In the eye of the storm? How advisors and clients are handling uncertainty

In the eye of the storm? How advisors and clients are handling uncertainty

The COVID-19 pandemic has significantly impacted financial advisors, their clients, and prospective clients—not only in their response to volatile markets and adoption of remote communications but also in the fundamental demand for financial-planning services.

Many advisors are reporting increased inquiries about their services, and more prospective clients are seeking comprehensive financial-planning services, including estate planning. This has happened despite the difficulty of prospecting for new business in a time when networking is largely limited to online, mail, and phone methods. Many in-person marketing activities, such as client-appreciation events or educational sessions, where clients are encouraged to bring a friend or associate, have had to be reimagined as digital versions.

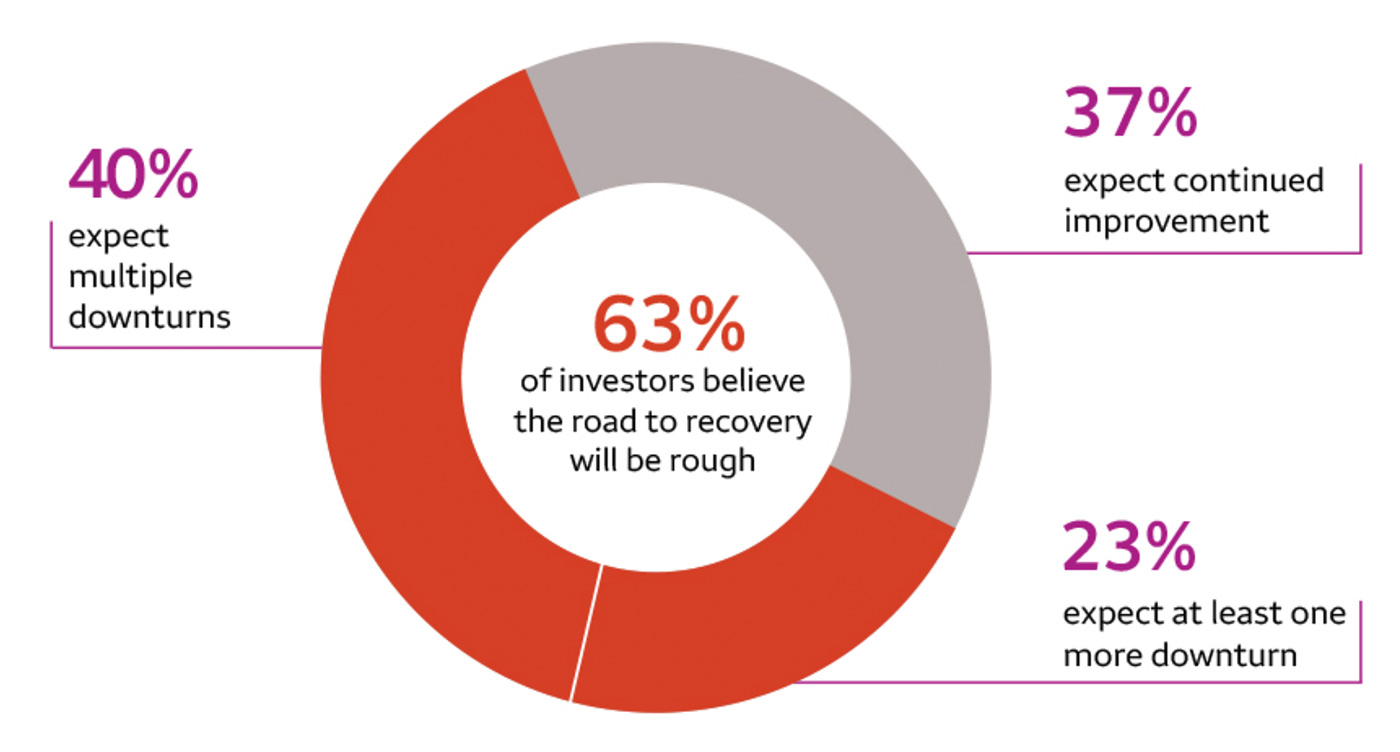

It is not surprising that more people are reaching out to financial advisors, according to ongoing survey data from the Wells Fargo/Gallup Investor and Retirement Optimism Index:

Sources: Wells Fargo/Gallup Investor and Retirement Optimism Index based on a Gallup Panel web study completed by 1,094 U.S. investors, aged 18 and older, from Aug. 10–16, 2020

Wells Fargo adds,

“Investors are planning for the road ahead in greater numbers as a result. … About half (48%) will be taking the advice of investment professionals and doing more long-term financial planning. ‘The uptick in financial planning is a silver lining to the pandemic and suggests that investors recognize that a well-thought-out plan helps to create financial resiliency,’ Ta said.”

While many in the financial press explored the immediate aftereffects of the pandemic, how are advisors’ practices doing now? Are they able to attract new clients or successfully add to staff? Are some throwing in the towel? Are they able to sell their business or successfully hand it off to someone they’ve been grooming? How are advisors doing emotionally? How are their clients handling the pandemic? Has it spurred more clients or prospects to take a new look at their legacy planning?

We spoke with advisors, coaches, and consultants to learn more about how the advisory industry and its clients are faring during this unprecedented time.

Kevin J. Meehan, CLU, CFP, ChFC, CASL

Regional president of Wealth Enhancement Group, Elk Grove Village, IL

“In any time of stress in the economy and in the markets, advisors should always dramatically increase their contact with clients. For this pandemic, clients may also be worrying about other things—how the virus is going to affect them and their loved ones, whether they are going to lose their job or business. On top of that, some may also be in a location with social unrest.

“It’s important for advisors to periodically reach out to clients during this time and ask whether they are being affected by all of what’s happening now. Ask how they are doing and if anything has changed since they last talked. Just ‘game up’ on sensitivity. You may not have the answers to all of your clients’ challenges, but you can have perspective. If you don’t know where your clients are personally, how can you counsel them financially?

“Many clients who have been waiting to do estate planning are now realizing this is a good time just in case. They are now asking themselves, ‘What if I die? What about my family?’ Those concerns have been elevated over the last five months.

“For older advisors who run their own firms, some are getting burned out and are thinking about exiting. The stress is greater with firms that have smaller resources, fewer staff members to help do things, and some advisors are going to tap out. Those people are either looking for an equity event by selling their firm or to transition their practice internally. Neither option is easy. Some firms are too small to attract buyer interest. Internal transitions are also not easy because the founder is typically a rainmaker while often the other advisors in the firm are more servicing advisors. Many founders of small firms will likely ‘fade away’ rather than actually leaving the firm—unless they are forced to.

“For advisors heading up larger RIA firms, more are thinking it’s prudent to develop a transition plan if they haven’t already done so. It’s a good time to consider selling, as multiples are high. Private equity is now in the wealth-management business, and for quality firms, interest in buying is high. Some advisors will continue to stay independent until they believe the time is optimal for them. The pandemic may accelerate some of the industry’s consolidation that has been happening as baby boomer advisors are aging out of work. It’s certainly not getting easier.”

Jay Mooreland, MS, CFP

Founder of The Behavioral Finance Network, a coaching firm for financial advisors

“Advisors are human, too, and not only did they have to live through a very difficult market this spring, but they also may have had issues due to the pandemic. Some people are dealing with sickness or fear because they have preexisting conditions. Like many other people, this situation has likely affected many advisors’ well-being—not really clinical depression in most cases, but more of a malaise.

“We are creatures of habit, and when our daily routines are blown up, it can be challenging to create a ‘new normal’ of routines and habits. Not having structure for a few days can be great for our mental wellness—not having structure for weeks can wreak havoc on it. Many are also now getting their own kids back to school and worrying what the heck that’s going to look like, at the same time making sure grandma and grandpa are safe, considering we may just be in the eye of the storm.

