Why goals-based investing makes sense

Financial advisors and investment managers use 21st-century tools to help clients achieve “real” investment success.

Financial advisors who use fee-based managed accounts can more effectively help clients meet their investment objectives if they incorporate goals-based strategies—as well as behavioral finance techniques—to minimize the irrational client behaviors that can derail an investment plan.

Goals-based investing has two meanings in today’s retirement planning environment:

- The practical notion that an investment plan should be based on achieving realistic goals customized to an individual’s (or couple’s) overall financial-planning requirements, risk profile, and time horizon—not some far less relevant market benchmark.

- The philosophical idea that investment success should be measured on how it helps clients achieve the lifestyle goals they desire. Those goals could be basic, such as attaining a comfortable retirement income stream. Or, they could also be more ambitious, such as helping fund a grandchild’s college education, buying that second home in the Caribbean, making a significant contribution to a favored charity, or going back to school to jump-start a new career.

These two descriptions of goals-based strategies are intertwined and present unique challenges and opportunities for advisors in today’s financial environment.

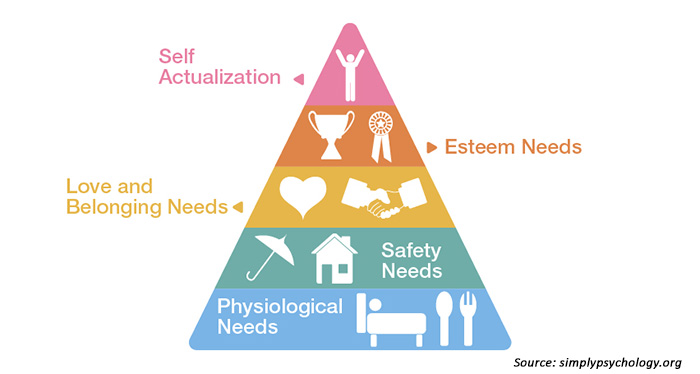

Some in the financial industry track the fundamental underpinnings of goals-based investing back to famed psychologist Abraham Maslow’s work on the human “hierarchy of needs.” A thoughtful perspective in this vein was provided in a recent website posting by Australia-based investment manager AMP Capital:

“In his 1943 paper ‘A Theory of Human Motivation,’ Abraham Maslow presented a theory around a hierarchy of needs, and he looked at how these needs influence human motivation. Maslow’s Hierarchy of Needs states that the most fundamental needs, related to survival itself, are to be addressed first before any other needs can be satisfied.

“The goals-based approach to investing is based on this thinking, and the three buckets of goals fit together in a similar hierarchy. The most important and fundamental needs are at the base as they are needs that are to be met first, and the aspirational goals are towards the top.”

The article goes on to describe how these needs might be broken into three buckets when a financial and investment plan is constructed:

- Essential needs: food, clothing, shelter, everyday expenses.

- Lifestyle “wants”: vacations, a new car, luxury items.

- Legacy “aspirations”: family, endowments, charity.

MASLOW’S “HIERARCHY OF NEEDS”

Why choose goals-based investing over traditional passive asset allocation?

For decades, investment and financial advisors have applied the principles of modern portfolio theory (MPT), the capital asset pricing model (CAPM), and the efficient frontier theory when constructing client portfolios. These principles were largely based on the work of American economist Harry Markowitz, who wrote an article titled “Portfolio Selection” in 1952, published in the Journal of Finance. That paper laid out the mathematical arguments in favor of portfolio diversification. Markowitz later shared the Nobel Prize in Economics in 1990 with two other scholars “for their pioneering work in the theory of financial economics.”

MPT theory retains strong advocates, and it generally served investors well during the last few decades of the 20th century. Says Investopedia, “Modern portfolio theory has had a marked impact on how investors perceive risk, return, and portfolio management. The theory demonstrates that portfolio diversification can reduce investment risk.”

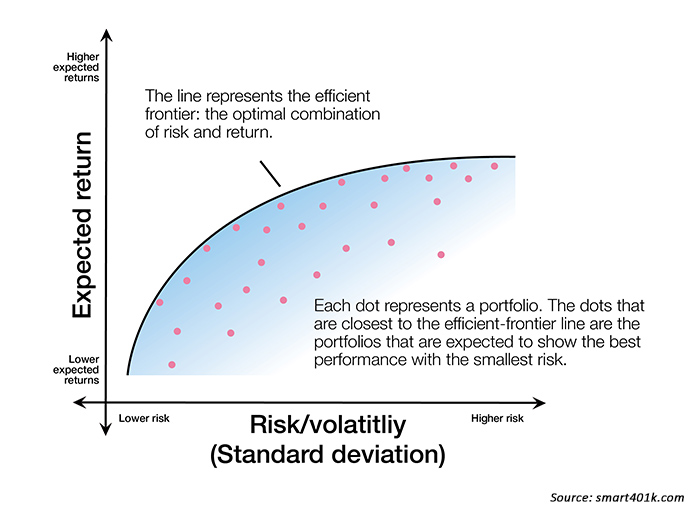

There is little doubt that focusing on the relationship of risk and return was, and is, a compelling and positive tool for investors and their advisors as they consider investment options. Efficient frontier theory took this to a new conceptual level, identifying “the portfolio composition(s) that provide one with the maximum return for a given degree of risk or, alternatively, the least amount of risk for a given return” (efficientfrontier.com).

On a theoretical level, this sounds vastly superior to selecting investment vehicles and portfolio composition with little regard to risk. And it is. MPT and efficient frontier theory still have valuable roles to play in examining portfolio alternatives.

THEORETICAL VIEW OF THE EFFICIENT FRONTIER CURVE

Note: This graph is an example of what the efficient frontier equation looks like when plotted. The purpose of the efficient frontier is to maximize returns while minimizing volatility.

But the broad and deep market downturns of the 21st century exposed some serious weaknesses in the theory of classic asset-allocation strategies and MPT, especially as they relied on a passive approach to investing. Advisors and their clients witnessed several “real-world” effects on markets and investor behavior in times of severe stress, such as that seen during the dot-com meltdown and the more recent credit crisis:

- MPT/efficient frontier theory was severely challenged by traditional asset-class correlations not behaving as expected, which was explored in Proactive Advisor Magazine’s article, “A more efficient (and profitable) frontier.” That article examined one of the key underpinnings of efficient frontier theory, concluding,

“The efficient frontier was wildly different for every 10-year period from 1950 to 2009 (and this inconsistency persisted from 2010 to 2014). What that means is using any period of historical asset-class returns to create an optimal portfolio for the following 10 or 20 years is, at best, unreliable.”

- The “sequence-of-returns” dilemma undermines even very capable application of MPT for client accounts. As numerous studies have shown, when clients are in the distribution phase of retirement, the sequencing of their investment returns can have disastrous effects on the long-term viability of generating an income stream. Put simply, two portfolios may have the exact same “average return” over a 20- or 30-year period, but the timing of those returns can mean the difference between building a very comfortable retirement trajectory and simply running out of money.

- Classic passive asset allocation according to MPT, while perhaps “maximizing” return relative to risk, does not mean risk is totally mitigated. As one experienced financial advisor told Proactive Advisor Magazine, “I was a firm believer in modern portfolio theory up until the financial crisis of 2008–09. I always thought it was sufficient to have client portfolios that were optimized as much as possible for risk and return. However, while a portfolio might beat the worst of the market’s performance in a severe crash, it is still unacceptable to see portfolio declines of over 20% or 30%.”

- To the point above, the most troubling aspects of client behavior can surface when markets crash—despite having “well-constructed” portfolios. The herding mentality can come to the forefront when investors perceive “the investment world is coming to an end,” and emotional panic dominates decision-making. In their 2015 book “Applied Asset and Risk Management,” authors Marcus Schulmerich, Yves-Michel Leporcher, and Ching-Hwa Eu had this to say in their chapter “Modern Portfolio Theory and Its Problems”:

“Moreover, traditional finance theory cannot explain market situations like crashes and stock market anomalies. … The global financial crisis caused many to reexamine practices in the finance industry and to wonder if there had been too strict an adherence to theoretical concepts at the expense of a more pragmatic or practical viewpoint.”

Many financial advisors have not needed a deep and well-researched academic analysis to come to these very same conclusions, looking for new solutions for clients’ long-term investment plans. A good portion of these advisors have turned to a combination of “goals-based investing” and outsourced investment management, using managers who provide more active and risk-mitigating strategies.

What are the broad objectives of goals-based investing?

It is perhaps easiest to start with what goals-based investing is not. It is not an investment plan that seeks to duplicate broad market results or build comparisons to popular market benchmarks.

It starts with a financial plan that attempts to identify realistic levels of returns that will help a client meet their financial goals, typically beginning with the most fundamental goal of generating adequate income (along with other sources) in retirement.

