Can lower returns lead to more money in retirement?

Can lower returns lead to more money in retirement?

The impact of sequencing and volatility on portfolio value.

Returns, risk, pricing models, optimal portfolio construction—there are so many facets of effective investing and portfolio management. As busy as most of us are, who has time to really dig in and question conventional wisdom? So when well-known publications have said over the years that active management results in lower returns than passive management, I used to take that information at face value.

But like many things in life, the deeper you dig into the “passive management wins” numbers, the less satisfying you find the conventional “wisdom.” Two important problems with the common arguments concern risk and withdrawals. It turns out some “passive wins” news stories don’t take risk or withdrawals into account. But how much do those factors really matter? In fact, their impact is so strong that leaving them out of the discussion may lead to financially destructive conclusions.

Active strategies using momentum and value can outperform passive on both an absolute and risk-adjusted basis.

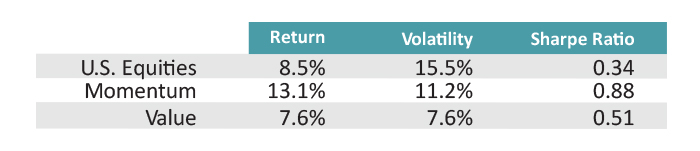

Let’s start with a bit more information comparing active and passive strategies. Dr. Antti Ilmanen, a Ph.D. graduate of the University of Chicago and currently managing director at AQR Capital Management LLP, wrote a book in 2011 titled, “Expected Returns: An Investor’s Guide to Harvesting Market Rewards.” After examining a number of business and academic sources, Dr. Ilmanen found momentum and high book-to-market ratio (referred to as “value” for simplicity)—both active management strategies—significantly outperformed stocks, bonds, and almost all other asset classes on a risk-adjusted basis.

I can already hear some of you saying, “But my clients only care about absolute returns.” Of course they do, and who can blame them? But how would they feel if we showed them how lower average returns with less volatility could result in significantly more money in their pockets?

Let’s walk through an example. Say you have two clients, Paula and Ann. Paula has heard through the news that active management is a “bad deal” for investors and she only wants to use passive investment strategies in her portfolio. Ann, on the other hand, is more open to active strategies and believes that in the hands of a skilled advisor, they can provide significant benefits.

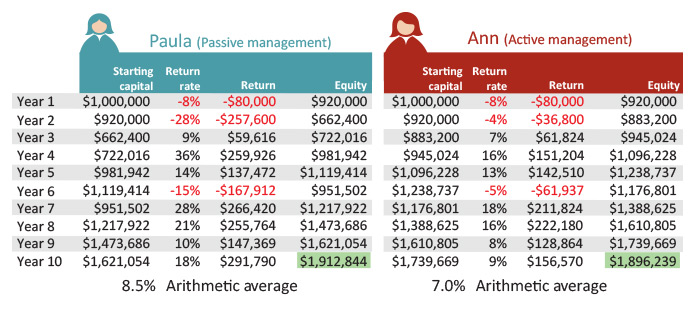

Dr. Ilmanen and others have shown that active strategies using momentum and value can outperform passive on both an absolute and risk-adjusted basis. But for the sake of argument, let’s say that when we consider fees, passive management outperforms an active portfolio during the hypothetical 10-year period we will use in our example. More specifically, the arithmetic average return is 8.5% for the hypothetical passive portfolio and 7.0% for the hypothetical active portfolio. We use the arithmetic average return because it is often used by proponents of passive management strategies as “proof” that a hands-off approach outperforms. As shown in Figure 1, the final value of Paula’s passive portfolio is slightly higher than Ann’s actively managed portfolio, although the difference—only about $16,000—is probably smaller than you might expect.

Figure 1: Comparative hypothetical returns without withdrawals

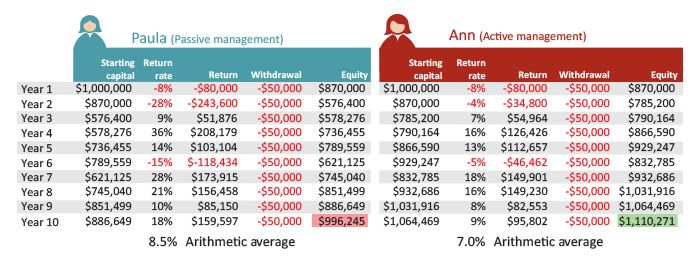

So even though the hypothetical active portfolio had 1.5% lower average annual returns, the passive and active portfolios have almost the same overall performance over 10 years. But I forgot to mention something: both Paula and Ann need to withdraw $50,000 each year from their respective accounts. Since Paula’s passive portfolio had the slightly higher absolute returns in Figure 1, you would expect her portfolio to outperform Ann’s despite the withdrawals, right? Wrong. Let’s take a look at the table including the withdrawals.

Figure 2: Comparative Returns Including $50,000 Annual Withdrawals

The annual percent returns for both portfolios are the same as noted earlier. Despite the fact that Paula’s passive portfolio outperformed Ann’s active portfolio in seven out of 10 years, Ann’s active portfolio ended up in better shape. As shown in Figure 2, the active portfolio finishes the 10 years with an 11% higher final equity balance.

What is going on, you ask? There are two issues at work: (1) the sequence of returns and (2) the impact of volatility.

How would clients feel if we showed them how lower average returns with less volatility could result in significantly more money in their pockets?

You may be aware that the sequence of returns makes a difference in terms of the ending portfolio value. In other words, a negative return in year 1 has a very different impact than a negative return in year 10. But in this case, the general sequences of returns—when positive versus negative years occur in the two portfolios—are almost identical.

The larger issue here—and a dynamic often overlooked by studies and news articles proclaiming passive management “outperformance”—is the volatility of returns. An appropriately constructed active management portfolio can be significantly less volatile than a passive portfolio. Returning to Dr. Ilmanen, he shows that from 1990 to 2009, U.S. equities had an average return of 8.5%, but the volatility was 15.5%, nearly double the return. In contrast, value investing had a 7.6% average return with a 7.6% annual volatility, and momentum had a 13.1% average return and an 11.2% annual volatility—in other words, volatility was significantly lower in the active strategies.

Figure 3: Comparing 20 Years of Returns and Volatility (1990–2009)

It is also worth noting that since both clients needed to make withdrawals from their accounts each year, most advisors oriented to passive management would likely put a larger proportion of the client’s assets into bonds versus equities. This means the 8.5% annual returns for passive management over the 10-year period shown are surely on the optimistic side—the larger allocation to bonds would reduce the annual returns, making the active management strategy look even more advantageous in comparison.

So what is important to take away from this analysis? First, looking only at average annual returns in a vacuum can be misleading. The volatility of returns can make a major difference. Second, when you also consider withdrawals, the reduced volatility of some active management strategies has the potential to make a far larger impact on portfolio value than losing some small portion of returns due to fees. Finally, while there are always exceptions, certain active management strategies with proven track records, like value and momentum, could significantly outperform a passively managed portfolio. While we have used fairly conservative rates of return in comparing the two hypothetical portfolios, Dr. Ilmanen’s study suggests that using the right active strategies can outperform passive strategies on both an absolute and risk-adjusted basis.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

This article first published in Proactive Advisor Magazine on January 22, 2015, Volume 5, Issue 3.