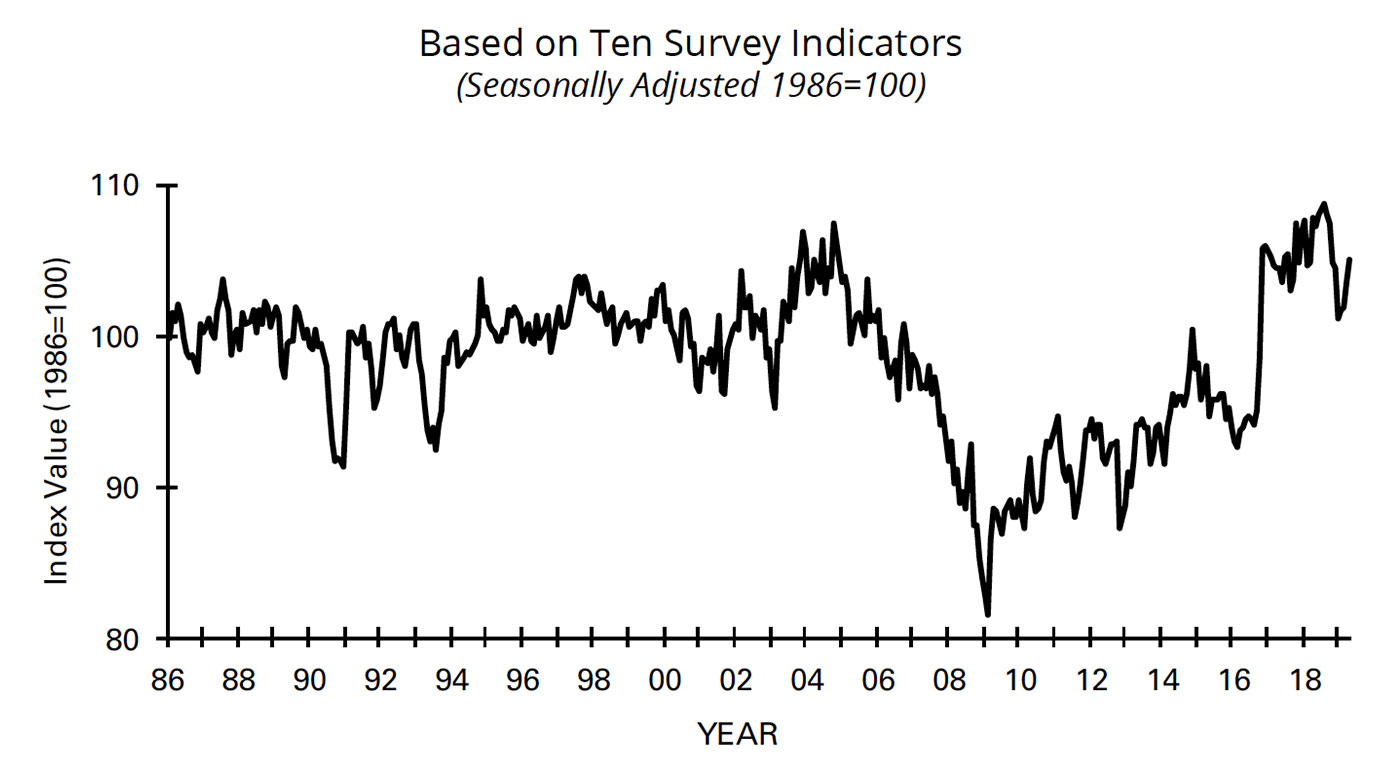

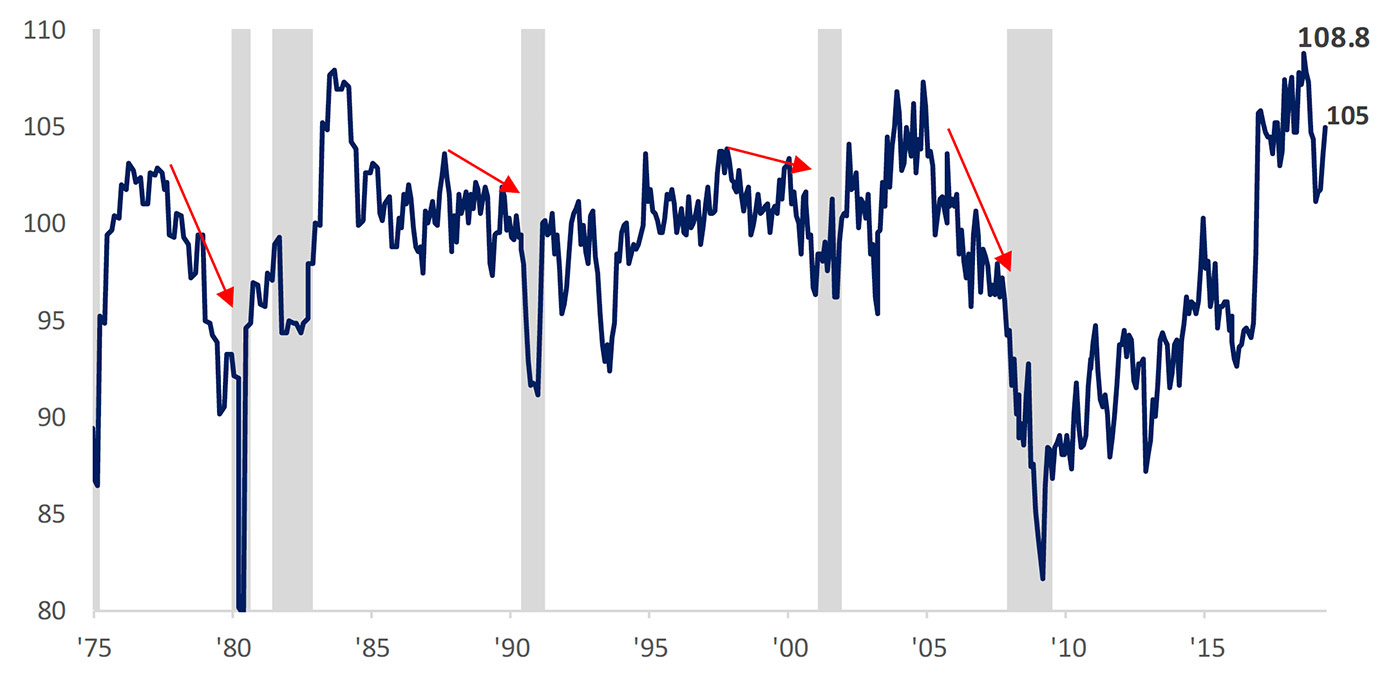

Despite the numerous trade-related issues that could potentially affect U.S. businesses, the most recent numbers on small-business optimism continue to reflect an upbeat view of the economy.

According to Bloomberg,

NFIB President and CEO Juanita D. Duggan said,

“Optimism among small business owners has surged back to historically high levels, thanks to strong hiring, investment, and sales. The small business half of the economy is leading the way, taking advantage of lower taxes and fewer regulations, and reinvesting in their businesses, their employees, and the economy as a whole.”

