Before the significant week-ending rally last Friday (Jan. 20), much of the financial news commentary had centered on a consistent theme in response to the market’s recent weakness: “Is bad news bad again?”

CNN focused heavily on the “impending debt ceiling drama in Washington” in its article “Bad news for the economy is now bad news on Wall Street.”

But CNN also cited recent economic data and earnings in its analysis:

“Retail sales fell more than expected in December. Industrial production unexpectedly slid last month too, a sign of weakness in the manufacturing sector.

“‘A clutch of economic data releases … indicate that the economy is finally slowing more broadly, and that the all-important consumer is becoming increasingly careful about spending,’ said Quincy Krosby, chief global strategist for LPL Financial, in a report.

“‘What just some weeks ago would have seen markets cheering the weaker data … is now being judged more harshly with bad news no longer enjoying a warm welcome,’ she added.”

Reuters’ Jan. 18 article “Finally, bad news is bad news” focused on economic data and yield curves that may be foreshadowing recession:

“Retail sales, industrial production and producer price inflation on Wednesday all pointed to the world’s largest economy notably slowing in December. This follows recent figures showing recession levels of manufacturing and services activity.

“Finally, bad news may be bad news for risk assets. Bond yields slumped on Wednesday to multi-month lows, but rather than moving higher on expectations the Fed will slow up on its policy tightening, this time Wall Street slumped into the red. …

“A range of yield curves in the United States and elsewhere shows investors are clearly anticipating economic slowdown, disinflation or outright recession. The inversion in the three-month/10-year U.S. yield curve is particularly staggering.”

Business Insider reiterated these themes in “Bad news for the economy is once again bad news for the stock market as recession uncertainty dents consumer spending,” writing,

“Last year, most negative economic data was treated by the stock market as bullish, as it signaled to investors that their main concern of inflation was likely to ease, allowing the Federal Reserve to slow down or pause its interest rate hikes.

“But now that inflation has clearly made progress on abating, and the Fed has stepped down from its outsized 75-basis point rate hikes, bad economic data has less of a positive impact on stock prices.”

Broader view of market trend

Bespoke Investment Group sees both good and bad news in recent market trends:

“It was nice to end the week on a positive note, but the pattern for all three major indices remains the same as the S&P 500 (SPY), Nasdaq (QQQ), and Russell 2000 (IWM) all remain stuck in downtrends that have been in place for over a year. As we’re all familiar with by now, every time a rally approaches the 200-DMA it gets stopped in its tracks.

“One encouraging aspect of the latest pullback from the downtrend/200-DMA this time around is the fact that, none of the three ETFs shown made lower lows following the pullbacks that began right at the end of 2022. QQQ came closest to a new low, but for both the S&P 500 and Russell 2000, lower lows never even came into question.

“There isn’t an active investor around these days that isn’t watching these downtrend lines, and usually whenever any market trend attracts so much attention, it loses its effectiveness, so maybe—just maybe—we’ll see this pattern break ahead of an earnings season that pretty much everyone expects to a be a tough one.”

