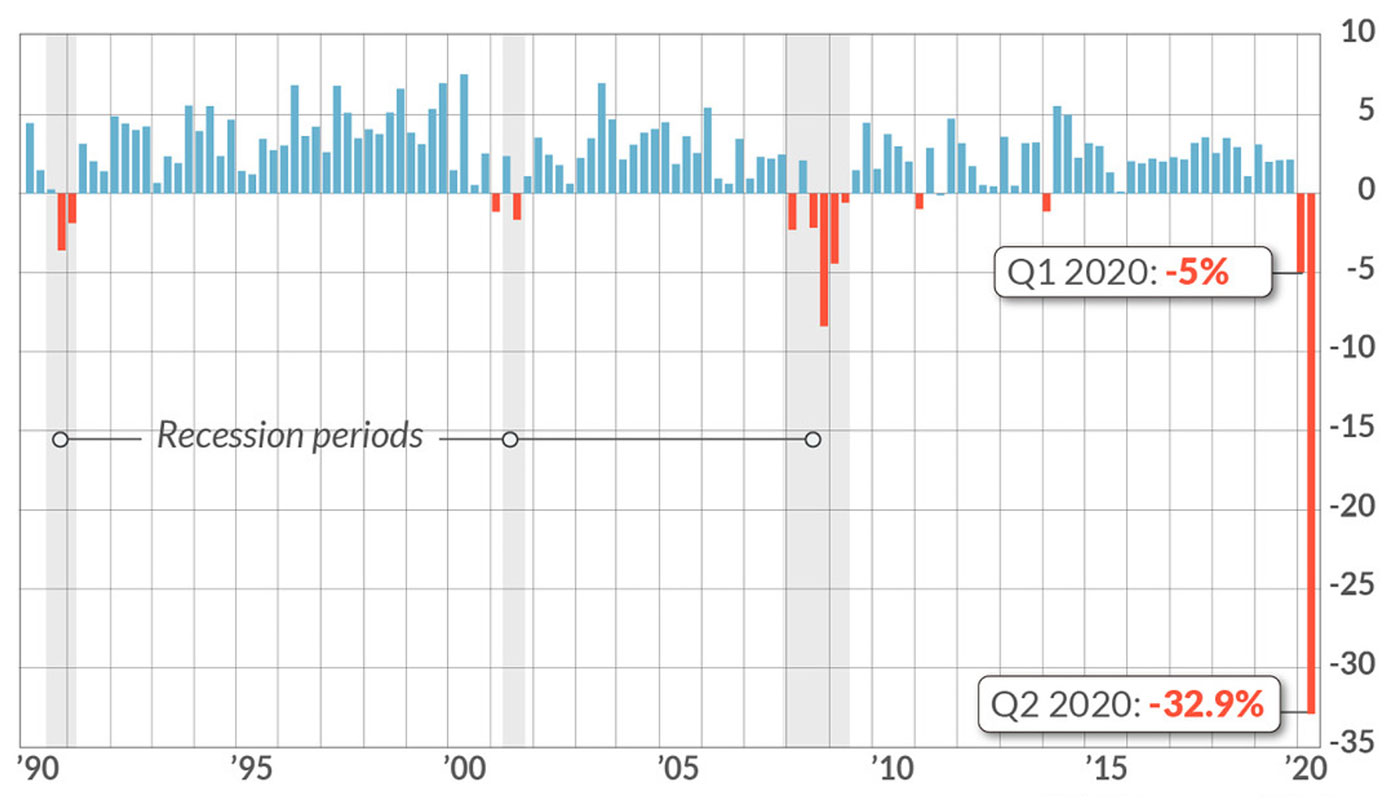

According to MarketWatch on July 30,

“An economy badly battered by the coronavirus shrank at a record 32.9% annual pace in the second quarter, underscoring just how big a hole the U.S. finds itself in as it labors to recover from the deepest recession in American history. … Previously GDP had never shrunk by more than 10% on an annualized basis in any quarter since the government began keeping track shortly after World War Two.”

Sources: MarketWatch, Bureau of Economic Analysis

The Trump administration has made frequent references to Q3 2020 being a largely positive “transitional” quarter and has high hopes for signs of solid economic recovery in Q4 2020 and Q1 2021.

How does that line up with analyst estimates?

The same MarketWatch article said,

“The economy is primed to expand in the third quarter, but the surge in coronavirus cases in many U.S. states has already taken some air out of the recovery. Economists polled by MarketWatch predict GDP will expand at an 18% annual pace from July to September, though estimates are likely to be ratcheted down.”

Reporting by Business Insider on Goldman Sachs’ growth forecasts included the following assessment in July:

- “Goldman Sachs economists lowered their third-quarter US GDP growth forecast to 25% from 33% … citing weak consumer services spending and the strong uptick in national coronavirus cases.

- Reimplementation of strict lockdowns and social distancing practices in states including California, Florida, and Texas are ‘already having a noticeable impact on economic activity,’ the team led by Jan Hatzius wrote in a note.

- The firm lowered its full-year growth projection to -4.6% from -4.2%.

- Still, offset spending and reopening benefits led Goldman to boost its [2021] first-quarter growth forecast to 8% from 6.5%.”

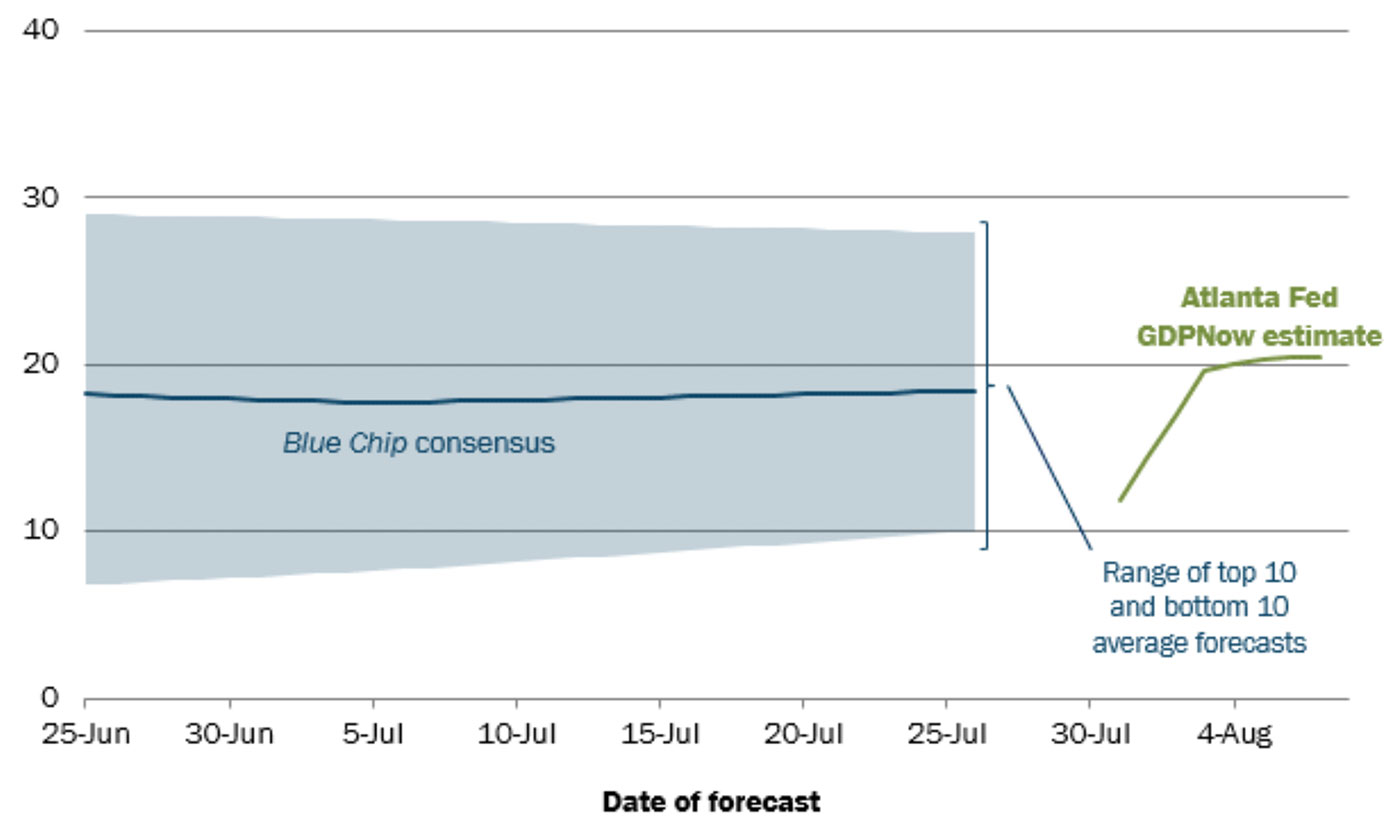

The Federal Reserve Bank of Atlanta publishes a weekly forecast for U.S. GDP based on the latest economic data points. The forecast from August 7 said,

“The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 20.5 percent on August 7, up from 20.3 percent on August 5. After this morning’s releases of the employment report by the U.S. Bureau of Labor Statistics and the wholesale trade report from the U.S. Census Bureau, an increase in the nowcast of third-quarter real government spending growth from 6.9 percent to 14.0 percent was partially offset by a decrease in the nowcast of third-quarter real personal consumption expenditures growth from 23.1 percent to 21.9 percent, and a decrease in the nowcast of third-quarter real gross private domestic investment growth from 12.2 percent to 9.5 percent.”

Note: SAAR refers to seasonally adjusted annual rate. The Atlanta Fed offers this disclaimer: “There are no subjective adjustments made to GDPNow—the estimate is based solely on the mathematical results of the model. … The GDPNow forecast is constructed by aggregating statistical model forecasts of 13 subcomponents that comprise GDP.”

Sources: Federal Reserve Bank of Atlanta, Blue Chip Economic Indicators and Blue Chip Financial Forecasts

On July 31, Barron’s published an article questioning the relevance of GDP figures during a period of such unprecedented upheaval, stating,

“Everyone knew it was coming, but the anticipation made it no less ugly: The U.S. economy shrank an annualized 32.9% in the second quarter from the first. Investors should dismiss the historic number—but not just because the worst of the pandemic’s toll is over.

“First, the annualized figures that economists like to use are pointless at a time like this. The headline number effectively represents how much gross domestic product would decline if the lockdowns meant to contain Covid-19 continued across four quarters. They didn’t and won’t, so the real decline in output was more like 9%. Still terrible, but not exactly a third of the economy.”

“More importantly, though, the speed and magnitude of the pandemic’s impact [have] rendered old news like quarterly GDP especially dated, as renewed surges in infections prompt states and businesses to roll back reopenings. … No one really knows where this recovery—which started earlier and more strongly than expected—is going. Federal Reserve Chairman Jerome Powell said as much on Wednesday, repeatedly stressing that the U.S. economy is at the mercy of the coronavirus.”

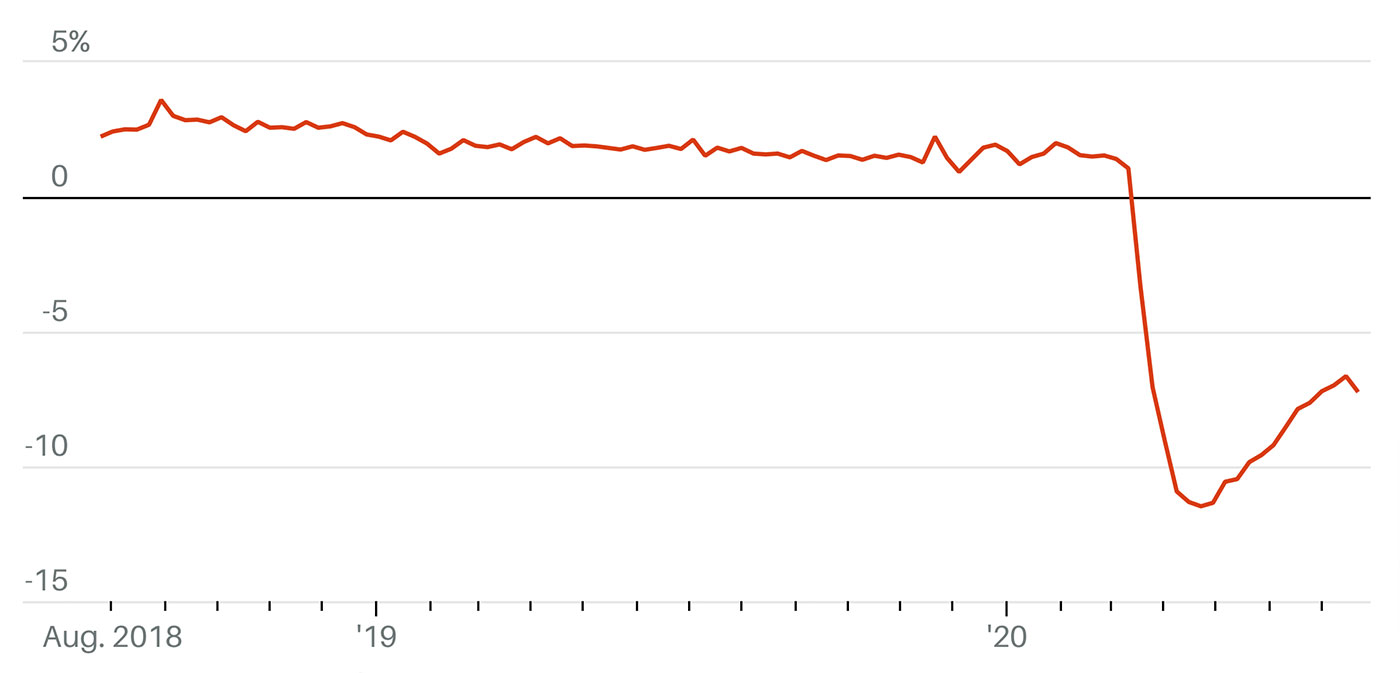

Barron’s points out that several analysts feel real-time, high-frequency indicators are far more important than backward-looking GDP figures. One such indicator is the New York Fed’s Weekly Economic Index (WEI), a basket of 10 daily and weekly indicators of real economic activity that includes jobless claims and fuel sales.

