The conventional wisdom for the past few months has been that the Federal Reserve will cut interest rates in July—maybe by as much as 50 basis points, according to some analysts’ projections.

Barron’s lead column on June 29 noted, “Fed-fund futures are anticipating three quarter-point cuts by year-end, based on the expectation that the Fed and other central banks will seek to offset the apparent decline in global economic activity.”

But that was before the latest employment report, which has thrown some doubt into the certainty of a July rate cut and how many rate cuts might occur in 2019.

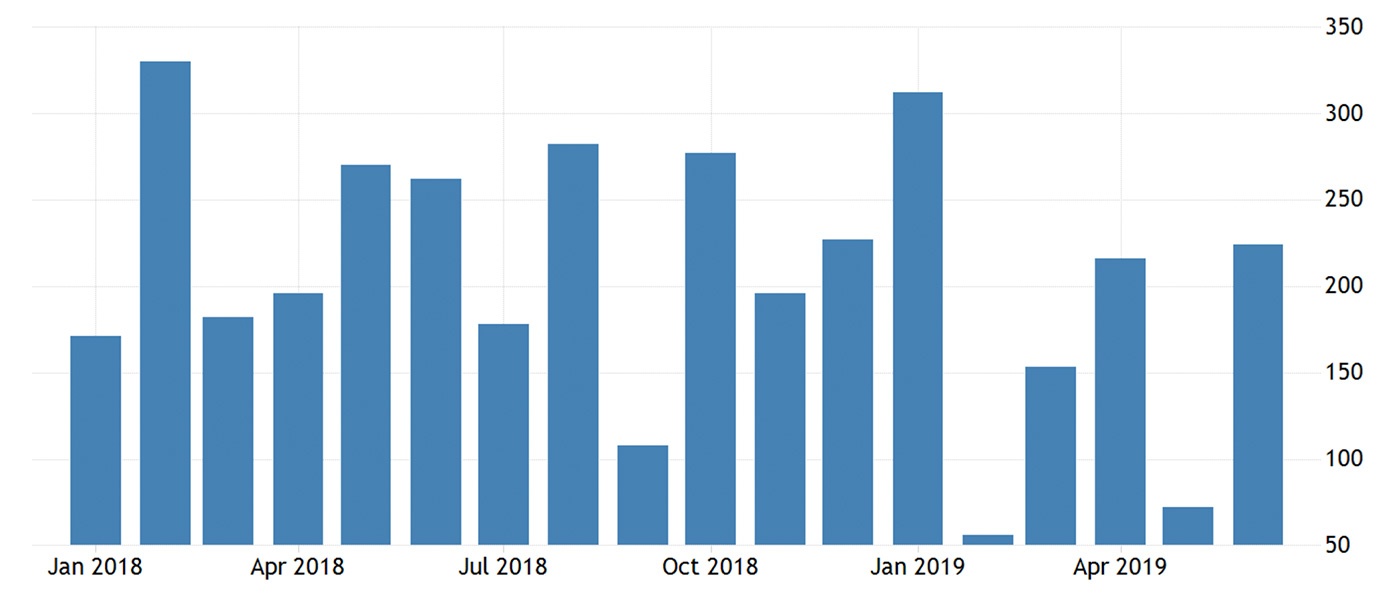

U.S. employers added 224,000 jobs to payrolls in June, according to the Labor Department. This was significantly above the consensus estimate for the addition of 165,000 jobs.

The Wall Street Journal commented on the report,

“Robust June hiring suggests a decade of domestic growth is powering ahead despite global headwinds. … The latest data, which comes after uneven gains this year and a surprisingly weak May that stoked fears of a stronger slowdown, confirms that hiring is trending along the same lines as an economy that is cooling from better than 3% annual growth toward the 2% pace maintained during most of the decade-long expansion.”

To the point of the labor market showing some overall signs of “cooling,” MarketWatch notes, “Employment growth in 2019 has averaged 172,000 jobs per month, well below 2018’s average of 223,000 per month, suggesting U.S. economic growth may be at least reverting to the mean after last year’s boost after the Trump tax overhaul in late 2017.”

Source: tradingeconomics.com, U.S. Bureau of Labor Statistics

The Federal Reserve has come under fire from the Trump administration and more than a few Wall Street analysts for a “policy mistake” in raising rates in December 2018. The central bank took the target range for its benchmark funds rate to 2.25% to 2.5%. The move, according to CNBC, marked the fourth increase in 2018 and ninth since it began normalizing rates in December 2015. At that time, the Federal Open Market Committee (FOMC) projected two rate hikes for 2019.

