While oil, coffee, gold, natural gas, wheat, and copper usually dominate the discussion of global commodities, soybeans have garnered more than their fair share of attention in recent months.

According to a recent Bloomberg radio feature, “Treasury Secretary Steven Mnuchin checks the price of soybeans every day.”

The reason, of course, is obvious.

Back on April 4, 2018, Bloomberg wrote,

“China has taken aim at America’s rural heartland as the top buyer of U.S. soybeans said it would restrict imports. China’s Ministry of Commerce on Wednesday said it plans to impose 25 percent duties on the commodity in addition to other U.S. agricultural produce including wheat, corn, cotton, sorghum, tobacco and beef. They’re among 106 products ranging from aircraft to chemicals targeted by Beijing in retaliation for proposed American duties on its high-tech goods.”

Why has this taken on so much importance?

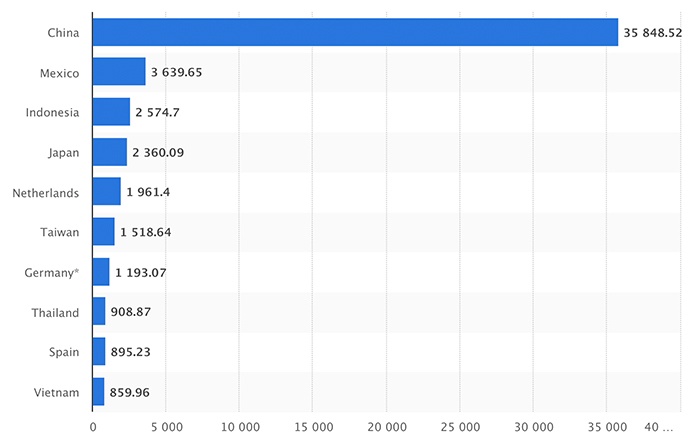

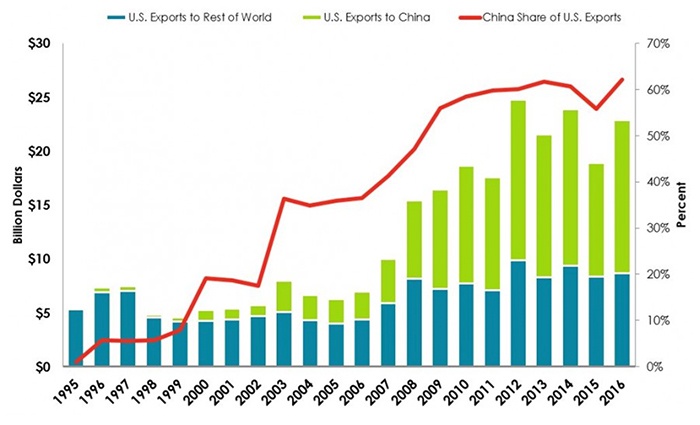

- China is, by far, the world’s largest importer of soybeans and the largest buyer of the U.S. soybean crop (worth $14 billion last year, according to Bloomberg).

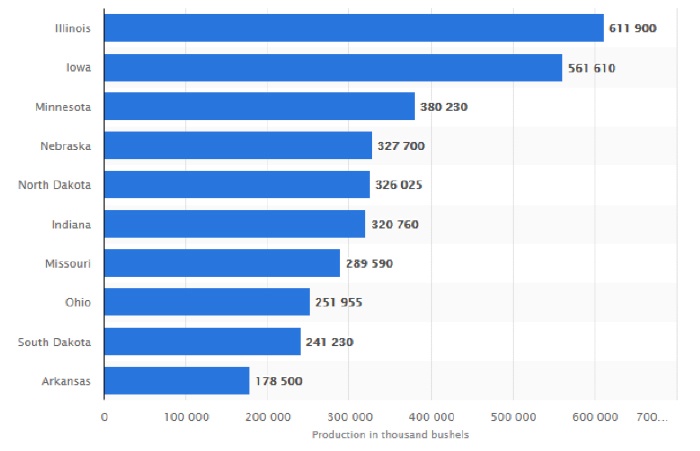

- This aspect of the “tariff wars” is of prime concern to American farmers and politicians from the key soybean-producing states.

Since the proposed tariffs were announced, the price of soybean futures has declined about 20%.

FIGURE 1: COMMODITY FUTURES PRICE TREND FOR SOYBEANS

Source: nasdaq.com, price as of 7/23/18. Visit CME Group for contract specifications.

While the United States is currently the global leader in soybean production, according to Reuters, Brazil is poised take over that position in 2018.

The U.S. is expected to harvest 116.5 million tons of soybeans in 2018, says Reuters, “falling short of Brazil’s estimated collection of 117 million tons for its crop year that is just drawing to a close. … Brazil, already the world’s largest soybean exporter, is expected to expand this lead in the coming years thanks to its unique ability to expand planted area.”

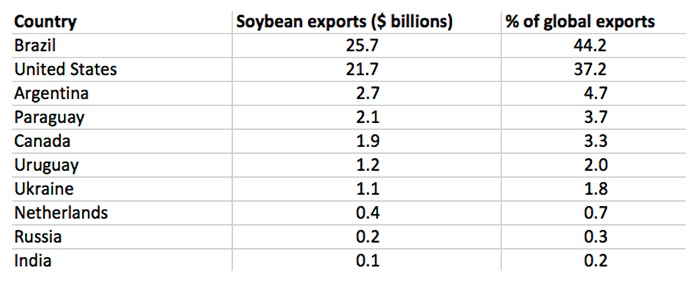

The two countries account for more than 80% of the world’s exports (measured by dollar value), according to worldstopexports.com.

TABLE 1: TOP TEN SOYBEAN-EXPORTING NATIONS (2017)

Source: worldstopexports.com

China’s high demand for soybeans is primarily driven by the product’s use as a component of livestock feed, says an article posted at Quora by Wyatt Mingji Lim, co-founder at DefensePoliticsAsia.com:

“China imports soybean for a very simple reason: China cannot produce enough soybean for itself. … Half of all pigs in the world are in China, and a huge fraction of the soybean (imports) is used for pig feed.”

FIGURE 2: COUNTRIES OF DESTINATION FOR U.S. SOYBEAN EXPORTS (2016)

IN MILLION METRIC TONS

Source: Statista

FIGURE 3: VALUE OF U.S. SOYBEAN EXPORTS TO CHINA AND THE WORLD (1995–2016)

Sources: American Farm Bureau Federation, USDA

The Chicago Tribune recently ran an article discussing the impact of the “tariff wars” on Midwestern farmers. They said,

“Soybean prices have fallen sharply, to about $8.50 a bushel from about $10.50 in May. China imposed a 25 percent tariff on soybean imports effective July 6, largely in retaliation to the Trump administration’s tariffs on $34 billion worth of steel, aluminum, and other goods the United States imported from China. … To avoid paying tariffs, customers in China are buying soybeans from Brazil and Argentina instead of the United States. … Many wonder how tariffs and the trade war might affect political support for Trump among farmers and others.”

Donald Trump won the Electoral College vote in 2016 in eight of the top 10 soybean-producing states, with the notable exceptions of Illinois and Minnesota.

FIGURE 4: TOP SOYBEAN-PRODUCING STATES IN U.S. (2014–2017)

Source: Statista

Last Friday (July 20), Politico wrote,

“President Donald Trump’s trade wars could become a major political drag for Republicans, with job losses and price increases piling up just as voters head to the polls in November. Trump jolted markets once again early Friday when he said he’s prepared to impose penalties on some $500 billion in Chinese goods regardless of the consequences that might ensue, economic or political. ‘Look, I’m not doing this for politics,’ the president said on CNBC. ‘I’m doing this to do the right thing for our country.’”

This week, according to The New York Times, the Trump administration will take steps to “ease the pain” for farmers. The publication reported on July 24,

“The Trump administration on Tuesday announced up to $12 billion in emergency relief for farmers hurt by the president’s trade war, moving to insulate food producers from looming financial losses that would be a direct result of President Trump’s policies.

The aid to farmers, announced by the United States Department of Agriculture, will come through a direct assistance program, one designed to help with food purchase and distribution and one specifically geared toward promoting trade.”

The proposed programs, so far, have received mixed reviews.

CNN commented on July 25,

“Many experts and farm groups see the administration’s plan as an immediate fix for the industry’s losses. But it doesn’t address the long-term pain that farmers will feel if the tariffs remain in place.

“‘The $12 billion package of agricultural assistance announced today by the administration will provide a welcome measure of temporary relief to our farmers and ranchers who are experiencing the financial effects of the trade war,’ said Zippy Duvall, president of the American Farm Bureau Federation, a trade group. ‘This announcement is substantial, but we cannot overstate the dire consequences that farmers and ranchers are facing in relation to lost export markets. … We will continue to push for a swift and sure end to the trade war and the tariffs impacting American agriculture.’”