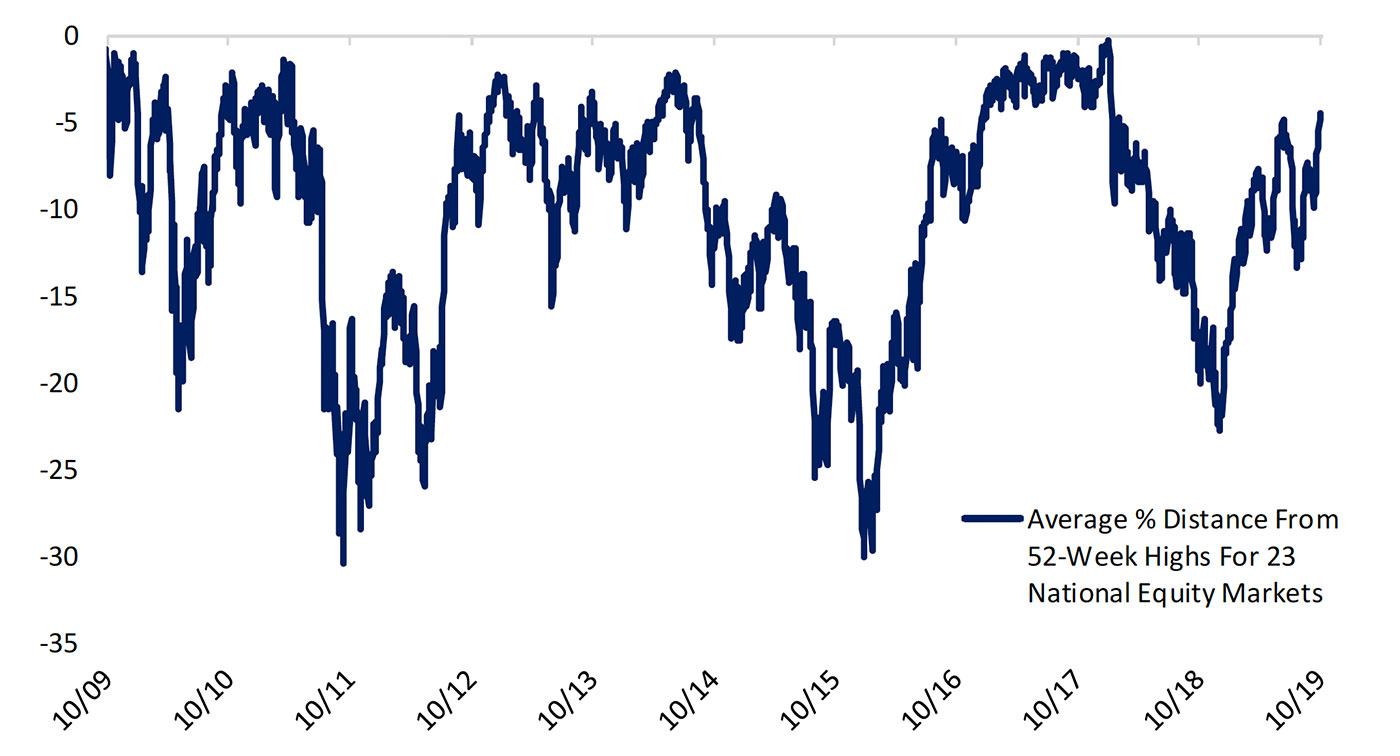

Bespoke Investment Group noted last Friday (Oct. 25) that “most of the world’s equity markets are very close to 52-week highs, thanks to uptrends that started earlier this year.”

Bespoke added dimension to this statement with two charts.

