Client development in an unprecedented ‘season of complacency’

American investors are conflicted by feelings of complacency, distrust, inertia, hope, fear, and skepticism.

As an independent financial advisor for several decades, I do not believe I have ever seen a market environment quite like the one we are experiencing today. Nor do I think I have ever encountered clients and prospects who have such conflicted feelings about the state of our nation and its institutions, the economic outlook for the U.S., how to think about their investments, and their financial futures.

This presents unique challenges in developing new business prospects and a premium on patient education around the investment philosophies that have always been cornerstones of my practice: risk management, controlled growth for client portfolios, and actively managed portfolios.

Any introductory economics course begins with the laws of supply and demand.

Prices are set by the push and pull between buyers and sellers in the marketplace. When there are more net buyers than sellers, prices should rise accordingly. In a capitalistic economy, we expect the market participants who are buying and selling to be the collective body of institutional and individual investors. Ever since the Great Recession of 2008, central banks across the globe have moved beyond their traditional roles of setting interest-rate policy to become some of the largest purchasers of financial products.

The Federal Reserve and its counterparts have expanded their role from merely interest-rate policymakers to participating in the market to a degree that is unprecedented and of historical magnitude. Their purchases are generating demand and consuming supply that is not only leading to price appreciation, but also resulting in tremendous complacency for many investors.

But there are also many conflicting feelings underlying this complacency: distrust, fear, inertia, hope, and skepticism. Frankly, many investors just do not know what to make of today’s investment environment. They are constantly bombarded by messages in the financial and general press that range from “doomsday” predictions to wildly optimistic views of future market gains.

In many ways, a skeptical “inertia” has set it in for a great segment of the investing population. Many investors have reacted by keeping a relatively large proportion of their investments in cash or cash equivalents. Others, fed up with the low-interest-rate environment, have passively taken on far too much risk in equities. While many are deeply concerned about funding their retirement, they remain shell-shocked by the past financial crisis, uncertain about the mixed messages of the economy and where financial markets are headed.

Webster’s Dictionary defines the word, complacency as a “feeling of security, often while unaware of some potential danger.” It is often said that markets do not like uncertainty. The challenges that “complacency” brings to me as an advisor and marketer of my practice are similar to the consequences uncertainty has on the market. Though I feel that such complacent attitudes will ultimately be detrimental to prospects’ long-term outcomes, intellectually, when I put myself in their shoes, I get it.

The sense of complacency that prevails today goes beyond the comforts stemming from market performance.

There is something deeper this time beyond a strong market up-cycle. And I think that there are undercurrents that correspond with the U.S. presidential election, but beyond the normal rhetoric. What I am saying is that not even the most-esteemed, best-of-breed pundits, political forecasters, or politicians predicted the influence of Donald Trump or Bernie Sanders.

So, if the specialists in the world of politics were so off base, why should anyone believe that any of us can predict future events, particularly as they relate to something as abstract as the economy? This point was brought home in no uncertain terms by the “great miss” of professional pollsters, politicians, and market analysts regarding the issue of the U.K. “Brexit” vote in late June.

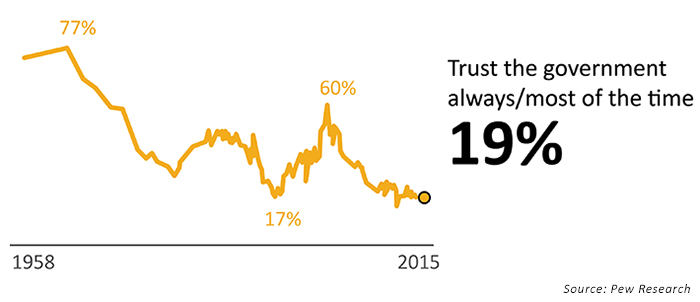

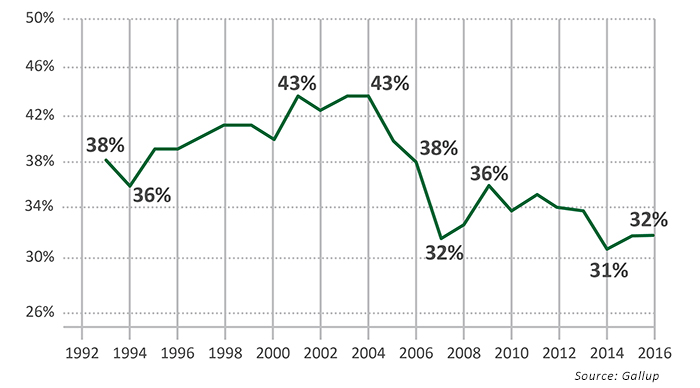

My point is that there is a general distrust in the population regarding experts of all kinds: politicians, the media, pollsters, economic forecasters, and Wall Street analysts. Several research studies have shown that trust in fundamental American institutions is at one of the lowest points in modern history. This is especially true of trust in the federal government, but also cuts across many other “establishment” institutions.

