The observations have ranged from one extreme to another and consider economic, political, and societal factors, as well as issues of national and regional security. And all of these are highly connected, making it a mammoth task to understand implications that will take months and years to become at least somewhat clear.

The opinions that have surfaced since the results of the vote from June 23 have been as diverse as the following shorthand representations:

“It is basically a nonevent that has been overblown, similar to ‘Y2K.’ U.S. financial markets will probably get over it by the Fourth of July holiday.”

“It spells the end of the European Union as we know it, though it will take years to completely fall apart.”

“This could throw the world into global recession.”

Many more sober-eyed analysts have rightly said, in effect, “We are in the eye of the storm right now, and estimates of market, economic, and political dislocations are very difficult to make with any degree of certainty.”

There is one thing most respected economists seem sure of: The financial and growth expectations for Britain will suffer for the foreseeable future. Goldman Sachs issued a note this week saying a “mild” recession could hit Britain by 2017.

There is one thing most respected economists seem sure of: The financial and growth expectations for Britain will suffer for the foreseeable future. Goldman Sachs issued a note this week saying a “mild” recession could hit Britain by 2017.

According to CNBC, the economists at Goldman authoring the most recent outlook say, “U.K. gross domestic product (GDP) would take a 2.75 percentage-point hit in the next 18 months from the cumulative effects of ‘increased uncertainty and deteriorating terms of trade.’”

Perhaps it is instructive to step back from the current “noise” and look at economic estimates that were formulated before the Brexit vote on the potential impact on the U.K. economy.

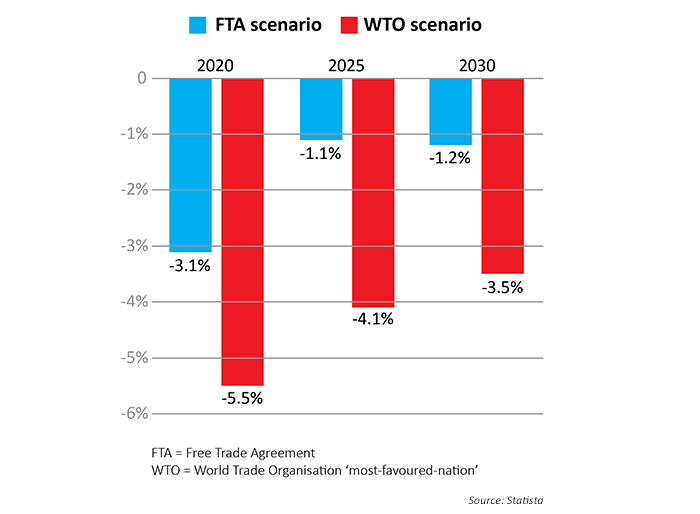

Statista, a data analysis firm and website, reported this spring on a report assembled for the Confederation of British Industry (CBI) by PricewaterhouseCoopers (PwC) on the potential economic fallout from a Brexit.

Says Statista (citing The Week as a resource):

“Two main scenarios were considered—FTA and WTO. In the FTA scenario, it is assumed that the UK is able to arrange a free trade agreement with EU states and continue trading with them on a tariff-free basis. WTO refers to the chance that such an agreement is not feasible with the UK therefore resorting to becoming a World Trade Organisation ‘most favoured nation’. Trade on this basis would not be tariff-free (more detailed explanations can be found in the PwC report).

“One of the major results of the analysis was the projected long-term effects on GDP. As the chart here shows, in both Brexit scenario types, PwC predict that economic output will suffer. The initial ‘shock’ of the UK severing its ties with the EU are expected to have a heavy impact regardless of an FTA being in place or not. GDP growth rates are forecast to match or exceed those in the base ‘remain’ scenario in the long-term, but the initial setback of leaving the union is projected to leave overall levels playing catch up for years to come.”

THE ECONOMIC IMPACT OF BREXIT

% difference in real UK GDP compared to ‘remain’ scenario, by Brexit type