“As advisors work with clients, they can improve their value and delivery by spending time and effort on both the money stuff and the ‘softer stuff.’ In behavioral finance, it’s more about psychology in everything advisors do than about strictly finance. Those who successfully incorporate psychology in their practice connect better and deeper with their clients and prospects.”

Anjali Jariwala, CFP, CPA

Principal of FIT Advisors, Redondo Beach, CA

“I’ve seen an uptick in business since COVID started, though one client who is a business owner had a drop in income. I suspended his fees in March until his business was a little more stable, and by July he came back. Outside of him, all of my clients continued to use me throughout the spring and summer. The majority of my clients were prepared due to the work we were doing together.

“After this uptick in my business, now I’m at my capacity of 40 clients, so I’m not taking any new clients at this time. I have a ‘super niche.’ I work with owners of medical practices, partners of medical groups, small-business owners, and independent contractors that have complex tax needs, working virtually with clients in 17 states. Since I have a well-defined niche, I built my firm to service a small number of ideal clients. I attract new clients mainly through referrals by existing clients, centers of influence, and through my own marketing channels. I host a podcast called Money Checkup, and I also have a blog.

“Attracting new clients during the pandemic has been the same or even slightly more productive than before. More people are staying at home, and so a lot of them are revisiting their finances to make sure they are going to be OK if anything happens to their jobs or the market again. They realized now is a good time to seek out an advisor.”

Eben Burr

Managing director at Toews Asset Management and co-founder of the firm’s Behavioral Investing Institute

“When talking to clients during this time, a good financial advisor may be akin to a life coach—if necessary, attempting to help clients with every financial issue or at least acting as a sounding board. Some clients may be forced to exit their businesses or push forward into their retirement. Some may be able to sell their businesses at this time. Others won’t be able to, so the question becomes how much longer will they be able to stay in business at all.

“For advisors, transitional planning in normal times can be challenging because the industry has been having trouble attracting younger people. It can be a very stable job but not that sexy to many younger people. Now in the pandemic, it’s even harder to hire people. In a lot of locations, advisors can’t meet in person with candidates, especially if the advisors are older and their health is compromised. They could possibly catch COVID, and the consequences might be fatal. They have to ask themselves, ‘Is this lunch meeting worth it?’ So it’s even harder now to hire than it was before.”

Ray Sclafani, PCC

Founder and CEO of ClientWise, a coaching and consulting firm for financial professionals

“Advisors are telling us that client acquisition hasn’t been a problem. In fact, some advisors are finding more clients now than before the crisis. Their existing clients have been so appreciative of the good planning work the advisor has been doing that the clients are even more willing to refer friends and family to the advisor.

“The COVID crisis also has served as an opportunity for advisors to develop or update their business continuity plans for when they may be temporarily unable to operate the business, as well as their business succession plans for when they permanently leave the business. Some advisors are telling us that because of the crisis, they have discovered that their plans might not be as durable as they would have hoped.”

“For example, we have one Midwest firm whose two partners have been developing a young advisor to succeed them. She has been running most of the day-to-day operations, including managing the firm’s other advisors and employees. She’s always been an excellent financial planner and effective leader, but feedback from the rest of the team during this time shows that she really needs to further develop her leadership skills, particularly empathy skills.

“The partners reached out to our firm, and we’ve been coaching her to think through the implications of her actions and communication style. But she’s been really resisting, saying she’s not the problem—everyone else is—and so the partners are now checking in to see whether she needs some other kind of support. They are also further exploring whether they need to reconsider their succession plan.”

Ryan Grau, CVA, CBA

Vice president of business valuation services and partner of FP Transitions

“Financial service practices have proven resilient through the COVID-19 pandemic. FP Transitions hasn’t observed significant decreases in revenue. While some practices have suffered losses, most have been reporting growth rates consistent with pre-pandemic growth rates. Many practices have reported reductions in overhead, primarily due to reduced travel, meal, and entertainment expenses.