By its very nature, a goals-based investment plan will not see returns anywhere near those of the best bull markets. But, importantly, it should also not suffer the worst drawdowns seen in severe bear markets. In general, the objectives of a goals-based investment plan are to smooth out volatility, achieve steadier returns, and project a range of returns for a client that is consistent with their risk profile and has a reasonably strong mathematical probability for success over time.

In very simple terms, if a client requires returns from an investment plan (with all other factors being considered) that average 4% over time, a goals-based investment plan might target an expected annual range of 2%–8%. Will there be outlier years to both the upside and downside? Of course. But the goal is to minimize their frequency and their severity, and manage risk such that portfolio drawdowns are consistent with an investor’s risk tolerance.

Investment managers give their view of goals-based investment approaches

It is perhaps most instructive to summarize how a few leading investment-management firms broadly describe a goals-based investment approach.

In an article for Advisor Perspectives in November 2015, Matthew Rubin of Neuberger Berman said,

“When we work with clients to design a customized portfolio, we need to understand their most fundamental goals. Goals lead us beyond the simple mix prescribed by a risk profile—conservative, moderate, aggressive—and help us understand how wealth fits into our clients’ lives and what they want to achieve with the assets they have accumulated. …

The trend of goals-based allocation first took hold in the institutional world. Think of a company preparing for future pension outlays or a university endowment planning for a specific investment like a new campus building. Because institutional portfolio designers know the particular goal and the exact time horizon, they can design an allocation geared toward that outcome. This is known as liability-driven investing (LDI), and the process has become a standard practice for many institutions. While a duration-targeted LDI portfolio may not suit the typical family, we can use the same concept to identify specific goals and timelines for clients, which then guide asset allocation proposals and portfolio construction.”

In a white paper titled, “Goals-Based Investing—Aligning Life and Wealth,” SEI Investments Company addresses many issues for investors, especially how goals, risk, and time lines need to align:

“We do not think it makes sense to identify separate goals and then treat them identically by putting all financial assets into a single bucket. Investors’ financial goals differ in terms of importance, time horizon and the level of risk the investor is comfortable assuming relative to each goal. For example, logic would dictate that one can take more risk with long-term goals and less risk with short-term ones.

Similarly, one would want to take less risk with the funds designated for ‘have-to-have’ financial goals, such as covering day-to-day living expenses, while accepting more risk for discretionary ‘nice-to-have’ goals, like luxury vacations. By tracking each goal separately so that they can be monitored more accurately, investors will have a much clearer picture of how well they are succeeding.”

Flexible Plan Investments has a proprietary goals-based methodology called “OnTarget Investing.” Their description of the process for investors says,

“Markets were not created to have a goal that matches yours, presumably accumulating and/or preserving wealth for a future time defined by you. Instead, financial markets spend large periods going up and down, finally returning to where they started many years before. … Superior investment results require an expanded number of asset classes combined with the whole spectrum of strategies.

Using our proprietary software to marry traditional and alternative investments with strategic and tactical strategies, we will design a solution that is consistent with the information you provided—to set appropriate expectations for your investments. Investment markets are dynamic, requiring continuous assessment to assure your account is OnTarget to reaching your goals. Our process applies multiple management approaches to reduce market risk.”

***

By incorporating goals-based strategies, the investment managers listed above and many others work with advisors to better tailor investment approaches to meet clients’ specific needs and desires. Combined with the behavioral finance benefits of this process, clients are more likely to have realistic and achievable expectations, enabling them to stay the course to meet—or even exceed—their stated goals.

CNBC recently quoted Ashvin Chhabra, former chief investment officer at Merrill Lynch Wealth Management and author of the book, “The Aspirational Investor: Taming the Markets to Achieve Your Life’s Goals.” Said Mr. Chhabra, “At the end of your life, saying ‘I beat the S&P by 3 percent’ doesn’t mean anything. But if you say, ‘I invested well, I had a nice house, my kids went to a good school,’ that’s something.”

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

David Wismer is editor of Proactive Advisor Magazine. Mr. Wismer has deep experience in the communications field and content/editorial development. He has worked across many financial-services categories, including asset management, banking, insurance, financial media, exchange-traded products, and wealth management.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.

Katie Kuehner-Hebert is an award-winning journalist with more than three decades of experience writing about the financial-services industry. She has expertise in banking, insurance, financial planning, economic development, and employee benefits, and her work has appeared in many leading publications.