The March jobs report was received in positive fashion by the markets, despite a slight rise in the unemployment rate. Total nonfarm payroll employment rose by a better-than-expected 215,000 jobs, with the unemployment rate ticking up to 5.0%, according to the U.S. Bureau of Labor Statistics. This represented only the second increase in the unemployment rate over the past year, and one of a handful over the past few years (Exhibit 1).

EXHIBIT 1: U.S. UNEMPLOYMENT RATE

Admittedly, the 0.1 percentage point increase was hardly remarkable, and the markets were far more focused on the positive news in the employment report:

- A significant increase in job creation in the retail, construction, and health-care sectors. The 48,000 retail jobs added were particularly noteworthy, considering a disappointing seasonally adjusted sales drop of 0.4% in the latest retail report in January.

- In March, average hourly earnings for all employees on private nonfarm payrolls increased by 7 cents to $25.43 (+0.3%), following a decline in February. Over the past year, average hourly earnings have risen by 2.3% (which Barron’s still sees as “sagging”).

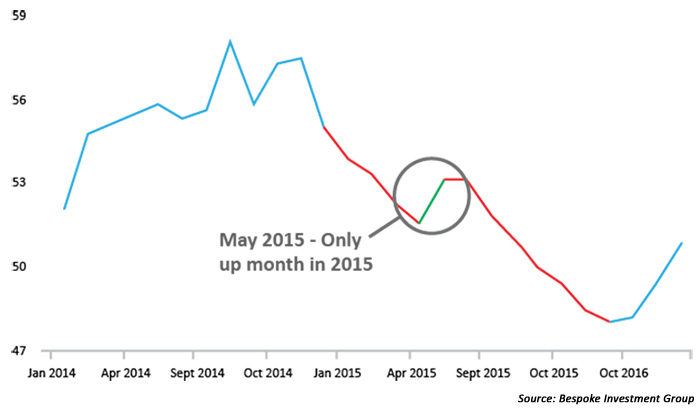

- The participation rate of the labor force improved, continuing a string of increases since September 2015 (Exhibit 2).

EXHIBIT 2: PARTICIPATION RATE OF THE U.S. LABOR FORCE

Although the gain in the participation rate was also small, markets were encouraged by the continued trend higher in the numbers of people either employed or seeking employment. The uptick in the unemployment rate was generally attributed to more people coming back to the labor force, which is seen as a long-term positive and reflective of some optimism that more employers are hiring.

The Wall Street Journal said of this factor:

“The steady pace of job growth has lured workers off the sidelines, bringing the share of Americans participating in the labor force up to 63% in March—its highest level in two years. The measure bottomed out at 62.4% in September, the lowest level since 1977. Relatively modest wage growth suggests the labor market still has considerable room to bring in more workers without spurring high inflation.”

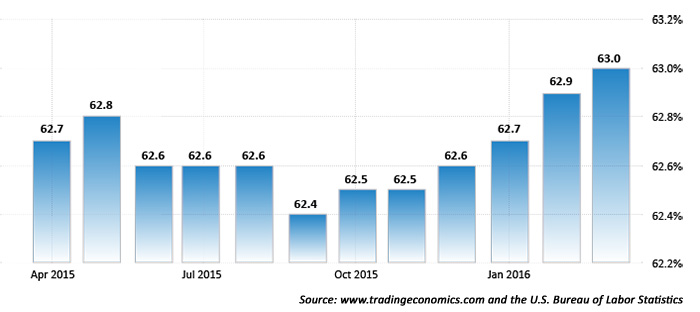

One of the weaker points in the employment report was the continued loss of jobs in the manufacturing sector. Employment in manufacturing declined by 29,000 jobs, with most of the job losses in durable goods (down 24,000 jobs). On the same day of the employment report, however, some surprisingly good news emerged from the Institute for Supply Management (ISM) manufacturing data. The ISM’s Manufacturing PMI came in at 51.8 in March, up from 49.5 in February and above market expectations of 50.7 (according to Trading Economics). Manufacturing activity grew for the first time in six months as production, new orders, and prices increased. The new orders index, which saw a nice gain from exports, moved up by nearly seven points to 58.3, for the best result since November 2014. Barron’s notes that the ISM’s new orders index is particularly important and closely watched, and is a component of the index of leading economic indicators. However, Bespoke Investment Group believes that the manufacturing sector has something to prove in 2016, with 2015’s weak performance contributing heavily to fears of recession. Said Bespoke in its recent Q2 2016 Outlook, “In all of 2015, ISM Manufacturing only saw a month/month increase once (May 2016), and in December, it was at its lowest level since June 2009. With such a steady pace of declines, you couldn’t fault someone for thinking the economy was hanging by a thread.”

EXHIBIT 3: ISM MANUFACTURING 2014 TO 2016