The week of Feb. 22 was a busy one for economic data reporting, with Bespoke Investment Group summarizing 37 different economic data releases.

The overall picture was quite positive, with 70% of the releases (26 of 37) either at or above estimates, or, where estimates were not available, coming in equal to or higher than the previous period’s release.

The most notable of these was the Dallas Fed’s manufacturing activity index, which came in at 17.2, versus a consensus estimate of 5.0.

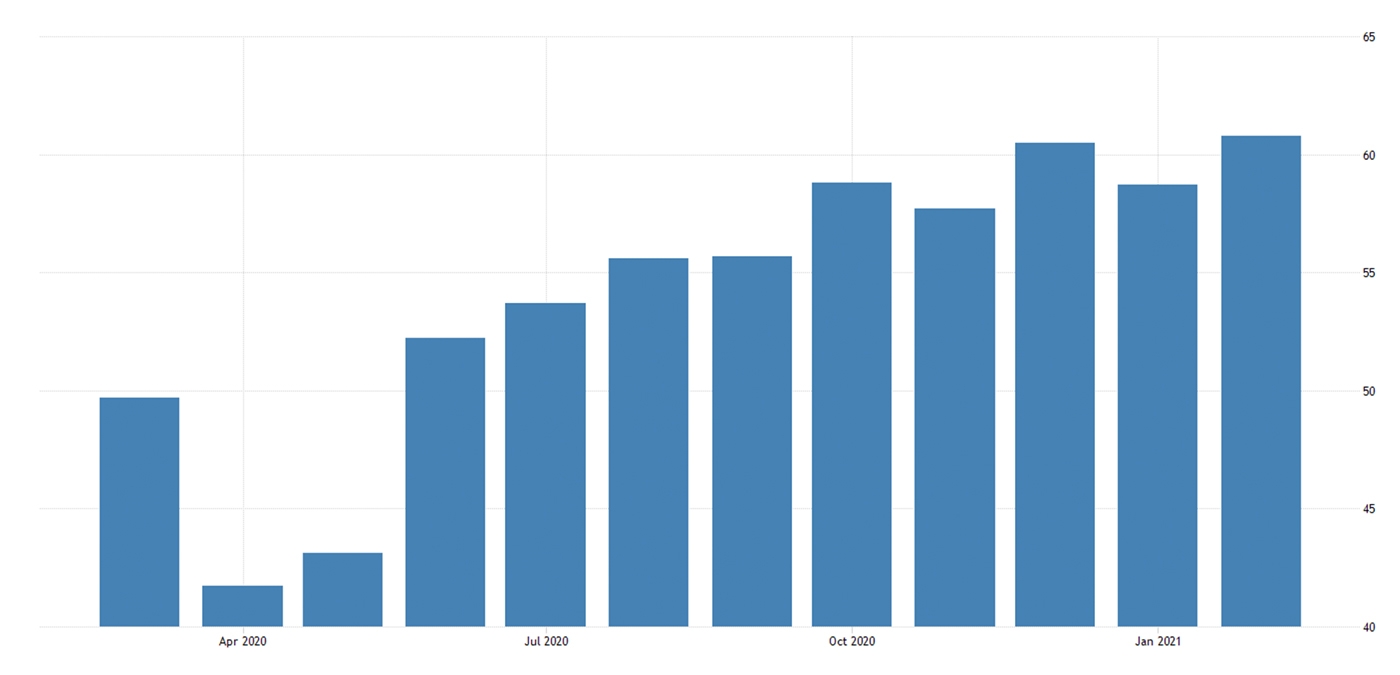

This trend continued into last week, with two reports released on Mar. 1 that well exceeded expectations. The Institute for Supply Management (ISM) reported its manufacturing index moved to its highest level since January 2018, and the growth in construction spending for January was double the expected percentage increase.

The ISM noted that “economic activity in the manufacturing sector grew in February, with the overall economy notching a ninth consecutive month of growth.”