In this type of environment, active investment management has taken a back seat to investment in passive index funds. The emphasis on sophisticated risk management and market analysis provided by active managers are presently considered superfluous by many investors. Facts and data go relatively unappreciated today as if they have no relevance or predictive advantages. This feeling of “security” goes beyond being unaware of some potential danger. It is more serious than that because some prefer to ignore objective signs of danger. Yet the signs are real and foreboding.

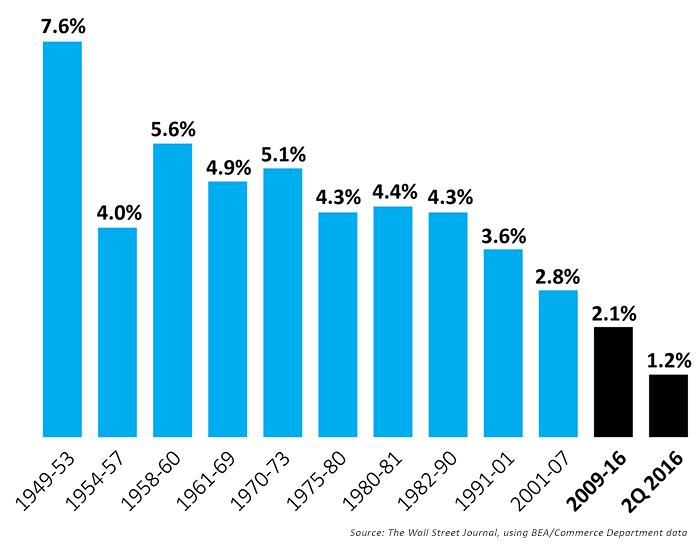

I am aware that facts can be spun different ways. Nonetheless there are several facts that should at least rattle investors from their slumber. Today’s economic recovery is recognized as the slowest since World War II, yet, at least in the U.S. equity market, new all-time highs were achieved this summer.

Note: Figures are adjusted for inflation and seasonality.

- Tepid global growth projections from the IMF and declining world trade figures.

- Cheap money leading to stock buybacks that engineer stock appreciation, rather than top-line growth or business investment, leading to price/earnings ratios at stretched levels.

- An aging population in many parts of the world and continued problems with employment among younger generations.

- Subpar growth and productivity here in the U.S., further characterized by historically low workforce participation, stagnant wages, and a lack of business investment.

- Financial asset valuations relative to disposable income at levels exceeding both the dot-com and housing bubbles.

- Dismissal of the fact that business cycles and recessions normally re-emerge approximately every seven years.

Regardless of what outreach or marketing strategy we use to generate more activity, it is imperative to put ourselves in the shoes of the recipient on the other end. How would we feel about being contacted in the way we are attempting to contact them? How frequently should we “touch” the prospect? How receptive would we personally be to such a connection if our portfolio was fairly “copasetic” at the moment?

The majority of people in the advisory business have type A personalities. We are outgoing. We are oriented to making rain rather than passively waiting for our phones to ring. Pushing hard comes naturally for us. We have to remain cognizant of the fine line between being informative and proactive versus being overwhelming and distracting.

Not only do our reputations depend on not crossing that line, but so does our business. By crossing that line we might deter a legitimate prospect from ever engaging us. As such, there may be an inverse relationship between the amount of outreach we provide (phone messages, emails, and “data dumping”) and how effective it is. Therefore, our outreach needs to be both thoughtful and reasonably timed. Our efforts should also be personalized. We want prospects to think of us as providing valuable insights that they are not receiving elsewhere, rather than feeling like the recipient of a mass email marketing campaign—just a number.

While life events such as job changes, inheritance, relocation, and divorce occur in every economic environment and result in some movement of money, I have come to accept that I must significantly lower my expectations for establishing new client relationships in an age of complacency. Just as the success of a real estate agent’s marketing efforts depends on the prevailing economic backdrop and willingness of the parties to transact, we, too, are impacted by consumer perceptions and temperaments and economic climates that are in large part out of our control.

This is the time to “drip” ideas to prospects and follow-up with them persistently but not aggressively—and not so frequently that our message loses impact or curiosity. Your actions will demonstrate that you are organized, that you care, that you are a professional, and that you will be there when the tide changes. I often send links to interviews and compelling charts. Although these may be falling on quite a few deaf ears, at some point the market corrections will not be restored right away, and the exuberance of buy-and-hold passive investing will diminish.

For those of us who are strong-willed and determined, it is difficult to succumb to outside influences and events. The reality is that we cannot control market conditions or sentiments. We therefore have to work within their confines. For advisors who employ money managers actively engaging in risk-minimizing strategies, this is a particularly challenging time in terms of client development. To some degree, the levels of complacency and uncertainty have nullified those attributes. We have to view the season of complacency as a time to plant seeds to be harvested when the season turns. If we have played our cards correctly by being a consistent professional resource in the background, prospects in the future should be far more receptive to meeting, hearing our story, and desirous of our guidance.

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com