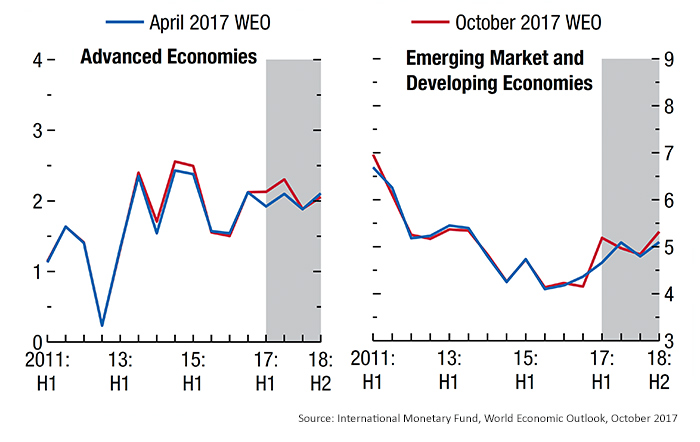

The Commerce Department said in its press release:

“Real gross domestic product (GDP) increased at an annual rate of 3.0 percent in the third quarter of 2017, according to the ‘advance’ estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 3.1 percent.

“The increase in real GDP in the third quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, nonresidential fixed investment, exports, and federal government spending. These increases were partly offset by negative contributions from residential fixed investment and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.”

FIGURE 1: REAL GDP—PERCENT CHANGE FROM PRECEDING QUARTER

Barron’s noted that the GDP first estimate for Q3 topped their high estimate (range of 1.9%–2.9%) and was “led by personal consumption expenditures which came in at a roughly as expected 2.4 percent pace and contributed 1.62 points to the quarter. Durable spending was very strong, at 8.3 percent and reflecting, at least in part, hurricane replacement demand for vehicles.”

The GDP news came at the tail end of a very positive market week, marked by some blockbuster technology sector earnings, progress on the Trump administration’s tax agenda, further efforts at bank deregulation, and a generally well-received policy statement from the European Central Bank. Amazon (AMZN) was far and away the earnings story of the week, with a +687% earnings surprise, resulting in AMZN stock rocketing higher after earnings by 13%.

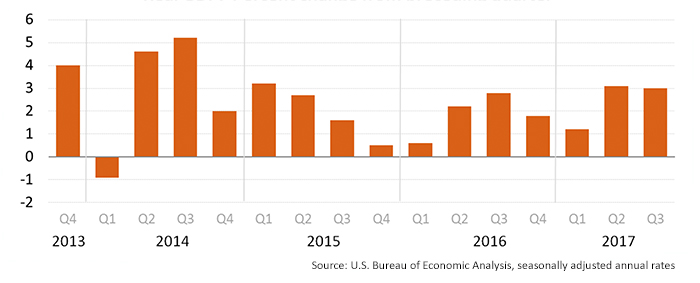

FactSet reported on Oct. 27 that with 55% of the companies in the S&P 500 reporting results so far, “76% of S&P 500 companies have reported positive EPS surprises and 67% have reported positive sales surprises.” They added that a significantly improved earnings picture has taken shape since estimates a month ago, “For Q3 2017, the blended earnings growth rate for the S&P 500 is 4.7%. … On September 30, the estimated earnings growth rate for Q3 2017 was 3.0%.”

FactSet is now projecting a year-over-year increase in S&P 500 companies’ blended EPS for 2017 of 9.5%.

FIGURE 2: S&P BOTTOM-UP EPS ESTIMATES (ACTUAL AND PROJECTIONS)

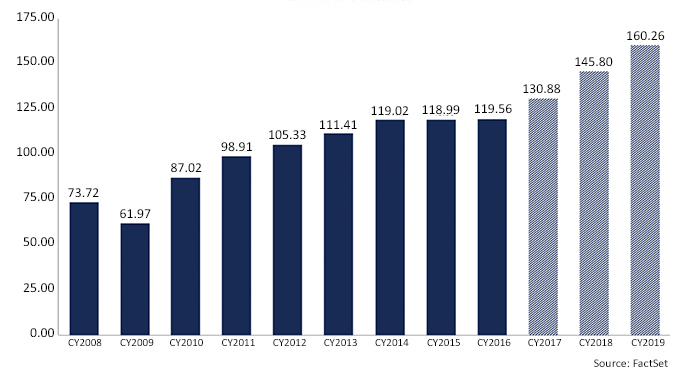

Markets around the world have also been responding to the global growth story. Barron’s reports, “Real gross-domestic product growth was 4.6% globally in the second quarter, up from 3.9% in the first, according to Barclay’s.”

The International Monetary Fund’s (IMF) October 2017 “World Economic Outlook” has a slightly less robust forecast for global growth, but does see improvement:

“The global upswing in economic activity is strengthening, with global growth projected to rise to 3.6 percent in 2017 and 3.7 percent in 2018. Broad-based upward revisions in the euro area, Japan, emerging Asia, emerging Europe, and Russia more than offset downward revisions for the United States and the United Kingdom. But the recovery is not complete: while the baseline outlook is strengthening, growth remains weak in many countries, and inflation is below target in most advanced economies.”

Most notably, the October IMF analysis sees a continuing gap between growth in advanced economies versus emerging markets and developing economies.

FIGURE 3: GDP GROWTH FORECASTS (ADVANCED ECONOMIES VS. EMERGING MARKET/DEVELOPING ECONOMIES)