How active is your client’s 401(k)?

How active is your client’s 401(k)?

Incorporating active management solutions within defined contribution plans.

There was a time not that long ago when an employee’s retirement was provided by his employer almost exclusively in the form of a defined benefit plan. The responsibility and burden of investment performance in a defined benefit plan rested firmly with the employer—with employees “guaranteed” a fixed amount of income at retirement.

The employer in a defined benefit plan is liable to provide the predetermined retirement benefit irrespective of how the underlying investments perform. This liability has underscored the extreme financial difficulties of many major companies, including General Motors and American Airlines. Over the last 30 years, there has been a notable trend by corporations to alleviate—or at least minimize—the obligation with respect to the performance of their employees’ retirement accounts. This has resulted in a shift from companies offering defined benefit plans to defined contribution plans such as 401(k) plans.

This shift began in the 1980s, and the exuberance of the market at that time enabled this change to occur without much backlash. By the mid-1980s, a perfect storm was brewing. Almost magically, the largest generation of all time, the baby boomers, was at its peak earning and spending years. At the same time, a technology revolution was forming. These two factors unified perfectly to result in one of the most massive bull markets in U.S. history. A soaring market provided the perfect context for corporations to make this shift, not only without backlash, but with overwhelming support.

Almost magically, the largest generation of all time was at its peak earning and spending years. At the same time, a technology revolution was forming.

While legacy defined benefit plans still have an impressive asset base, total assets of defined contribution plans are now roughly twice as large, with such plans representing more than 90% of new pension plans formed in recent years. To an employee who has entered the workforce since the mid-1980s, the defined contribution plan is now the norm. This means that the investment choices that one makes in their corporate retirement plan will hugely impact their golden years.

This evolution of retirement plans and investment choices—and what has been generally accepted as financial guidance to participants—has been incongruent, to put it mildly. While mountains of laws and regulations have been developed to “safeguard” plan participants, they fail to adequately address the primary issue of investors’ lack of preparedness for making life-changing financial decisions.

Today’s typical 401(k) plan provides participants with not much more than a menu of mainly traditional stock and bond investment options. Most retirement plan participants typically meet with a plan representative once a year in a group setting for largely a functional presentation. Participants make a selection from the menu and the vast majority either (A) set it as best they can and forget it, or (B) make poor timing decisions based on mostly emotional reactions to a prior period’s market performance.

Company perspective on employee behaviors and preparedness for retirement readiness

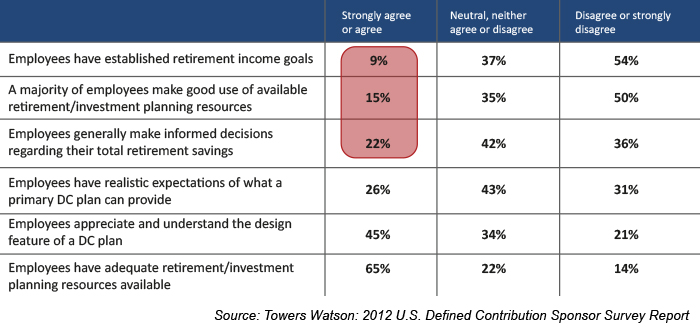

Even major corporations sponsoring defined contribution plans recognize the issue. A 2012 survey by benefits consultant Towers Watson found only one in five large companies believed their employees generally made informed decisions about retirement savings.

Obviously, the term “201(k)” did not originate without some grounding in the market realities of the past 15 years. Does it make sense that retirement plan participants remain basically uninformed about the principles of investment risk management, let alone have the means to practice them within their 401(k) plans?

If 401(k) plans had been actively managed to provide defensive strategies attempting to insulate them from downward market momentum, it could have been much less likely that their values would have been halved during the past two major market corrections. Far too many plan participants are taking excessive risk with their retirement portfolios, especially as they enter their 50s and 60s. Because the vast majority of today’s retirement plans are not actively managed, we have disadvantaged participants, stacking the odds against their success.

If 401(k) plans had been actively managed to provide defensive strategies, it could have been much less likely that their values would have been halved.

Where does all of this leave today’s financial advisor—especially the financial advisor with a holistic approach that embraces active investment management? From several perspectives, this can be a difficult question for advisors due to fiduciary issues and questions of access and compensation.

I believe it starts with education, and I like to explain it to clients with a simple analogy. Because I personally have zero construction skills, even if all of the supplies to build an addition to my office were delivered, it would be totally unreasonable to conclude that I would have the proficiency to construct anything. This is tantamount to believing that the average skilled contractor has the expertise, inclination, or desire to build and actively manage his 401(k) just because a menu of investment options was delivered to his “parking lot.”

One relatively straightforward answer to this issue can be found in the growing ranks of advisors who are becoming experienced at the 401(k) market within their overall advisory practices. These advisors, working with plan sponsors, third-party administrators, and custodians, are able to incorporate actively managed solutions through fiduciary relationships with money-management firms. One advisor with a very robust 401(k) practice says, “It can be extremely comforting for those individuals who are carving out a piece of their hard-earned paychecks that professional, well-screened third-party managers are proactively working on their behalf every day.”

There are also a good number of plan providers offering self-directed options (often called the “brokerage option”) for individual participants as part of their 401(k) investment alternatives. While the nomenclature and restrictions can vary widely within the industry, plan participants have the ability through many of these providers to call upon advisors for guidance and, ultimately, access to active management investment solutions. I believe advisors should be informing their clients of this option, and, where permitted, assisting clients to find the most appropriate investment alternatives for their 401(k).

With many retirement plan balances today just slightly above their pre-crash levels, the time is now ripe to deliver actively managed 401(k) plans.

Active money management is far more than simply buying securities. It is about having a game plan consisting of when to buy, sell, and how to rotate, and even when to invest on an inverse basis. The vast majority of Americans’ savings for retirement is tied to their corporate retirement plans. For this reason, all of the benefits and rationales stressing the importance of active investment management should especially apply for these assets. With many retirement plan balances today just slightly above their pre-crash levels, the time is now ripe to deliver actively managed 401(k) plans. Because participants’ expectations for managing 401(k) plans are so low, we should more than satisfy their expectations—we should exceed them.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com