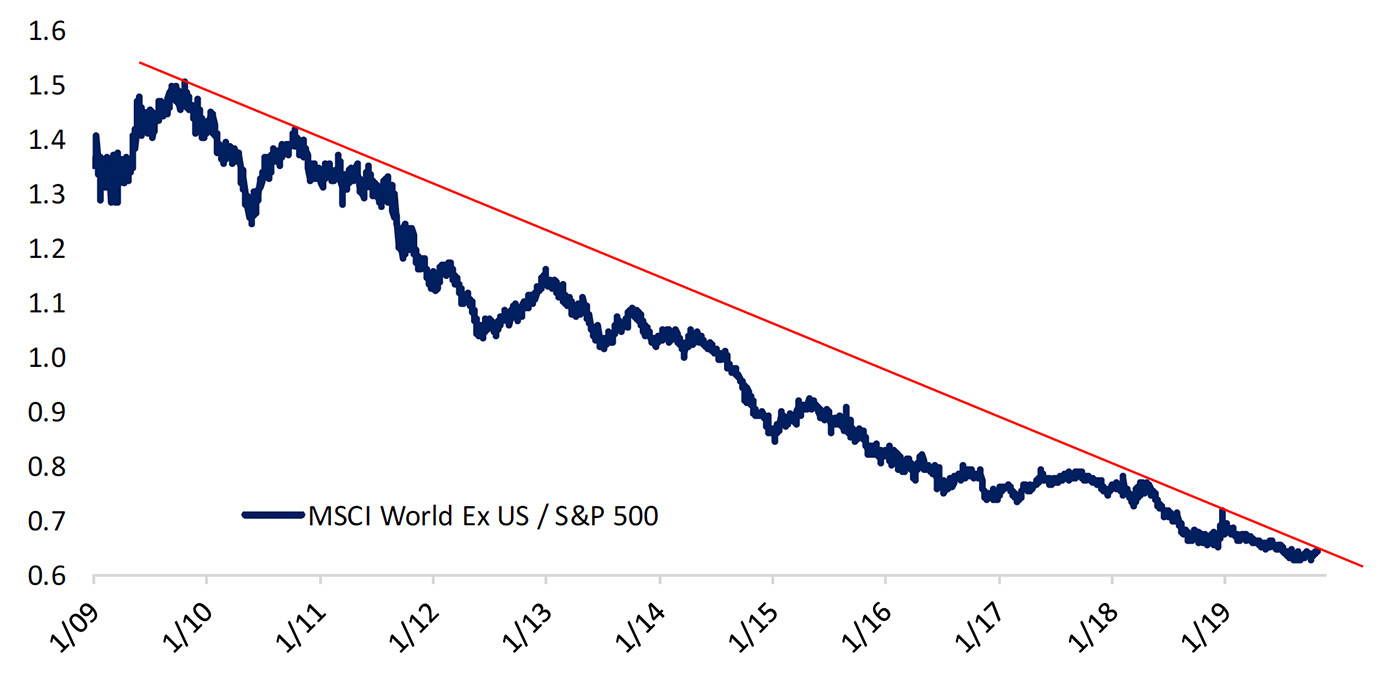

Figure 1 shows the relative underperformance of major global markets versus the U.S. market since 2009. The downward trend line represents the MSCI World Ex-U.S. Index over the S&P 500. Bespoke points out that the relationship might finally break out above the trend line, “and any shift towards balanced performance or international outperformance would be a big change.”

Source: Bespoke Investment Group

Figure 2 shows how 23 of the largest global equity markets, on average, are closing in on 52-week highs.