FIGURE 1: SPDR S&P 500 ETF (SPY)—LAST 18 MONTHS

Source: Bespoke Investment Group

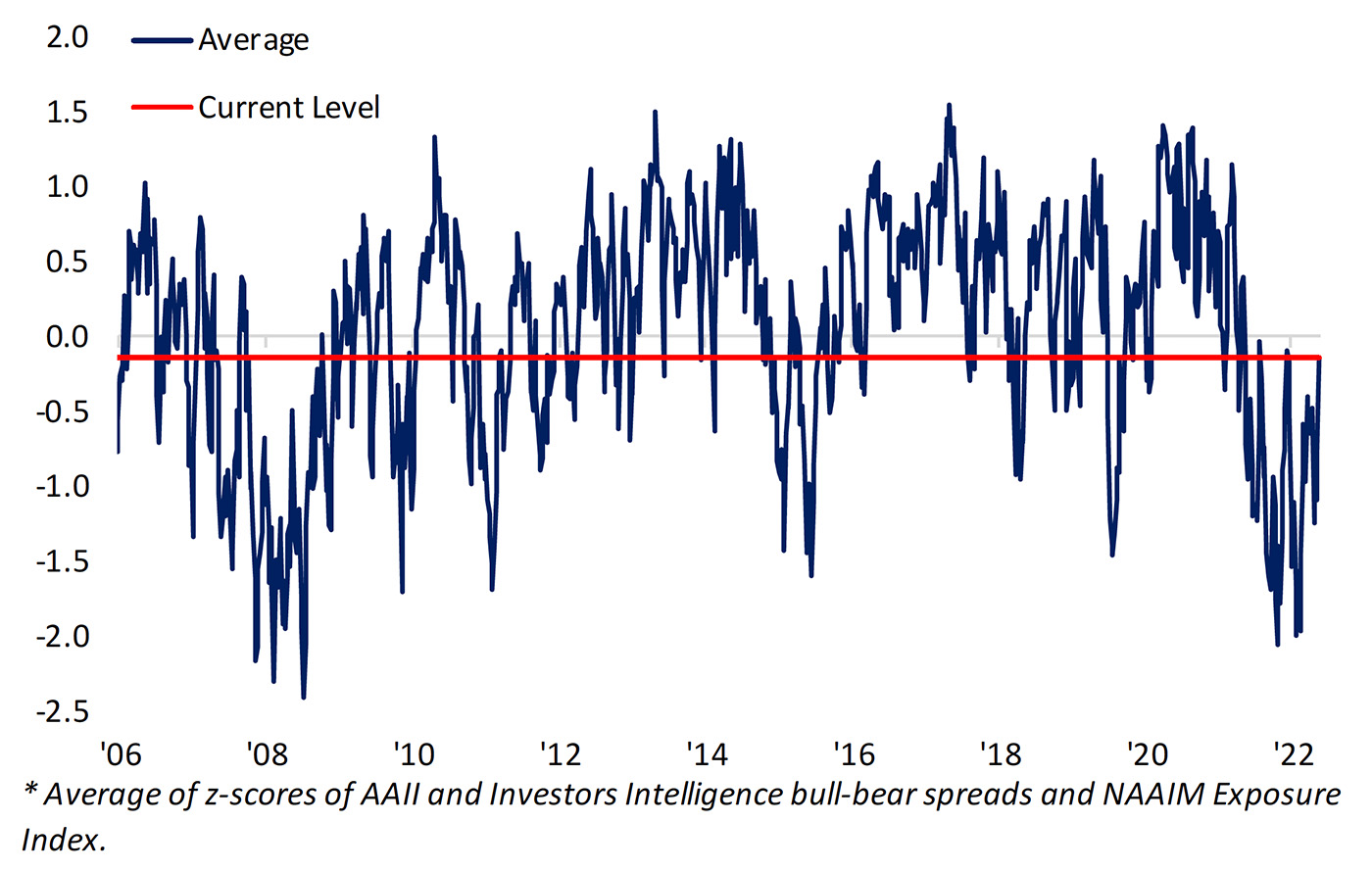

Bespoke also points to improving investor sentiment as perhaps a sign of a more risk-on environment:

“The S&P 500 may have turned lower in the past week, but surveys measuring sentiment have shown investors are shifting to a less bearish tone. …

“… Combining each of these surveys into a single index … we show our sentiment composite [Figure 2]. Like the AAII bull-bear spread’s streak of negative readings, this composite has been negative for a record 54 straight weeks, tying the previous record ending in June 2009. Albeit still negative, this week’s number was one of the least pessimistic readings of the past year and change. In other words, record streaks of bearish sentiment are still alive, but just barely, per the latest data.”

FIGURE 2: SENTIMENT COMPOSITE NEARLY RECOVERED

Source: Bespoke Investment Group

However, there is still no shortage of analysts with a bearish outlook for the intermediate term—despite the market’s more positive tone of late.

Morgan Stanley’s chief U.S. equity strategist Mike Wilson, according to MarketWatch, says investors need to beware of the “bear market hall of mirrors.”

Adds Wilson, “Suffice it to say, we’re not biting on this recent rally because our work and process are so convincingly bearish on earnings. … This cyclical rotation in particular is convincing investors that they are missing the bottom and must reposition. … The final stages of the bear market are always the trickiest and we have been on high alert for such head fakes. …”

New this week: