How behavioral finance is delivering alpha

How behavioral finance is delivering alpha

The front end of behavioral investing analyzes the collective emotional mistakes made by market participants. The back end creates an investment approach that can yield strong performance.

A growing trend within the investment industry is the direct application of behavioral finance to portfolio management. This represents a new direction, building on the industry’s current emphasis on how investors and advisors can avoid the emotional biases that destroy wealth. Its focus is on using behavioral factors as the basis for constructing an investment strategy, while at the same time avoiding the cognitive errors made by fund managers.

The starting point is the identification of behavioral investment ideas through reading the academic or professional literature, discussions with other investment professionals, or actual experience in managing portfolios. The more ideas the better, because many of them will not pan out.

A critical step is to test each idea using as much objective data as possible. If there is no such data, then the idea should be discarded. Nobel laureate Daniel Kahneman’s admonition to “keep your hands firmly on the data” is particularly important for identifying usable investment concepts (Kahneman 2011). Otherwise, the manager is no better off than the typical investor, who frequently falls prey to cognitive errors.

In this article, I build upon Howard (2019) by exploring the behavioral factors underlying high-performance funds. I discuss how to construct a behaviorally based investment strategy and then examine those manager behaviors that both create and destroy alpha. Two important aspects underlie high-performance funds: careful creation of a behavioral-factor strategy and the avoidance of cognitive errors inherent in managing in the heat of battle.

Why focus on behavioral factors?

One way to think of professional investing is as a zero-sum game among well-informed investors. If I win, then someone who is as smart and heavily resourced as I am must lose. There is a certain amount of bravado in this way of thinking: I have to outthink and out-analyze my fellow professional investors. This is the professional sports model in which the very best beat their highly competent rivals.

But there is another way to think about investing. As is often said in professional sports, “Take what the defense gives you.” Rather than going after the best defender on the other side, pick on the weakest link—which isn’t as emotionally satisfying but a successful approach nonetheless. The starting point is the recognition that many diverse groups are driving equity prices. I refer to these as emotional crowds, because new information may provide the trigger but the resulting price is a response to collective emotional decisions.

Markets are awash with excess return opportunities as emotional crowds drive individual stock prices, as well as broad market indexes, away from underlying fundamental value. I refer to these as behavioral price distortions. The challenge is to filter the signals from the considerable underlying noise.

Fundamental analysts accomplish this by conducting careful analysis of a company’s financial and competitive situation. Big-data analysts test their ideas on as long and large a database as they can assemble, looking for excess returns that are, ideally, both economically and statistically significant. An investment methodology is then created in order to utilize the resulting measurable and persistent price distortions. Smart beta is an example of this approach in which a methodology is built around one or more of the anomalies. Other active managers may start with this approach but then supplement it with their own management recipes for utilizing the behavioral mispricings.

The focus should be on identifying reliable proxies of behavioral price distortions. Fundamental and objective measures are used to accomplish this, which means that they play second fiddle to behavior in the investment process. This is a sea change in how we typically think about investing, casting fundamental information in a supporting role with behavior as the star.

Limits to arbitrage

Once a strategy is implemented, the challenge is that others also are pursuing the same strategy and will, by trading alongside, reduce or even eliminate the opportunity uncovered in earlier research. Proponents of the efficient market hypothesis contend that such arbitrage-motivated trading means all superior return opportunities eventually are eliminated. However, the evidence provides a much more nuanced picture.

A large body of academic research has uncovered a number of reasons why mispricings are not fully eliminated by arbitrage activity. These barriers are referred to as limits to arbitrage (LTA). To date, the LTAs that have been uncovered include higher market sentiment, lower institutional stock ownership, greater idiosyncratic risk, small numbers of stocks available for short sale, low trading liquidity, high transaction costs, smaller stocks, low profitability, non-dividend-paying stocks, and greater financial distress. There is every reason to believe that LTAs will continue to exist.

Another advantage of a behavioral approach is that individual and collective behaviors rarely change. In addition, it helps that the arbitrage conducted in such situations is risky rather than risk-free.

The wider the LTA/behavioral moat protecting the opportunity, the more likely the opportunity is to survive. To be successful, the fund manager must not shy away from the LTA/behavioral barriers inherent in the portfolio. That is, where others are unwilling to tread, you rush in to reap returns. In the broadest sense, you continuously hold a contrary view of markets and securities and thus take positions opposite those fleeing such unpopular features.

Market exposure

Being in the right market at the right time offers some of the best returns available to a fund manager. Emotional crowds continually roil markets, so there is a strong incentive to identify measurable and persistent proxies of expected market returns. Many of these are based on measures of under- and overvaluation (one of the best known is Robert Shiller’s cyclically adjusted price-to-earnings ratio) or based on technical indicators such as moving averages, momentum, and market breadth.

The empirical evidence for market exposure strategies in general, and these proxies in particular, is at best mixed. Their forecasting ability has been shown to be ineffective, with large prediction errors. Strategies based on these proxies generally produce unsatisfactory results. The academic literature is particularly brutal with respect to the usefulness of short-term market-timing strategies.

Behavioral measures have fared somewhat better. In 2006, Malcolm Baker and Jeffrey Wurgler proposed a measure based on six objective measures of investor sentiment. Unlike other measures that are surveys of investor and other market-participant opinions, Baker and Wurgler’s inputs are “put your money where your mouth is” measures. They discovered that when sentiment is high, high LTA stocks are priced at a premium relative to their low LTA brethren, and it’s just the opposite when sentiment is low. Of particular interest here is that they also found that when sentiment is low, small stocks outperform large stocks, and when sentiment is high, large stocks outperform small.

The Baker and Wurgler Sentiment Index has been widely accepted within the academic community as a measure of the behavioral state of the market. In this regard, the underlying components provide an objective basis for making exposure decisions with respect to large-cap and small-cap stock markets.

Volatility strategies

In recent years there has been an increasing interest in market volatility, with the best-known measure being the CBOE Volatility Index (VIX). It is based on the average of implied volatilities from S&P 500 index options on either side of the at-the-money option. There is nothing tangible underlying the VIX calculation, so it is purely a behavioral measure, referred to as the fear index. On the other hand, it is also a “put your money where your mouth is” measure because it is based on actual option prices.

VIX and other volatility measures are widely used for hedging and managing equity portfolios. The best-known and most successful strategy is referred to as constant volatility, in which equity exposure is inversely adjusted based on changes in volatility.

An array of volatility futures, options, swaps, and exchange-traded products has developed around this most esoteric of concepts. In other words, a purely behavioral trading environment has arisen in recent years. Numerous strategies are built on these instruments, one of which has been successfully implemented by our firm.

For market exposure decisions, our firm uses a market barometer (MB) that measures macro-level crowd behavior. The ranking of 10 equity strategy returns is the input for estimating expected market returns. The resulting MB is used for monthly management of our global tactical portfolio.

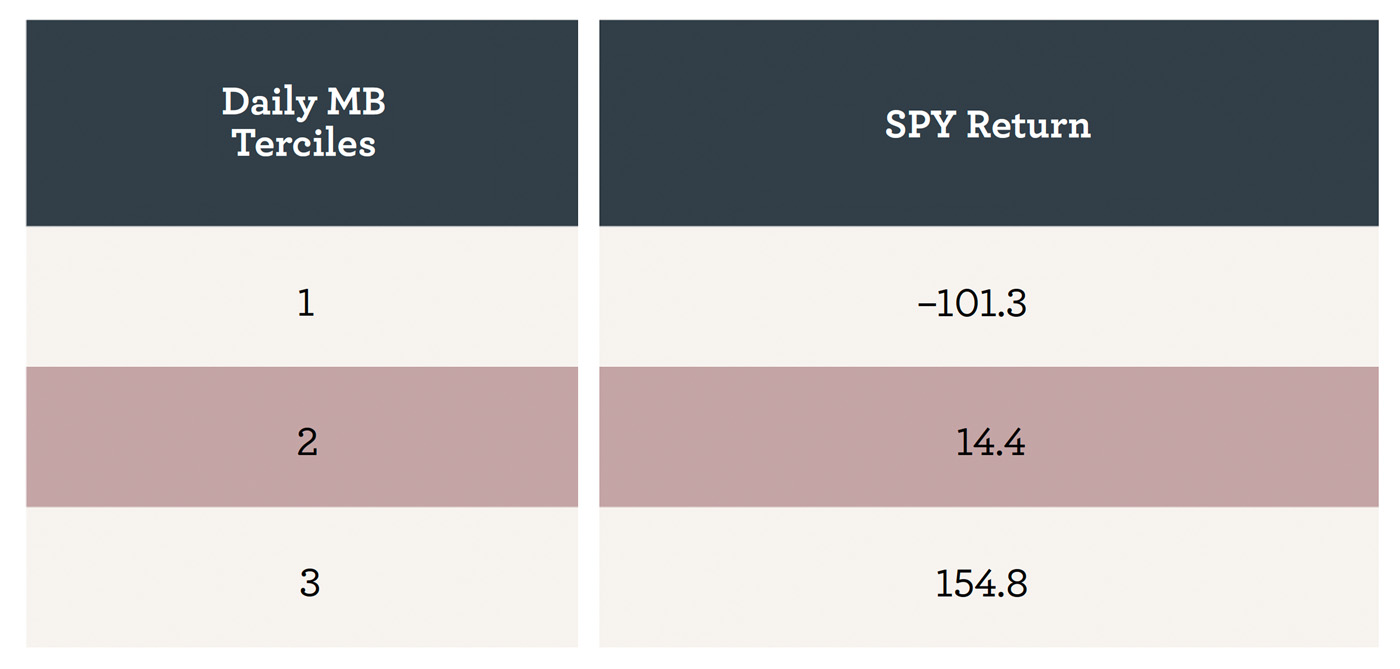

Even more intriguing, daily MB, based on the same approach used for calculating monthly MB, performs even better. Table 1 reports the 2016–2020 research results for the ability of daily MB to capture daily SPY (S&P 500 ETF) annualized return.

