Residents of the northern U.S.—who are facing the start of the winter heating season—are undoubtedly pleased that prices of crude oil have come down sharply over the past month.

Last week, the price of West Texas Intermediate (WTI) technically fell into a bear market, according to CNBC, “tumbling more than 20 percent from a nearly four-year high last month at $76.90.” The futures contract for WTI went as low as $59.26 on Nov. 9, “its weakest level in about nine months” and down about a half of a percent for the year. CNBC also reported that prices were down for 10 consecutive sessions and the fifth straight week, noting the 10-session losing streak is the longest since 1984. While crude-oil prices appeared initially to be rebounding Monday (11/12), crude oil’s losing streak extended to an 11th day. The decline moved to a 12th day on Tuesday (11/13), with WTI’s closing price falling more than 7% to $55.69—down about 27% from its October daily closing high.

FIGURE 1: FUTURES FOR LIGHT CRUDE OIL (WEST TEXAS INTERMEDIATE)

Source: CME Group, data through 11.13.18

Analysts have noted the “whipsaw” effect on the crude-oil market of the Trump administration’s position on Iran sanctions. Put simply, the run-up in prices earlier this fall was driven in part by the thinking that Iranian oil would have very limited access to global markets, reducing overall supply. The recent sell-off has been impacted by the policy decision to grant temporary sanction exemptions to eight countries, allowing Iranian crude exports to continue. Iran is OPEC’s third-largest oil producer.

Other factors are at play, of course, including the overall state of the world’s oil supply, the outlook for global manufacturing growth, the increasing oil output coming from the United States, and questions about production from Venezuela and Libya. Saudi Arabia recently announced a 500,000-barrel-per-day production cut in December.

CNN reported on Nov. 12,

“A senior OPEC source said the cartel and other major producers are discussing cutting production by as much as 1.2 million barrels per day. A decision could be taken at the next OPEC meeting in Vienna on December 6. A cut of that magnitude would reverse a decision in June by OPEC and Russia to pump over a million barrels per day more to make up for the expected loss of Iranian exports.

“‘The size of any potential cut will depend on how much oil demand growth slows down, how much Iranian supply falls due to US sanctions, and how fast US supply rises,’ said Giovanni Staunovo, an analyst at UBS.”

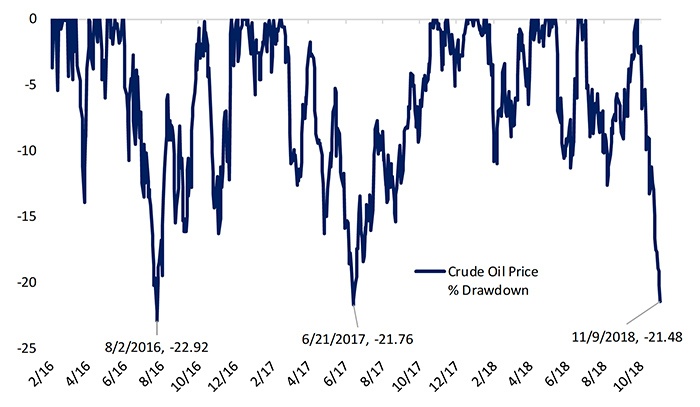

Bespoke Investment Group commented on Nov. 9 on the recent ups and downs of oil prices, finding that the price action is not that unusual,

FIGURE 2: PRICE DRAWDOWNS IN THIS CRUDE-OIL BULL MARKET CYCLE

Source: Bespoke Investment Group