Why ‘personal benchmarks’ are important for your investment clients

Why ‘personal benchmarks’ are important for your investment clients

When clients measure their investment progress against personal benchmarks—not some media-inspired number that does not represent their risk profile and investment time horizon—it helps them maintain realistic expectations for long-term growth within their investment plans.

I can still feel the doorjamb pressed hard against the back of my head, each move causing a painful tug against an errant strand of hair. But I wanted to be there, and I strained to stretch my body upward, fighting the urge to resort to tiptoes. Dad took the ruler and balanced it evenly on the top of my head. He then quickly penciled in a line at its intersection with the molding behind me.

It was that time of year again. My sister and brothers would follow me to the doorway and undergo the same process. Above each penciled line, a date and a name would be etched. Once finished, we would all crowd around the doorway and compare this year’s benchmark, our personal benchmark, with the last. How much taller had we grown? The answer was always there to see.

I know many of you have gone through this same exercise within your families. And I hope that young families still perform this yearly rite of passage. I’ll bet they do. It’s a natural human tendency to want to measure where we’ve been and how much we’ve grown. It gives us perspective and provides a foundation for our dreams.

In an attempt to fulfill this same need, benchmarks have been the norm in the financial-services industry.

How do other firms do it?

They take the returns achieved, print them next to the return of the S&P 500 Index, and let you compare. If they’re really progressive, they’ll also provide a short menu of other indexes, maybe a bond, the NASDAQ, or an international measure, to give further perspective.

The problem with these reports is that they are not realistic. Not only is the S&P 500 a bad benchmark, but, for most individuals, it is inappropriate to use with individual portfolios. A benchmark should provide a measure that has some application to the individual using it.

While indexes can tell us what direction the stock or bond market has traveled, they tell us nothing about whether the investment it is being compared to fulfilled what it was supposed to do for the investor. After all, an index is just a collection of stocks chosen by a committee to be used by the media. They do not measure the investment’s success in meeting the client’s goal. They are not the personal benchmark that every investor needs.

Indexes tend to be used in a one-dimensional fashion. Giving the return of only the S&P is like giving the return on a winning lottery ticket—it is worthless without providing a measure of its risk. Yes, you can earn a million percent return on the lottery ticket, but we all know that the odds of winning are also at least a million to one—meaning the risk is very close to 100%.

With the S&P, you can know that it went up 10% in a quarter, but to put that into perspective you have to know that at times the S&P 500 has declined more than 50%. If you knew that the value of your investment could be cut by more than half, would you invest in it in the first place? If not, why would you compare the performance of your investments to an index whose risk profile you could not tolerate?

At Flexible Plan Investments (FPI), we make all of this “standard” information available on our research, illustration, model performance, and our firmwide GIPS-verified information. Our model performance and GIPS reports detail how strategies have actually performed historically. But in enlisting an investment advisory firm, you are also enlisting their research department and its ability to adapt and improve even the seemingly best strategy.

To measure this, our research reports and illustrations demonstrate how the present methodology would have performed historically. Why is this hypothetical performance important? The effectiveness of all strategies changes over time and in different market environments. In addition, the rules for employing the investment vehicles (minimum holding periods, redemption fees, availability of funds) can also change.

When you choose a strategy or investment advisor, it is probably at least as important to know how the present methodology would have done with the new limitations of the investment vehicle as it is to view actual performance under an old set of rules that no longer applies.

On our account statements, we use the latest research report performance with the current fund rules to prepare a personal benchmark for each client account. We call it our OnTarget Investing process.

The process starts with the suitability questionnaire that clients execute as a portion of their investment management agreement with us. Pairing each client’s answers with the strategy or portfolio of strategies chosen by each client and their financial advisor, we are able to create a personal benchmark for what they indicate will be the time horizon of their investment.

This is provided to clients in the initial proposal. By doing so and then delivering it with each future account statement, we provide clients with a personal, customized measure to judge subsequent performance of their account.