TABLE 1: SAME-DAY ANNUALIZED SPY RETURNS BY MB

Sources: Morningstar and AthenaInvest

Daily MB is excellent at capturing today’s market return, as evidenced by the 250% annualized return range from the lowest to highest MB tercile. The daily ranking of how investors are rewarding equity strategies captures the underlying drivers of marketwide returns. Note that this is not a momentum strategy but rather captures the daily investor behaviors that determine market returns.

Because daily MB estimation is concurrent with the returns reported above, a predictive market-return model is needed. This means that future daily MBs need to be predicted, which, in turn, allows for estimating expected market returns. If such a model is persistent, a successful trading strategy can be implemented.

Stock selection

I have just discussed a few macro-level behavioral measures that can be used for making market exposure investment decisions. As we drill down into the stock-picking process, a number of behavioral considerations can improve performance. The following four examples show how it is possible to construct individual-stock behavioral-factor portfolios.

One of the leaders in the application of behavioral factors to stock selection is Fuller & Thaler Asset Management. Richard Thaler has devoted his academic career to the study of behavioral finance and received the 2017 Nobel Memorial Prize in Economic Sciences. His firm’s focus is on over- and underreactions to news events and making investment decisions based on these investor mistakes. The firm marries this with additional fundamental analysis to successfully manage nearly $3 billion.

Richard Peterson, who developed Thomson Reuters’ MarketPsych Indices, led a team that developed the “Profiting from Media Outrage” strategy. This simple behavioral strategy held the 20 stocks most scorned by social media and the press. Each stock was chosen using objective criteria, held for a year, and featured monthly trading. In defiance of the efficient market hypothesis, the strategy’s research results beat the S&P 500 in all but two years from 1999 through early 2018, besting the broad market by an average of more than 10% annually. The strategy has since been launched as a public fund.

John Riddle of Jackson Creek Investment Advisors has for 25 years pursued a strategy based on the under- and overreaction of sell-side analysts and investors to changes in analyst earnings estimates. Using big data, those companies for which such price reactions are most likely are identified. The persistence of this relationship is constantly reevaluated and modified as needed. The behavioral earnings estimate model has produced impressive returns since the mid-90s.

“We apply traditional fundamental valuation methods to identify deep value stocks and then overlay behavioral measures of confidence to evaluate a stock’s prospects.”

AthenaInvest has been employing behavioral factors at the individual-security level for picking stocks for its valuation/profitability portfolio since 2002. We apply traditional fundamental valuation methods to identify deep value stocks and then overlay behavioral measures of confidence to evaluate a stock’s prospects. Specific behavioral information is gathered from three independent sources: management confidence (paying dividends), analyst confidence (forward price-to-earnings ratio), and creditor confidence (debt ratio). These three are examples of fundamental information playing a secondary role, each proxying for an underlying behavioral error.

Fish while the fish are biting

Active equity opportunity (AEO) is a behavioral market measure that indicates when market exposure or stock picking works best. It reveals how investors, broadly, are driving individual stock-return dispersion and skewness and therefore the attractiveness of stock picking. Active equity managers prefer a higher level of AEO, because it indicates that their high-conviction stock picks are more likely to outperform. In other words, it’s a “fish are biting” scenario.

On the other hand, a low AEO foretells a period in which it will be difficult for even the most talented stock pickers to beat their benchmarks. A low AEO indicates a period when market exposure is expected to be more attractive for generating portfolio returns.

AEO is based on four measures of how favorable or unfavorable the current market environment is for stock picking (Gorman et al. 2010; Petajisto 2013; von Reibnitz 2017). These measures reveal that returns related to stock-picking skill rise in tandem with increased stock-return cross-sectional dispersion and skewness, along with greater market volatility. That is, high levels of cross-sectional and longitudinal volatility are the “fish are biting” scenario preferred by stock pickers.

Manager, heal thyself

Building a strategy that utilizes behavioral price distortions works only if the manager does not fall prey to the same emotional errors as other investors. It is critical to avoid the cognitive errors that are inherent in managing portfolios in emotionally charged markets. This requires considerable introspection, a rules-based process, and discipline.

