Best & worst market days

Best & worst market days

An ongoing study by Hepburn Capital Management, LLC, (HCM) confirms that missing the best days of the market really doesn’t matter if investors also miss the worst days.

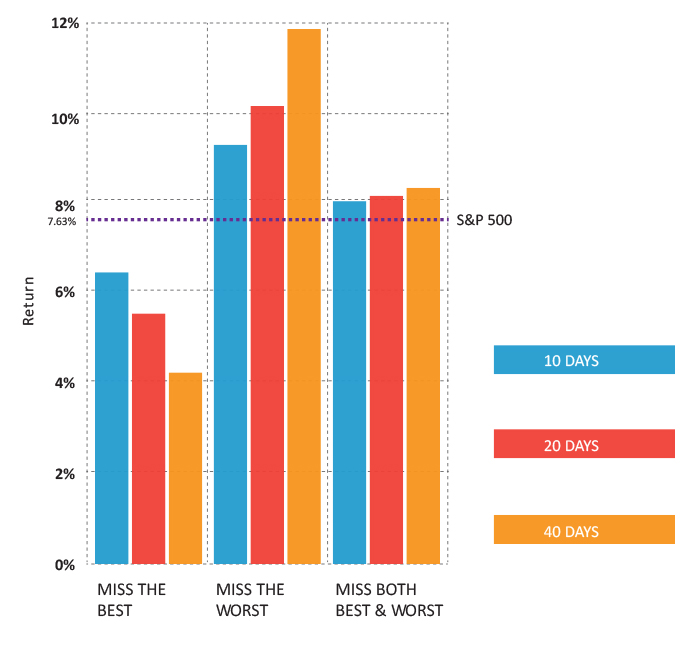

The S&P 500 stock index averaged 7.63% annual return (dividends reinvested) for the period January 3, 1950, through December 31, 2013, the HCM study shows.

If you happen to be the unluckiest investor on earth, and you miss just the 10 strongest days over that period, your return would have dropped to 6.39%. Move out of the market and miss the 20 best days and you end up with only 5.58% gains, and miss the 40 best days and your average gain drops to 4.18% per year. “Clearly it doesn’t pay to be unlucky,” explained Will Hepburn, president of HCM.

“The luckiest person around might miss the 10 worst days in the market instead and boost their average returns to 9.23%. If you are on a roll and miss only the 20 worst days, your returns jump to 10.3%, and if you are lottery-winning kind of lucky and your streak has you out of the market for the 40 worst days, your returns will soar to 11.96% annually,” Hepburn adds.

But how likely is either of these scenarios? Not very. Statistically, missing only the best or worst days of the market is virtually impossible. History shows that the best days tend to closely follow the worst days. Sometimes they occur back to back. So if an investor misses one, chances are he will miss the other as well.

What happens to an investor’s returns if one were to sit out for both the worst days and the best days?

Remarkably, average annual returns become more consistent and may actually increase at the same time. The HCM study shows that [compared to the buy-and-hold 7.63% annual return in the period,] if one were to miss both the 10 worst and 10 best days, the resulting average returns increase to 7.99%. Miss both the 20 worst and best, and annual returns become 8.22%; dodging the 40 worst and best days sends returns up to 8.38%.

Average annual return based on days missed

(Jan. 3, 1950-Dec. 31, 2012)

Missing the 40 best and worst days produces an increase in return over buy-and-hold investing of 0.75%. That may not sound like much, but that is a 9.84% earnings increase, and when compounded for long-term investors, it makes a huge difference in the end results.

This increased earnings compounded over the life of the study results in a hypothetical $1,000 investment growing to $172,633 for the actively managed portfolio versus $110,655 for buy-and-hold investing.

As Nobel Laureate Paul Samuelson said, “The longer one invests, the greater the chances of encountering a major market upheaval. Risk does not go down with time, it goes up!” The risk-reduction potential of active management as modeled in this study is what accounts for the significant outperformance of actively managed portfolios.

The reason that missing both the best and worst days increases one’s returns and dramatically reduces volatility is that the worst days in the stock market tend to be much worse than the good days are good. Throw in the math of gains and losses and the case for risk management becomes clearer.

If you lose 10%, you must have an 11% gain to break even. A 50% loss requires a 100% gain to return to breakeven, making it much more important to avoid a large loss than to make a gain of the same amount.

Although past performance does not assure future results, the HCM study illustrates the point that investments actively managed for risk reduction may provide added potential benefits compared to a passive buy-and-hold approach, including more consistent returns and lower principal fluctuations.

The worst days in the stock market tend to be much worse than the good days are good.

HCM also points out that it’s much easier to deliberately miss the worst days of the market because they rarely occur in isolation; rather they follow steadily deteriorating market values.

“Before you make up your mind whether or not it makes sense to actively manage your assets, you have to look at both sides of the argument. And you have to realize that no trading system is going to be perfect. But the good news is you don’t have to be. Simply reduce losses and you don’t need eye-popping gains to exceed a buy-and-hold position. That’s what the buy-and-hold argument conveniently overlooks,” says Hepburn.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Will Hepburn is founder and president of Hepburn Capital Management, LLC, which focuses on developing, implementing, and teaching innovative investment strategies. Mr. Hepburn is a past president of the National Association of Active Investment Managers and managed two mutual funds prior to entering private practice. He has taught classes on finance and investing at the college level since 1990 and is the author of “Why Bad Things Happen to Good Investments.” https://hepburncapital.com/

Will Hepburn is founder and president of Hepburn Capital Management, LLC, which focuses on developing, implementing, and teaching innovative investment strategies. Mr. Hepburn is a past president of the National Association of Active Investment Managers and managed two mutual funds prior to entering private practice. He has taught classes on finance and investing at the college level since 1990 and is the author of “Why Bad Things Happen to Good Investments.” https://hepburncapital.com/