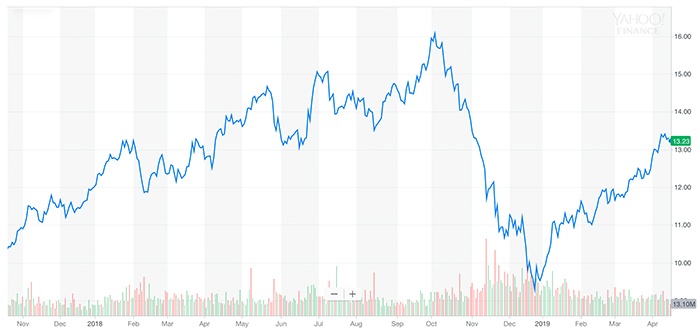

Source: Yahoo Finance, data as of 4/15/19

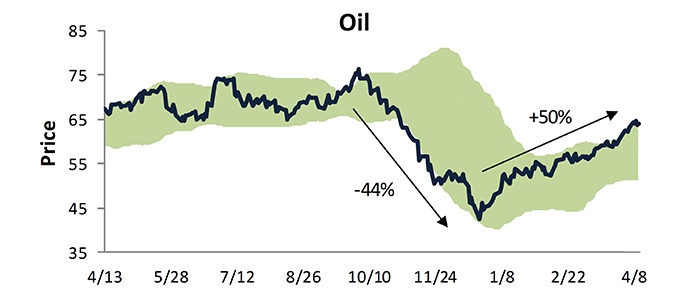

The price per barrel of light, sweet crude oil (WTI, West Texas Intermediate) registered its sixth weekly gain in a row last week, closing out Friday, April 12, at $63.89 per barrel.

Source: Bespoke Investment Group, data as of 4/12/19

The 50% rise in the price of crude oil shown in Figure 2 can be attributed primarily to several factors: (a) the rise in most asset classes since the December 2018 equity market sell-off; (b) some recent indications that fears of a global economic slowdown have been overblown; and (c) most importantly, the dynamics of supply and demand, impacted greatly by production cutbacks initiated last year by the Organization of the Petroleum Exporting Countries (OPEC).

The Wall Street Journal wrote this past Saturday (4/13) on why oil prices are rising, “More fundamental support continued to come from a tightening of global supplies as OPEC goes above and beyond its December agreement to cut production by 1.2 million barrels a day.”

They added that U.S. sanctions on OPEC members Iran and Venezuela also are an important factor in the overall global oil supply tightening.

Investor’s Business Daily reported this weekend,

“… Unrest in Libya and Sudan added threats to a market already pinched by OPEC cuts. …

“‘There’s continued depletion of global crude inventories and it’s hard to sell a market when that happens,’ said Thomas Finlon, director of Energy Analytics Group. …

“‘Demand is mixed’ but ‘the tightness of the market is going to win out,’ Amrita Sen, chief oil analyst at consulting firm Energy Aspects, said in a recent Bloomberg television interview.”

ETF Trends noted the potential for oil ETFs to head even higher:

“‘We see price risk asymmetrically skewed to the upside spurred by geopolitically infused rallies that could shoot prices toward or even beyond our high-end, bull-case scenario and test the $80/barrel mark for intermittent periods this summer,’ RBC strategists Michael Tran, Helima Croft and Christopher Louney said in a research note.

“Current OPEC compliance with production cut plans remains above their historical average, and it usually takes between two to three quarters for inventories to normalize after the cuts. While demand has yet to catch up to elevated supplies, rebounding economies in Europe and steady economic growth in the U.S. could prompt more upside for oil this year.”

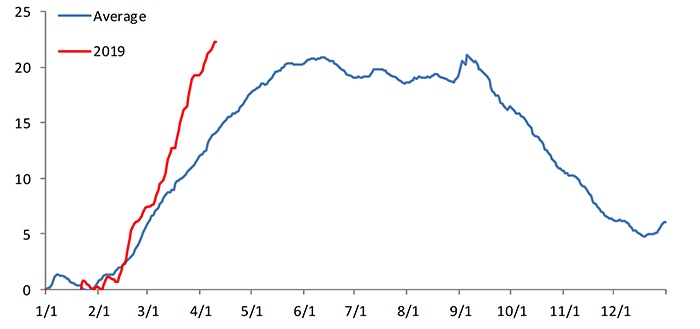

Bespoke Investment Group confirms what all drivers certainly know already—gasoline prices at the pump have shot up in 2019. Bespoke says that the average price per gallon of gas in the U.S. has risen about 22% since the start of the year. While prices historically climb toward a summer peak, Bespoke says, “This year’s path has been very similar to the average path, only this year price is up even more than it usually is at this point.”

There is some good news for drivers. Bespoke reports, “Once we get to June, gas prices have typically peaked for the year. They then trend slightly lower during the summer months before really starting to dip in Q4.” (Figure 3)

Source: Bespoke Investment Group