An important fund manager behavior is the consistent pursuit of a narrowly defined strategy. The challenge is how to measure consistency. A common approach is to demand consistent returns over time. All funds outperform at times and underperform at others. This is emotionally difficult for investors, but it is an unavoidable fact when investing in successful active equity funds because strategies do not perform well in all kinds of markets.

Strategy consistency can best be measured by focusing on the type of stocks in which a manager invests. For example, is a value fund invested in value stocks, or is it chasing an unrelated trend such as favoring growth stocks?

Using a top-down process, our firm evaluates consistency by comparing a fund’s holdings to other managers pursuing the same self-declared strategy. The pool of the stocks most held by these strategy managers is referred to as one’s own-strategy stocks. For a manager following a valuation strategy, for example, the pool comprises stocks most held by other valuation funds (Howard 2010). It makes intuitive sense to use a screen driven by those who are looking for similar stock characteristics. It is worth noting that strategy stock pools are in constant motion because managers make buy and sell decisions based on always-changing economic and market conditions. Unlike the fixed boxes of the style grid, this produces a dynamic process in which stocks of most interest to the manager are changing constantly. That is, the best results are obtained when the investment team moves about the equity universe in pursuit of own-strategy stocks.

Investment managers can be hard-nosed when making buying decisions because they have carefully considered dozens of candidates and invest only in best-idea stocks. But once the stock enters the portfolio, there is an emotional transformation. It becomes one of the family. Heaven forbid it ever goes down. “How could you do this to me!” the manager thinks. “I examined you carefully, even meeting with company management, and this is what you do to me!”

Emotional selling decisions are a problem for professional investors. Woodcock et al. (2019) provides evidence of what many think is the case: Managers fall in love with their stocks and end up hurting returns by selling too late.

Developing a rules-based selling rule is one of the most important emotional adjustments a manager can make to an investment process. Take the emotions out of selling by developing an objective selling rule, preferably before the stock is even purchased. This reduces the many cognitive errors surrounding this decision and leads to improved fund performance. The goal is to become as hard-nosed about selling as about buying.

Legendary investor Jim Simons of Renaissance Technology learned the importance of rules-based selling early in his career. In horror, he watched as his partner, trading based on emotions and intuition, imploded in the early 1980s. The trading debacle left Simons with deep scars, to the point that he almost gave up on trading to focus on his technology venture capital investments.

But he did not, and he realized that successful investing necessitated a set of specific selling rules lest he get caught up in the powerful emotions generated by market gyrations, like his partner did.

According to an Institutional Investor article by Hal Lux (2000), Simons has said, “Our scheme is to analyze data and markets to test for statistical significance and consistency over time. … After we determine its validity, we ask, ‘Does this correspond to some aspect of behavior that seems reasonable?’” The article continues, “Only in cases of extreme volatility, or if the signals appear to be weakening, does the firm sometimes manually cut back. Says Simons, ‘We don’t override the models.’”

Simons’ behavioral data-driven rules-based process propelled him to become one of Wall Street’s most successful investors. The story of how he succeeded where so many others failed is the subject of the book “The Man Who Solved the Market” by Gregory Zuckerman (2019).

Conclusion

Investment teams can implant behavioral factors throughout the investment process as a way to improve performance. This can be accomplished by consistently pursuing a narrowly defined behavioral strategy as well as developing an objective selling rule.

Building a strategy based on utilizing behavioral factors begins with identifying a number of interesting investment ideas. Many of these will not pan out, so the more the better. A critical step is to test each idea with as much objective data as possible. This data may come from the manager’s experience in conducting fundamental analysis or from a large and long-period data source. If such objective data is unavailable, the idea should be rejected in order to avoid making decisions based on emotional considerations.

Once an idea is confirmed as useful, a trading strategy is created that identifies the instruments to be employed and the trading frequency. An important part of this methodology is an objective selling rule. We all can be hard-nosed when buying, but emotions can be overwhelming when trying to sell.

The front end of behavioral investing involves utilizing the collective emotional mistakes made by market participants. The back end is creating a trading approach that yields strong performance by shielding oneself from the emotional mistakes of others. The results are superior returns for both client and advisor.

Editor’s note: Proactive Advisor Magazine wishes to thank the author and AthenaInvest for permission to publish an edited version of an article that first appeared on Feb. 17, 2021. Readers can view the full article, supporting data, and reference notes here.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

New this week:

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.

C. Thomas Howard, Ph.D., is the founder, CEO, and chief investment officer at AthenaInvest Inc. Dr. Howard is a professor emeritus in the Reiman School of Finance, Daniels College of Business at the University of Denver. Dr. Howard is the author of the book “Behavioral Portfolio Management” and co-author of “Return of the Active Manager.” AthenaInvest applies behavioral finance principles to investment management and also provides advisor coaching and educational resources.