Hopes were running high for this year’s back-to-school shopping season, especially for the beleaguered brick-and-mortar stores with a focus on apparel.

The National Retail Federation (NRF) had predicted earlier this year that growth would be more than 10% for back-to-school/college consumer spending. The NRF said in July,

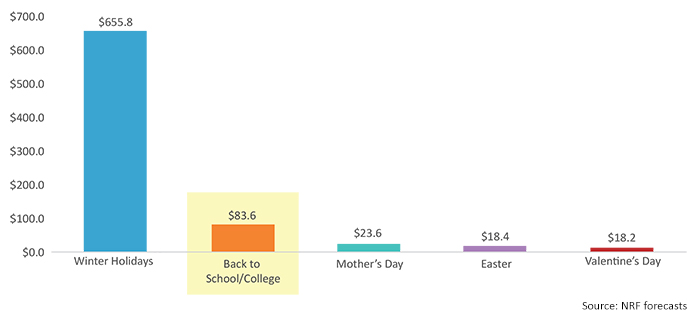

“With consumer confidence rising and more young people in school, back-to-college spending is expected to hit an all-time high this year while back-to-school spending (students under 18) is expected to see its second-highest spending level on record, according to NRF’s annual survey conducted by Prosper Insights & Analytics. Total combined spending is expected to reach $83.6 billion, an increase of more than 10 percent over last year’s $75.8 billion.”

FIGURE 1: TRENDS FOR BACK-TO-SCHOOL/COLLEGE SPENDING

However, the NRF also noted later in mid-August that the season was off to an unexpectedly slow start: “More parents holding off on back-to-school shopping. The average family with children in grades K-12 had completed only 45 percent of their shopping as of early August. Only 13 percent had completed all their shopping, and 23 percent had not started at all.”

According to a recent interview by the New York Post with marketing research firm NPD Group’s chief retail analyst, Marshal Cohen, the back-to-school season is significantly underperforming expectations, though last-minute shopping could still give sales a major boost. Cohen said he expects money spent on students getting ready for school to grow by 2.5% to 3% for the back-to-school period, which he defines as lasting through the end of September. Cohen said, “School is going to start this year, but where’s the big rush? It hasn’t come yet.”

NRF representative Ana Serafin told the Post, “Parents are taking their time in buying back-to-school items. Let’s not forget that these are parents who were highly impacted by the recession, so they’re looking for bargains.”

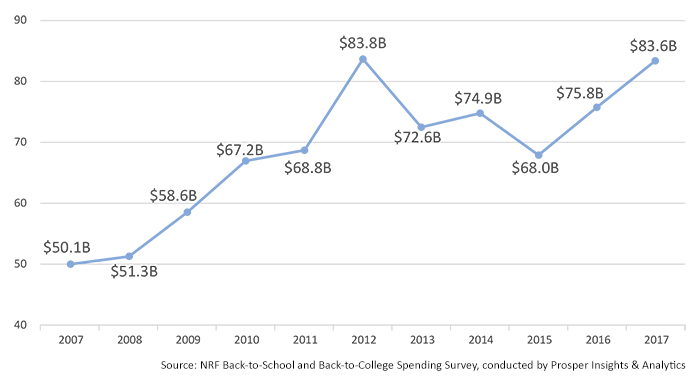

Website Retail Dive notes that this back-to-school season is particularly crucial for traditional retailers such as Macy’s, JC Penney, and Sears, saying, “Back-to-school is the second largest sales event annually. … Back-to-school could well be make-or-break for some retailers this year.” The website also notes that Amazon will predictably dominate online sales, while Wal-Mart, Target, Ikea, and Bed Bath & Beyond have a strong emphasis on special back-to-school sales efforts, promotions, and ways to make the shopping experience easier for consumers.

Retail Dive interviewed professor Erik Gordon from the University of Michigan Ross School of Business, who described the dilemma faced by many traditional retailers:

“If the traditionally exciting times like back-to-school are not exciting, if retailing is not exciting at the most exciting time, then that’s a problem. And (traditional) retailing is just not exciting.”

FIGURE 2: TOP FIVE SEASONAL SPENDING OCCASIONS FOR RETAILERS/CONSUMERS ($BILLIONS)