Source: NFIB

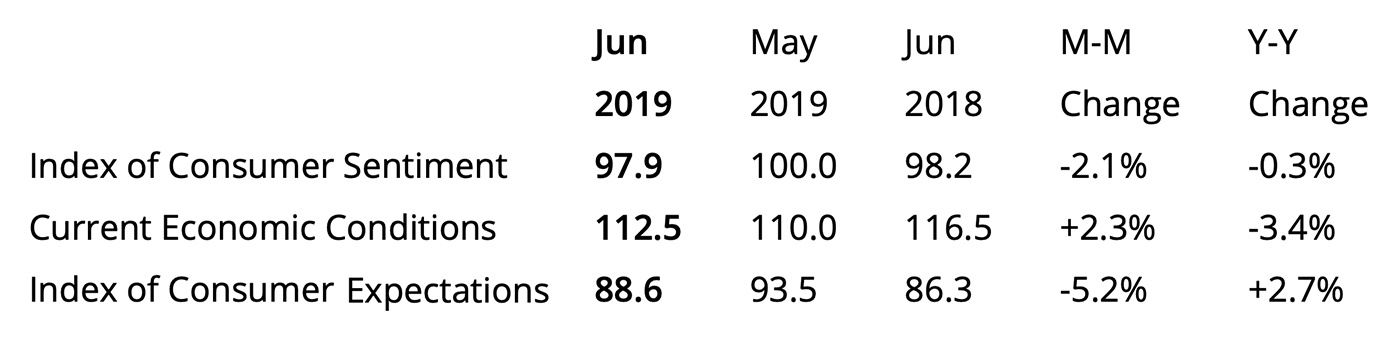

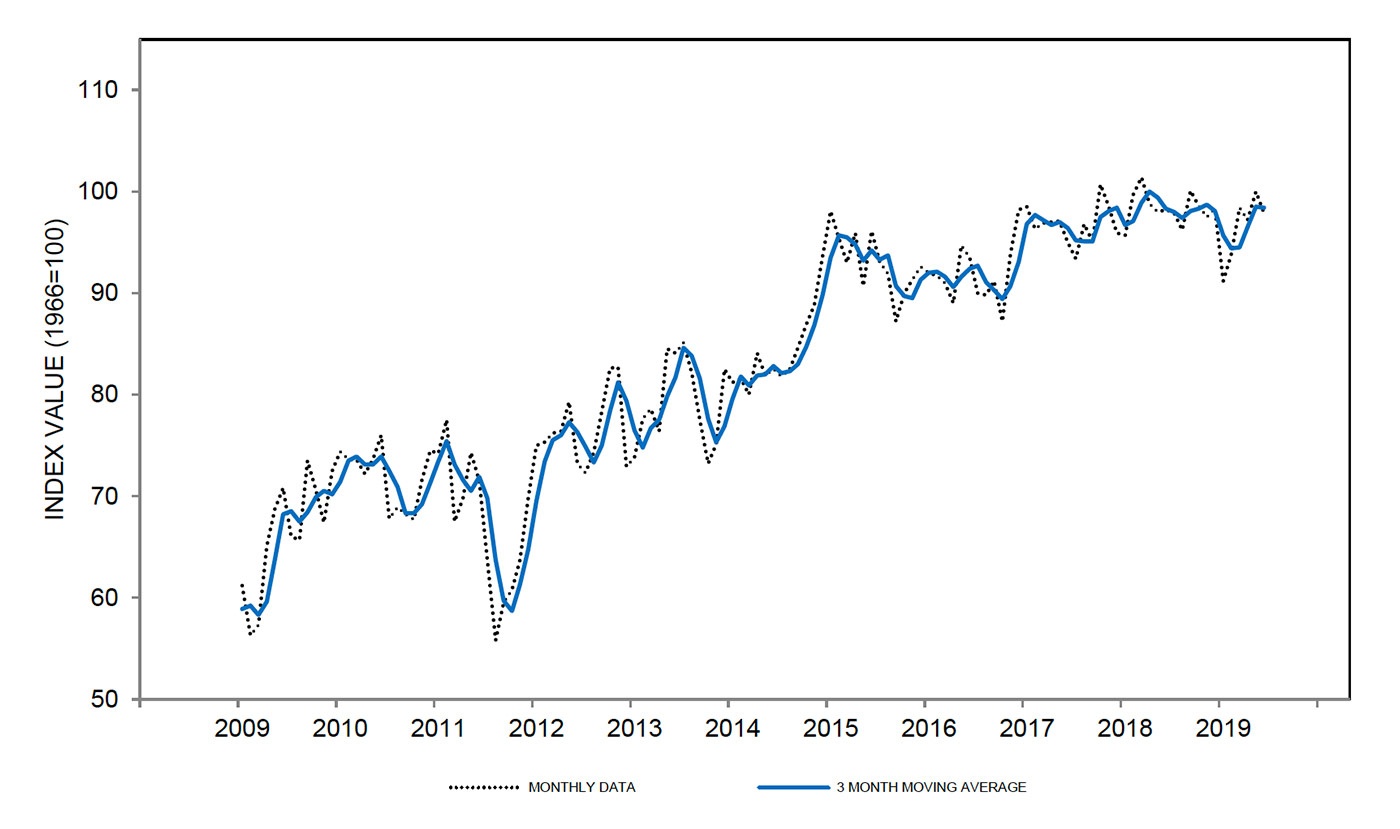

Consumer sentiment, released for June last week by the University of Michigan, was a little less upbeat, coming down slightly from May’s levels. While overall sentiment declined, perceptions of the current environment were strong, with less optimism about future conditions.

Surveys of Consumers chief economist, Richard Curtin, wrote,

“In early June, consumer sentiment reversed the May gain due to tariffs as well as slowing gains in employment. Some of the decline was due to expected tariffs on Mexican imports, which may be reversed in late June, but most of the concern was with the 25% tariffs on nearly half of all Chinese imports. Consumers responded by lowering growth prospects for the national economy, and as a consequence, reduced the expected gains in employment.”

Source: NFIB

Source: University of Michigan Surveys of Consumers

Bespoke Investment Group notes that the gains in the NFIB Small Business Index “marked a big turnaround in the last few months. After dropping for five straight months, it has now risen for four straight, which is tied with five other periods for the second-longest streak since 1986.”

Bespoke also observed that,

“From a longer-term perspective, it’s hard to imagine that the economy is on the cusp of a recession with the NFIB index right near record highs and rising. Taking a longer-term look at the NFIB index, the peak reading of this index typically comes much earlier in the business cycle and has been trending lower for months (if not years) before the recession begins.

“Perhaps the one exception was leading up to the 2000 recession. This doesn’t mean that a recession can’t happen, but in isolation, we don’t see the NFIB index as flashing a warning that the economy is about to start shrinking.”

The red arrows in Figure 3 illustrate this point, showing trending declines for the NFIB Index prior to recessions over the past 40-plus years.

Shaded areas represent recessions

Source: Bespoke Investment Group