profit growth.

Against these negatives, McKinsey anticipates that older investors may find they need to postpone retirement and, even then, may need to accept a lower standard of living when they stop working. Younger investors will need to dramatically increase their savings rate (which has the potential to negatively impact GDP). Public pension funds could experience widening funding gaps and solvency risks. Given aging populations, government at all levels—national but also local—will face rising demands for social services and even income support at a time when public finances are already under pressure.

Among the recommendations of the McKinsey report is to look to active management for higher returns. “Corporate profits are increasingly shifting from asset-heavy sectors to idea-intensive ones such as pharmaceuticals, media, and information technology, which have among the highest margins. … In such a world, active managers who can successfully identify the winners could see outsize returns.”

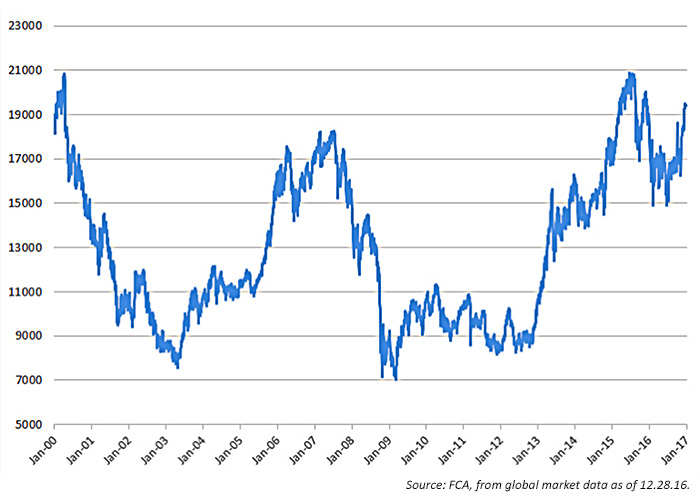

A low-return market environment doesn’t necessarily mean a low-volatility market. The poster child of minimal GDP growth, deflation, low or negative interest rates, and deteriorating demographics is Japan. The Nikkei Stock Average, considered the S&P 500 of the Japanese equity markets, ended 2016 below its 2000 high by 5% (going virtually nowhere for 17 years), but to get there, it navigated two round trips, including a 57% gain in 2013. Successful trend-following investment approaches should have been able to theoretically capture a good portion of the upturns, while avoiding the worst of the downturns.

NIKKEI STOCK AVERAGE (NIKKEI 225)

Daily Adjusted Close

In an extended low-return investment environment, passive investment approaches that focus on holding market index-based funds will have little ability to outperform market averages or mitigate volatility. Recovering from market downturns may be longer and more painful for investors who need to be withdrawing funds to meet expenses. Cost becomes a major factor. Returns given up to management fees become less acceptable to clients, putting increased pressure on advisors’ revenue derived from managing client portfolios.

In this type of market environment, to justify their management fees, investment advisors will have to find ways to provide value outside of investment returns, or they must develop strategies that take advantage of market trends. Active management arguably becomes key to the economic survival of investment advisory firms. By offering active management investment approaches that reduce volatility and/or enhance full-market-cycle returns, investors benefit and find value in the fees paid to the investment advisor.

Will the forecasts for a long-term, low-return market environment become reality, or will the new, more optimistic Trump-based forecasts prevail? The future has a way of surprising us, but the potential for a lengthy low-return environment is still real and needs to be considered as individuals and their financial advisors plan for retirement and other financial goals.

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com

Linda Ferentchak is the president of Financial Communications Associates. Ms. Ferentchak has worked in financial industry communications since 1979 and has an extensive background in investment and money-management philosophies and strategies. She is a member of the Business Marketing Association and holds the APR accreditation from the Public Relations Society of America. Her work has received numerous awards, including the American Marketing Association’s Gold Peak award. activemanagersresource.com