Wealth transfer equals opportunity

Advisors who can differentiate and add value via their investment management approach should reap the benefits of the upcoming “greatest transfer of wealth”

Advisors who are not actively courting younger generations may be in for a rude awakening, as the country gets set for the greatest wealth transfer in history.

A study by the Boston College Center on Wealth and Philanthropy states that $36 trillion is expected to be passed down to heirs between 2007 and 2061. A significant amount has been in the process of being transferred from the World War II generation to the baby boomers, but it will be nothing compared to the trillions passed on to succeeding generations for the next 40 years.

Yet, most advisors are giving the bulk of their attention to older clients who already have significant assets and not enough attention to younger generations—even though it may be equally advantageous to cement lifelong relationships now with the latter set before that wealth transfer begins to accelerate.

While most younger individuals are obviously still in the accumulation phase of their lives, it is well worth courting them in their early years so they can use the services of advisors for decades, according to the PriceMetrix report, “The Fountain of Growth: Demographics and Wealth Management.”

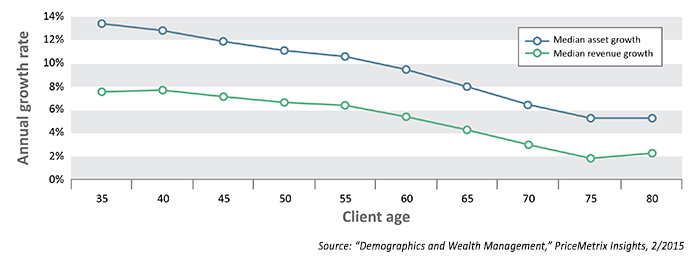

ASSET AND REVENUE GROWTH BY CLIENT AGE

PriceMetrix analyzed the value of advisory firms’ books of business and found higher growth rates, on average, for books with an average client age of 50 to 55, compared to books with an average age of 65 to 70.

For example, advisory firms that have only 20% of clients over age 65 have average earnings of $890,000 per year, and their books of business rise on average 14.1% per year. In contrast, advisory firms that have 55% of clients over 65, earn $810,000 per year on average, growing their books of business just 7.7% per year.

By attracting more younger generations as clients, “advisors may concede some current revenue but may feel it is worth it to capture stronger growth,” the authors wrote.

It helps if planning and advisory firms attract younger advisors, but many firms are having difficulty doing just that. Indeed, the industry as a whole is aging: the average advisor is older than 50 and a third of advisors are expecting to retire within a decade, a Cerulli study found. Only 11% of advisors are under 35, and just 5% are under 30.

Cement relationships now with younger investors before the wealth transfer begins to accelerate.

Younger advisors should be more attuned to the needs and attitudes of their own generation, who typically are much more risk averse than their parents, having come of age during the financial crisis and subsequent Great Recession. Seeing all of the financial firm failures and scandals during this period and the onset of robo-advisors, younger individuals may be less apt to seek out traditional financial institutions and advisory firms.

Their parents’ historic use of such firms offers little justification for the next generation, and a “new case” on its own merits will need to be made. They will demand more detailed information and conduct their own research. And, of course, members of the younger set are very tech savvy and will conduct their own quest for independent analyses on social media and elsewhere on the Internet.

This is a topic garnering much attention among leading wealth management firms. Wells Fargo Asset Management says that younger generations will have already done their homework when searching for advisors, and the firms that will win their business must be prepared to answer all of their follow-up questions. But advisors should not expect that younger individuals will always wait for a sit-down appointment, and that they will often want questions answered in a very timely fashion via email or text. Better yet, advisors should anticipate their questions and have the answers already posted on their firm’s website.

Ron Carson, founder of Carson Wealth Management Group, wrote in a 2014 CNBC article that younger generations also want timely and topical blogs, a host of financial awareness and market outlook videos, weekly online market commentary, monthly electronic newsletters, and, of course, engagement on Facebook, Twitter, and LinkedIn. “By establishing a relationship with your future inheritors today, we’re able to better prepare them for a tomorrow that will pose far different wealth challenges than either their parents or grandparents faced,” Carson said.

Advisors well-versed in 21st-century portfolio management techniques can distinguish themselves to a younger generation of investors.

A recent article in Private Wealth reinforces this point: “Advisors have the opportunity to play a pivotal role in the preservation of values, relationships, and wealth—the real difference between a transactional practice and ongoing counsel. The latter is part of the ideal relationship, and it goes beyond financial order-taking and limited estate planning. Family members should know they can look to their advisor for support on both financial and emotional levels.”

Above all, advisors will win the business of younger generations if they provide expert advice that helps them rise above the herd—and this is where advisors well-versed in 21st-century portfolio management techniques may distinguish themselves. A generation that is comfortable with incorporating technology-enhanced analysis and decision-making into many areas of their lives should also welcome this when it comes to critically important investment planning and implementation.

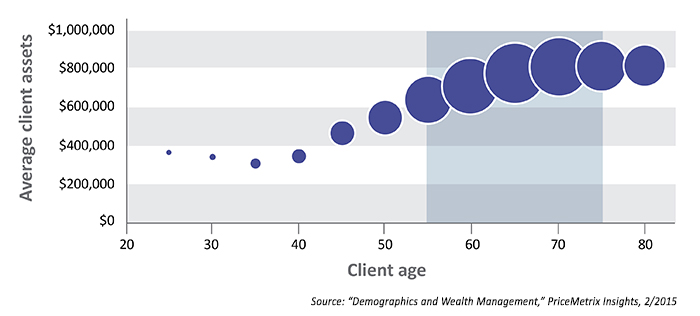

CLIENT ASSETS BY AGE RANGE

(size represents share of total assets)

While many younger individuals tend to be more conservative in their investment outlook, they are also more likely to be receptive to logical explanations about why it can be advantageous to adopt a more proactive strategy. Above all, younger generations were raised to demand evidenced-based arguments when deciding the best course—and ultimately they reject pitches based purely on emotions. Advisors who can offer thoughtful education and a range of portfolio solutions that address both capital preservation and careful growth should have an edge versus those offering passive investing solutions of the past.

Studies by Fidelity show that making inroads with the next generation of beneficiaries is critical from a time perspective—“after the fact” is often too late in earning the interest and the trust of the children or grandchildren of a current client. While heirs have a tendency to move inherited assets to a new advisor, Fidelity’s research shows that there may be an opportunity to retain these assets before they are transferred. Only 16% of potential beneficiaries in a 2013 Fidelity study were opposed to receiving guidance regarding their inheritance from the benefactor’s advisor.

It’s all about promoting financial literacy and helping younger generations understand how risk management should be a key component for their portfolios. It should prove beneficial to younger individuals to select advisors who provide them with smart analysis of their investing planning options and suitability-based strategies.

The bottom line? As PriceMetrix points out: “Advisors of all ages target older clients because that is where the largest concentration of wealth can be found today.” But proactive advisors will soon begin the process of planning for change, if they have not done so already.