It added,

Source: Trading Economics, based on data from Institute for Supply Management

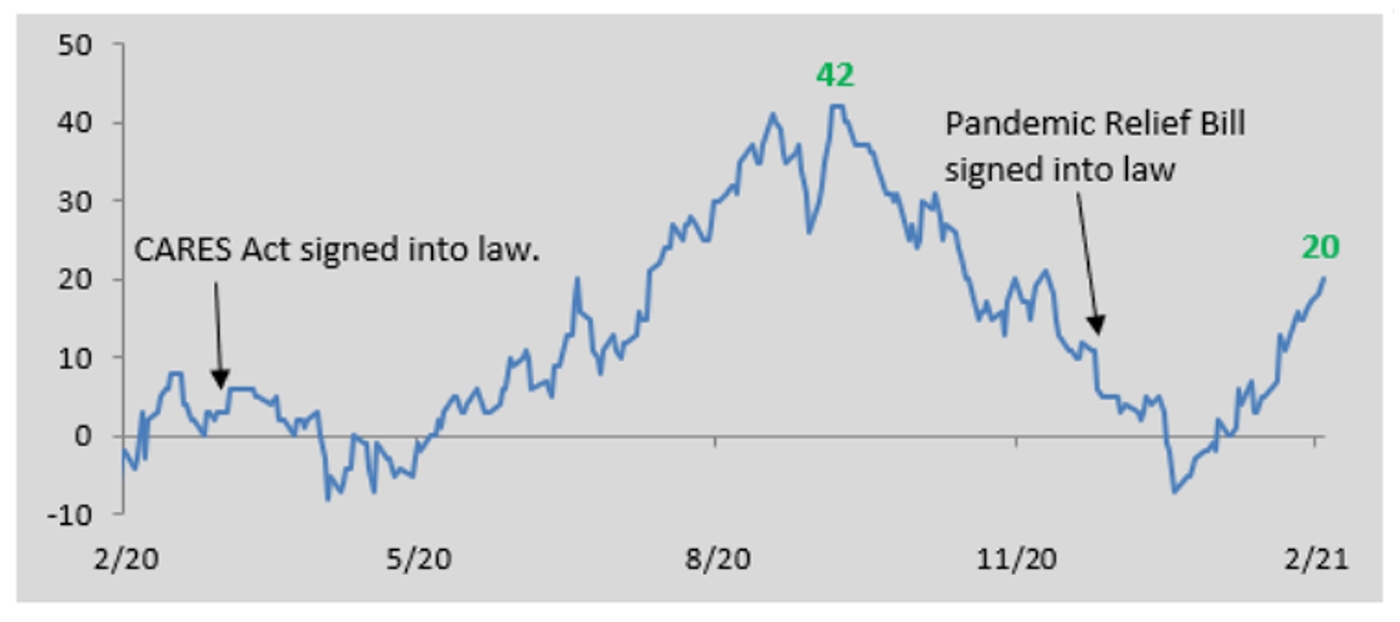

Bespoke Investment Group noted last week that its proprietary Economic Indicator Diffusion Index “is on the rebound.”

According to Bespoke, this index “measures the pace at which economic indicators are coming in ahead of (or below) consensus economist estimates over a 50-day period.”