Source: Bespoke Investment Group

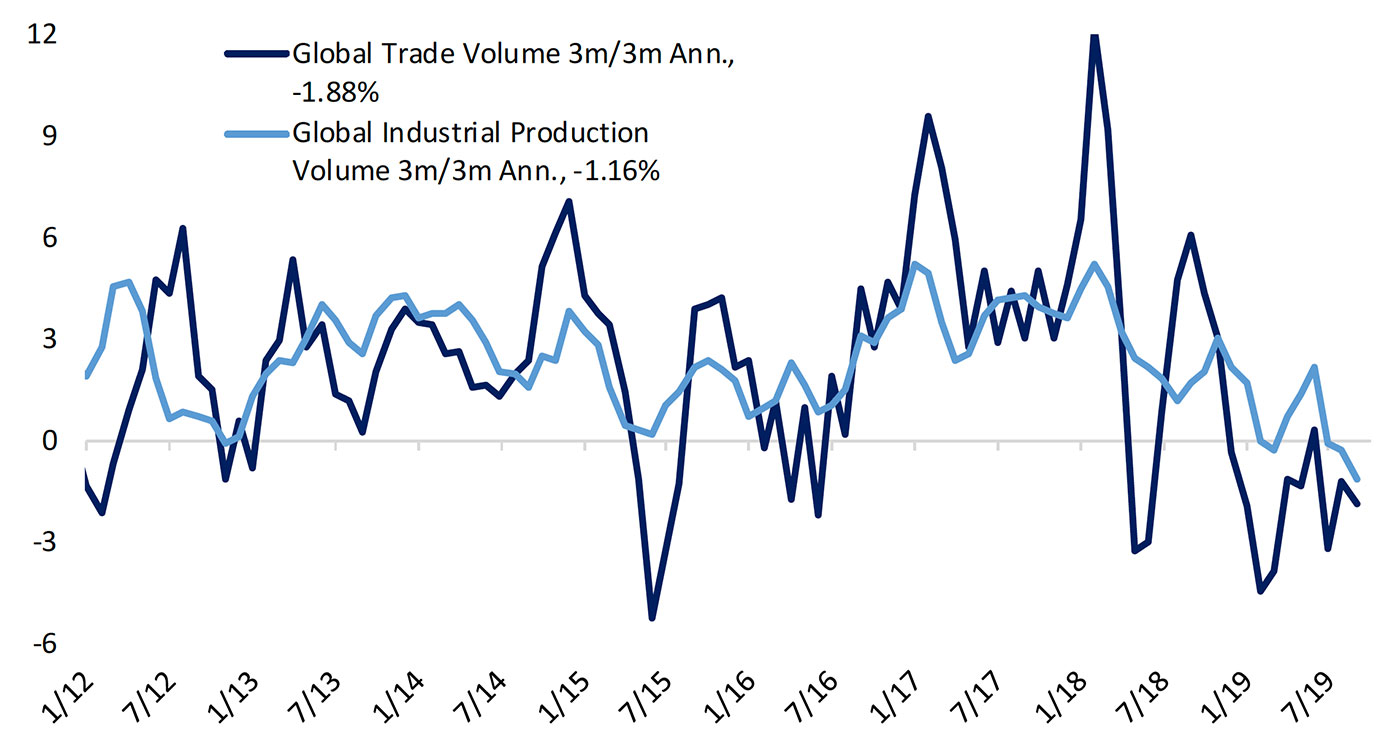

FIGURE 3: GLOBAL TRADE AND PRODUCTION SLOWING (AS OF AUGUST 2019)

Source: Bespoke Investment Group

Bespoke notes, however, that the most recent trends for various markets around the world can differ widely and also vary depending on what data source is being used. In general, October manufacturing PMIs were down in the Asia-Pacific area, flattish in Europe (though still in a downtrend, especially Germany), and somewhat improved in the U.S.

The International Monetary Fund’s (IMF) October World Economic Outlook said, in part,

“Global growth is forecast at 3.0 percent for 2019, its lowest level since 2008–09 and a 0.3 percentage point downgrade from the April 2019 World Economic Outlook. Growth is projected to pick up to 3.4 percent in 2020. …

“After slowing sharply in the last three quarters of 2018, the pace of global economic activity remains weak. Momentum in manufacturing activity, in particular, has weakened substantially, to levels not seen since the global financial crisis. Rising trade and geopolitical tensions have increased uncertainty about the future of the global trading system and international cooperation more generally, taking a toll on business confidence, investment decisions, and global trade.

“A notable shift toward increased monetary policy accommodation—through both action and communication—has cushioned the impact of these tensions on financial market sentiment and activity, while a generally resilient service sector has supported employment growth. …”

Source: International Monetary Fund, October 2019