Enhancing actively managed strategies

Enhancing actively managed strategies

Exploring rules-based enhancements for improving returns when invested in risk assets.

Enhancing an active strategy to deliver the potential for increased return while maintaining a desired risk framework requires a second level of decision-making. In addition to deciding to be exposed to a risk asset such as large-cap U.S. equities, the active manager, interested in potentially increasing returns, should also be deciding what the optimal large-cap U.S. equity exposure is at the time of the allocation. For the purposes of this article, we will call this two-decision approach an Enhanced Active Strategy (EAS).

To embrace an EAS, the active manager has to recognize two things:

- Modified exposures to an asset class perform differently through time.

- A manager can create a rules-based approach to selecting a preferred exposure.

To illustrate these two points, it is helpful to consider some examples. Let’s assume a manager runs an active strategy that switches between the S&P 500 and cash, and the manager is open to the concept of adapting this strategy to an EAS.

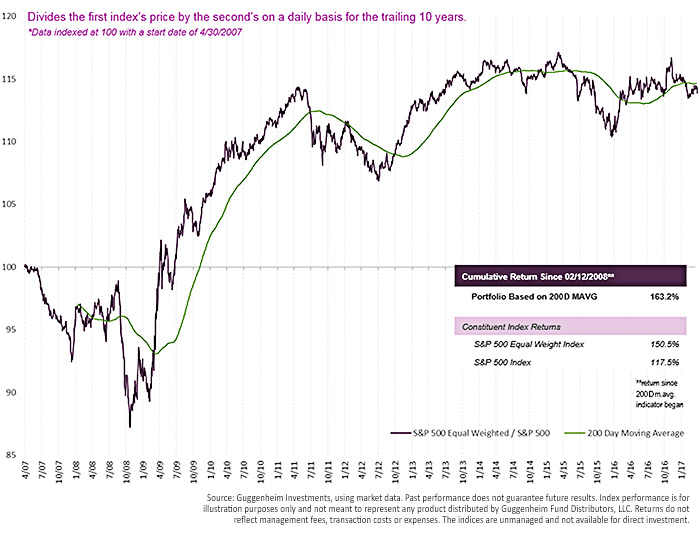

First, the manager would need to identify alternative S&P 500 exposures that perform differently through time. Let’s start with the S&P 500 cap-weighted and equal-weighted indexes. It makes sense that these two indexes would perform differently over time because of their security weightings. When the largest companies in the index are outperforming other constituents, the cap-weighted index will outperform. When performance is more dispersed across constituents, the equal-weighted index should outperform. The following chart divides the price of the S&P 500 Equal Weight Index (S&P EWI) by the price of the S&P 500 and plots the result over time. When the resulting line is moving upward, the equal-weight index is outperforming the cap-weighted S&P 500, and when the line is moving downward, the S&P 500 is outperforming its equal-weighted counterpart. It is clear from the graph that there are extended periods of outperformance of one index over the other.

FIGURE 1: S&P 500 EQUAL WEIGHT INDEX / S&P 500 INDEX

Next, the manager needs to determine if these performance differences are exploitable. To test this, we overlaid a 200-day moving average (MVAG) and applied a simple trading rule. When the S&P EWI/S&P line crosses above the 200-day MVAG line, we invest in the equal-weight index, and when the S&P EWI/S&P line crosses below, we invest in the cap-weighted index. This simple trading rule added value. From March 2007 through December 2016, following this trading rule resulted in a return of 163.2%, versus a return of 150.5% and 117.5% for the S&P EWI and S&P 500, respectively.

In this example, the EAS would first determine if exposure to the S&P 500 or cash is preferred. Then, if exposure to the S&P 500 is preferred, determine if equal-weight or cap-weight exposure is preferred.

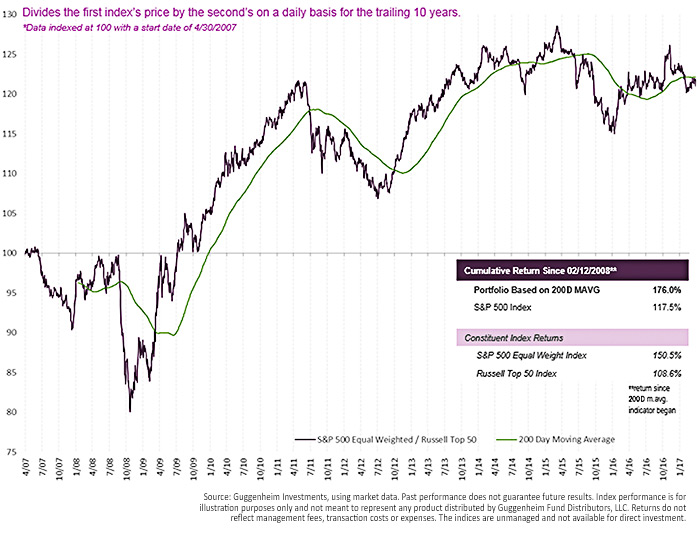

It may be possible for active managers to further enhance their active strategies.

FIGURE 2: S&P 500 EQUAL WEIGHT INDEX / RUSSELL TOP 50 INDEX

Carl Resnick is a managing director at Guggenheim Investments and heads the Defined Contribution Investment Only (DCIO) business and Rydex Funds distribution. In his DCIO role, he brings extensive experience in business development, key account management, and strategic planning to the firm’s relationships with retirement platforms and distribution partners. Before joining Guggenheim in 1998, Mr. Resnick worked in several capacities at Fidelity. He received a bachelor’s degree in business from Austin College in Texas and an MBA from The University of Dallas.

Carl Resnick is a managing director at Guggenheim Investments and heads the Defined Contribution Investment Only (DCIO) business and Rydex Funds distribution. In his DCIO role, he brings extensive experience in business development, key account management, and strategic planning to the firm’s relationships with retirement platforms and distribution partners. Before joining Guggenheim in 1998, Mr. Resnick worked in several capacities at Fidelity. He received a bachelor’s degree in business from Austin College in Texas and an MBA from The University of Dallas.