Last week was one of the more intriguing and contradictory periods for retail data in recent years.

Two major developments emerged out of broad retail sales data and the earnings reports of many of the largest brick-and-mortar retailers:

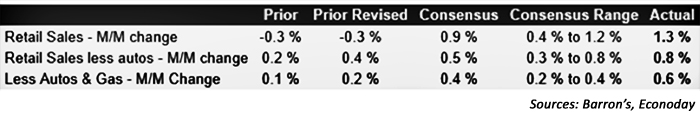

- Overall retail data surprised to the upside. The U.S. Census Bureau’s retail sales data last Friday far exceeded expectations, with a 1.3% jump in April—the most in a year. (See chart below.)

- Major retailer earnings reports disappointed, and guidance was no more encouraging. Said Yahoo Finance, “The peak season for big-box retail earnings started on a sour note. Macy’s lowered its earnings guidance for the year with some bleak commentary, while JC Penney whiffed on sales and slashed full-year projections. Their shares fell with Gap, Nordstrom, and others that missed expectations.” (Note: Department-store stocks fell about 16% overall after earnings were reported.)

U.S. CENSUS BUREAU REPORT ON RETAIL SALES DATA VS. ESTIMATES

(MONTHLY RETAIL TRADE SURVEY)

The intersection of these two factors had many scratching their heads. How could April overall sales be tilting toward an optimistic trend while Q1 results for retailers were so poor, and their 2016 outlooks so discouraging?

One possible explanation lies in comments from JPMorgan analyst Michael Feroli, cited by Yahoo: “That juxtaposition is a useful reminder that publicly-traded corporations account for a minority of economic activity in the U.S., and only the Census data are structured to get a read-through of sales irrespective of legal organizational form.” Also, as Barron’s reported, sales at gasoline stations, auto dealers, and nonstore retailers were all factors helping to drive the gains.

Barron’s “Up and Down Wall Street” column commented,

“The government report includes spending in lots more places than department and clothing stores. Even excluding automobile sales, the total was up 0.8%. Leaving out gasoline, which cost more last month, sales climbed 0.6%. And online shopping (along with mail-order purchases) was up 2.1% in the latest month and 8.1% in the latest four months, lending credence to the notion that Americans still are shopping, just not in stores, but instead at the likes of Amazon.com (AMZN).”

But the same column cautioned,

“The rosier hue of Commerce’s seasonally adjusted numbers, especially in contrast to the downbeat results from the retailers, inspired positive media portrayals that “may be getting a bit ahead of themselves,” according to the Liscio Report. Retail sales are a “noisy” series and subject to more revision than most government data.”

The Wall Street Journal echoed the theme regarding the blistering pace of online sales growth:

“While data from the Commerce Department on Friday showed overall retail sales rose 1.3% in April from a month earlier, the category that includes shopping on Amazon.com Inc. and rival websites and apps grew 2.4%. And in the past year, Internet and catalog sales have grown more than three times as fast as overall sales, up 10.2%. Department-store sales, meanwhile, sank 1.7% over the past 12 months.”

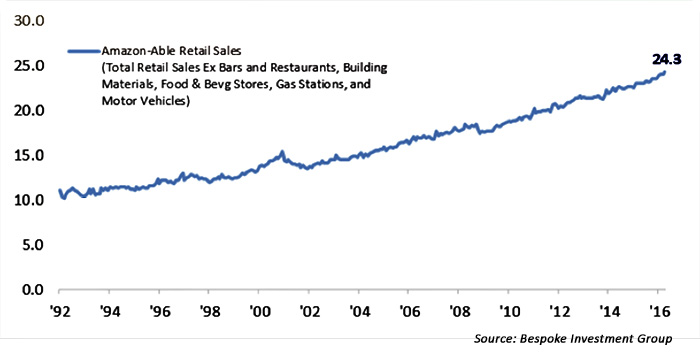

Bespoke Investment Group put this into remarkable context, pointing out to brick-and-mortar U.S. retailers,

“If you are in any of the other eight categories like Clothing, Electronics & Appliances, Furniture, General Merchandise, Health & Personal Care, or Sporting Goods, Amazon has its sights set on you. Through April, nearly a quarter (24.3%) of all “Amazon-able” retail sales were taking place online.”

ONLINE SALES AS A % OF AMAZON-ABLE RETAILS SALES: 1992-2012