“Average growth for practices with less than $1 million in annual revenue is approximately 10%, consistent with prior year growth observations. For smaller practices, the pandemic has highlighted the importance of having the support of a strong team. Average growth for businesses with $1 million to $3 million in annual revenue is approximately 10%, and for firms with more than $3 million in annual revenue, it is approximately 13.5%. Both of these are also consistent with prior year growth observations.

“M&A has remained consistent with activity observed in 2019. FP Transitions successfully closed 41 transactions by the end of Q2. We have seen an increase in the number of advisors wanting to merge or ‘sell and stay’ with the acquiring firm. Practices that were scheduled to close agreements when the pandemic shutdowns started have stayed the course and closed on time with no adjustments to price.

“Prices for small, medium, and large financial firms have held steady. Adjustment periods for performance-based notes (notes with ‘clawbacks’) have been extended. On average, practices with less than $1 million in annual revenue sold for an average revenue multiple of 1.96. This includes both registered reps and RIAs. The average down payment was 30% of the purchase price.

“On average, practices with $1 million to $3 million in annual revenue sold for an average revenue multiple of 2.29 (this also includes both registered reps and RIAs). The average down payment was 35% of the purchase price. On average, practices with more than $3 million in annual revenue sold for an average revenue multiple of 2.77. This cohort was fee-only RIAs. The average down payment was 54% of the purchase price.”

Catherine Seeber, CFP, CeFT

Financial advisor and vice president at CAPTRUST in Lewes, DE

“We have publicly announced the acquisition of four firms and added two solo practitioners so far this year, and we have no intention of slowing down. The pandemic has not impaired our success in attracting great firms located in our target areas that also possess a strong cultural fit—the pipeline is full.

“Those advisors who were recently acquired were, to some extent, struggling to effectively maintain the level of communication to clients that was needed during the pandemic. … Most advisors at other firms are not only dealing with clients but also operating their businesses and wondering whether they can stay afloat. And their personal lives may be in turmoil.

“On the business development side, I think clients are more tolerant of advisors asking them if they know anyone else who the advisor can help during this time. I’m in the process of developing a webinar about a very topical issue in estate planning: the duties of an executor before one dies and after one dies—and I’m suggesting clients invite their friends to join.

“I have a fillable electronic legacy document that I review with my clients, which concentrates on intentionally living a better life now—while alive, rather than focusing on what will be left behind. My practice is pretty high touch now that everyone is embracing legacy planning because the idea of their mortality is more real.

“Another thing I’m sensing among my clients: Some people are now considering whether to rename their executors and trustees, based on how the currently named executors are handling the pandemic—whether they’re being responsible about wearing masks and social distancing, or performing risky behaviors during this time. People are making judgments on that disparity among family and friends, reconsidering who they might have had in mind to be the best person to handle their estate or trust.

“In general, though, I don’t talk about COVID-19-related things or politics to clients. I just ask them how they’re doing, not in a vague sense, but how are they doing today. I ask them frequently because their frame of mind can change quickly, and the desire to be heard is magnified during these times. This is an opportunity for me to get closer to them and to show them my value-add both as a financial planner and a human—one who cares.”

***

The COVID-19 pandemic caught everyone off guard, but most advisors and their clients are adapting to the “new normal”—and some are even thriving. Many firms choosing to sell their business are finding receptive buyers, and others are recalibrating their internal succession plans. But perhaps the most important trend for the industry is the growing demand for advisory services. A recent NASDAQ article summed it up well,

“Amid this uncertainty, financial advisors are in greater demand than ever. People of all ages, from millennials to baby boomers, want smart counsel during times of market volatility and economic uncertainty. Investors want to know they’re doing everything they can to protect and grow their wealth.”