Source: Federal Reserve Bank of New York

Barron’s says for this measure of the economy,

“The latest reading of about negative 7% shows that the economy is springing up from April lows but still far from prepandemic levels (the WEI was at 2% in the beginning of February). … An improvement in small-business revenue has started to fade, now down 17% from January as the number of small businesses that are open are falling—a signal of business failures as the crisis continues. …

“The third-quarter GDP print is bound to look deceptively strong—as high as 25%, says Ian Shepherdson of Pantheon Macroeconomic—given the way it’s calculated. But employers don’t care about base effects lifting quarterly GDP growth. They care about the flow of incremental demand, and on that count, the picture is much less favorable, he says.

“For now, high-frequency data are the best way for investors to sift through the noise and see what’s actually happening. And it isn’t looking pretty.”

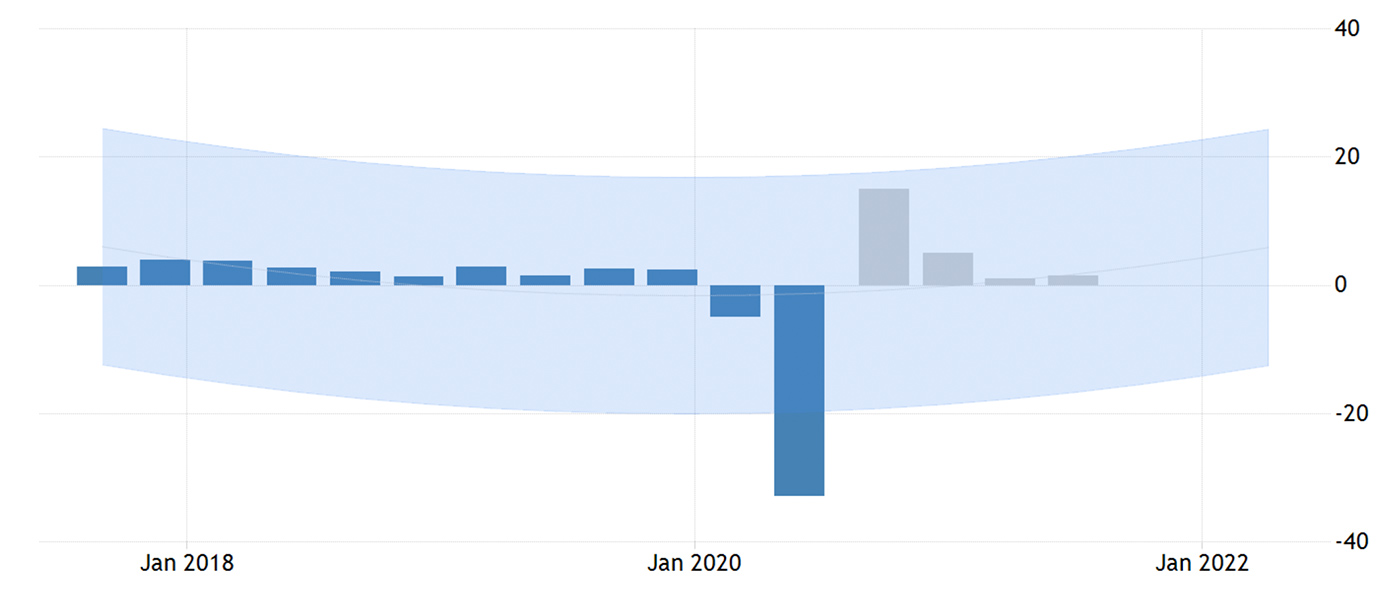

Trading Economics has published an outlook for the next few quarters, reflecting the consensus call for a very strong statistical rebound in Q3, a much lower increase in Q4, and modest growth in the first half of 2021. The outlook states,

“GDP growth rate in the United States is expected to be 15 percent by the end of this quarter, according to Trading Economics global macro models and analysts’ expectations. Looking forward, we estimate GDP growth rate in the United States to stand at 1.5 in 12 months’ time. In the long-term, the United States GDP growth rate is projected to trend around 1.7 percent in 2021 and 1.9 percent in 2022, according to our econometric models.”

Sources: Trading Economics, U.S. Bureau of Economic Analysis