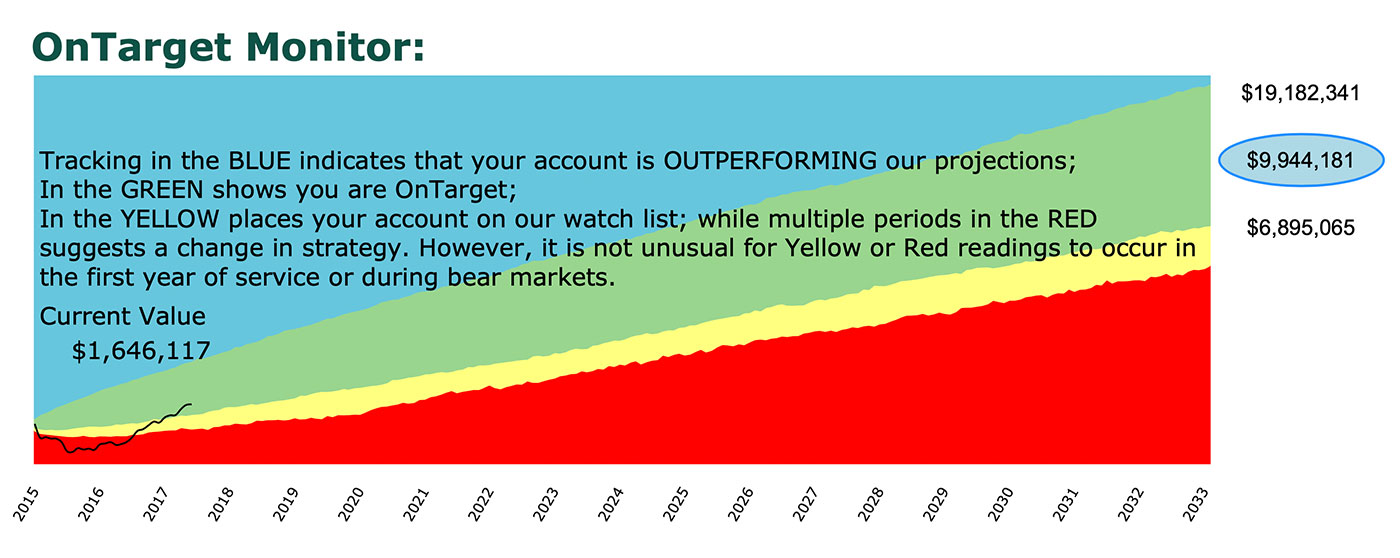

Each client’s personal benchmark is best represented by the OnTarget Monitor. This chart is the result of up to 1,000 calculations of possible scenarios that a client portfolio can experience over the time horizon selected. It uses the latest research results for the strategies selected in the same proportion as they are represented in a client’s specific portfolio.

Source: Flexible Plan Investments

Each color on the chart represents the probability that a portfolio is performing as expected, that it is OnTarget. These colors tie into the black line emerging from the left side of the chart, which shows which color zones a portfolio is and has been in.

If the black line is in the blue, it’s outperforming at least 80% of the scenarios generated by our research. If it’s in the green zone, it means that while not quite matching the blue zone, the portfolio performance exceeds all but the 20% of the outcomes that remain in the yellow and red zones.

What we refer to as OnTarget performance is obtained by portfolios where the black line is in the blue or green zones. The OnTarget goal for each portfolio is also circled on the right side of the chart. It is the value obtained in 60% of the research scenarios tested.

While a bear market can throw even the best of strategies or diversified portfolios briefly into the red or yellow zones, prolonged duration in the red zone suggests that a financial advisor and their client may want to discuss choosing a “better” (more appropriate) combination of strategies.

In addition, we put each client’s portfolio into perspective with two risk-measuring graphics, our Volatility Barometer and Risk Target. The former measures the volatility (standard deviation) of each client’s actual portfolio versus the volatility of the S&P 500 and NASDAQ, while the Risk Target compares the maximum uninterrupted decline of the investment versus the maximum loss of these two commonly referenced indexes.

Investors can check out their portfolio’s risk level in their account statement.

They will see that by both measures the account is undoubtedly exhibiting far less risk than both of the popular index benchmarks. This is done to make it more likely for a client to stick with their investment plan regardless of what the market is doing.

The major impediment to successful investing for most investors is their feeling of overconfidence at market tops, causing them to overcommit to risky investments, and their overwhelming pessimism at market bottoms that leads to abandonment.

***

My parents lived in their home for almost 50 years. My father, who was a builder, had been the contractor. It was difficult to leave it.

So many memories, yet before we left, each of us visited the doorway, rubbed our fingertips over the many notches, and bent down and squinted at the faded writing.

Such is the power of personal benchmarks. Our objective is to have all of FPI’s investors be “OnTarget”—achieving their own personal benchmarks—and not following some media-inspired number that does not represent their specific risk profile and investment time horizon.

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com

Jerry C. Wagner, founder and president of Flexible Plan Investments, Ltd. (FPI), is a leader in the active investment management industry. Since 1981, FPI has focused on preserving and growing capital through a robust active investment approach combined with risk management. FPI is a turnkey asset management program (TAMP), which means advisors can access and combine many risk-managed strategies within a single account. FPI's fee-based separately managed accounts can provide diversified portfolios of actively managed strategies within equity, debt, and alternative asset classes on an array of different platforms. flexibleplan.com