Bespoke added,

Source: Bespoke Investment Group

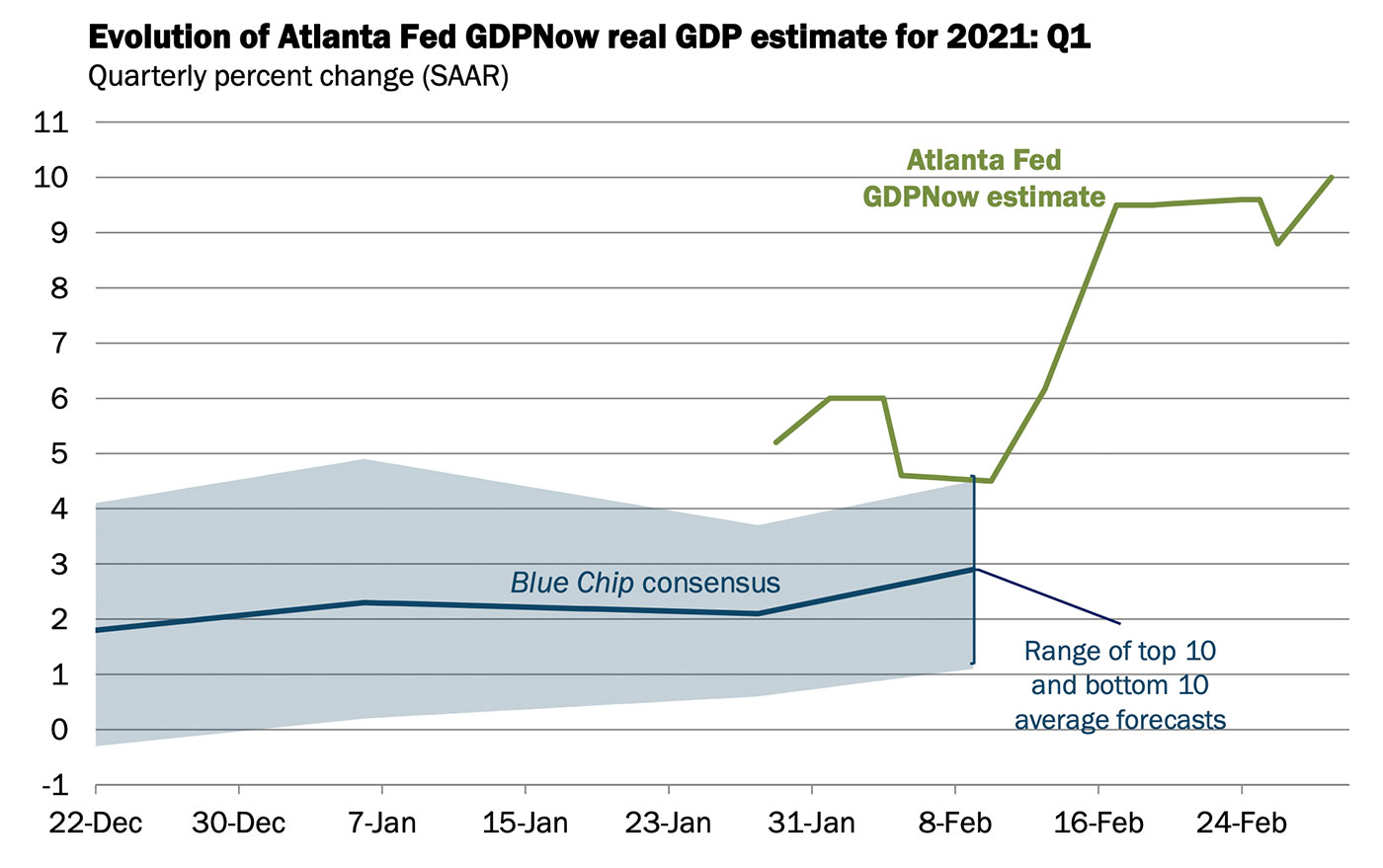

The growing optimism about economic data, significant news on the vaccine front, and the prospects for the passage of the next COVID relief bill have all contributed to rising estimates for GDP growth for Q1 2021 (and in many cases for the entire year).

The New York Times provided excerpts from a recent speech by John Williams, the president of the Federal Reserve Bank of New York. He remarked, in part,

Although there is a wide range of forecasts, Kiplinger’s recent economic forecast notes that GDP estimates generally keep rising and that “GDP will likely grow by 6.2% or more this year.”

According to the article, one large contributing factor will be pent-up consumer demand:

CNBC points to one of the highest estimates for Q1 2021 GDP growth from the Atlanta Fed, while also saying employment data could be a restraining factor on some of the more optimistic estimates for the entire year:

“The Atlanta Federal Reserve, which tracks data in real time to estimate changes in gross domestic product, now is indicating a 10% gain for the first three months of the year. The GDPNow tool generally is volatile early in the quarter then becomes more accurate as the data rolls in through the period.

“That comes on the heels of a report Friday showing that personal income surged 10% in January, thanks largely to $600 stimulus checks from the government. Household wealth increased nearly $2 trillion for the month while spending rose just 2.4%, or $340.9 billion. …

“To be sure, frailties remain in the economy. Paramount among them is the gap in employment, particularly in the services sector. As of January, there were 8.6 million fewer employed than there were a year ago, just before the pandemic began threatening the U.S., according to the Bureau of Labor Statistics. About 4.3 million Americans have left the labor force in that time.”

Sources: Atlanta Federal Reserve, as of Mar. 1, 2021; Blue Chip Economic Indicators and Blue Chip Financial Forecasts