Various statements from the Fed, meeting notes, and speeches in 2019 have walked back the sentiment for rate hikes, now pointing to a much more dovish policy. However, Fed Chairman Jerome Powell has, according to The New York Times, “made clear” that the Fed will not succumb to political pressure. The Times summarized Powell’s comments from late June in this way:

“The central bank is weighing whether an interest-rate cut will be needed as trade risks stir economic uncertainty and inflation lags. … Mr. Powell said the case for a rate cut has strengthened somewhat given that economic crosscurrents have re-emerged … with incoming data raising renewed concerns about the strength of the global economy. But he stopped short of saying a cut was guaranteed, noting that the Fed would continue to watch economic events unfold and would avoid reacting to short-term issues.

“‘The question my colleagues and I are grappling with is whether these uncertainties will continue to weigh on the outlook and thus call for additional policy accommodation,’ Mr. Powell said at a Council on Foreign Relations event in New York.”

Mr. Powell is delivering his semiannual Monetary Policy Report to Congress on Wednesday (7/10) and Thursday (7/11), and the FOMC will next meet on July 30–31. Powell’s prepared text for Congress was viewed by a BMO analyst as “striking a decidedly dovish cord with ‘uncertainties’ over trade and global growth … having dimmed the outlook,” according to Barron’s reporting.

The financial press is now being flooded with commentary on both sides of the interest-rate question and what the Fed should do at the end of July. While the arguments can get detailed and technical, a few common broad themes seem to be prevalent:

- Those calling for a rate cut cite the importance of continuing to support U.S. economic growth, protecting the competitive position of the U.S. versus nations with much lower rates, current low levels of inflation, and the prudence of providing “insurance” against a recession taking hold.

- Proponents of the Fed staying pat or even raising rates cite the generally stable position of the U.S. economy, the historically low current level of interest rates, the wisdom of continuing to “normalize,” and the need to maintain higher rates in the event that cuts are more urgently needed down the road.

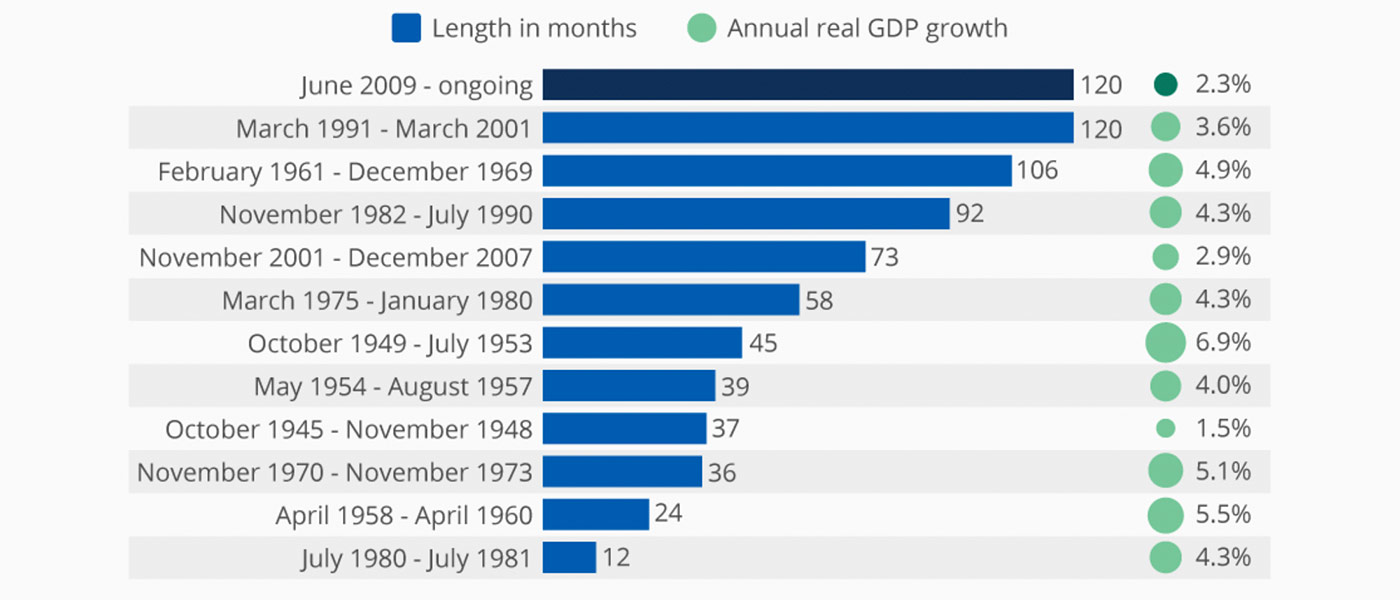

It is an interesting question, and one that comes at a point when the U.S. economy is setting a record for the longest period of expansion since World War II, according to data analytics firm Statista.

Source: Statista, based on data from the National Bureau of Economic Research. Data as of late June 2019.