The National Association for Business Economics (NABE) recently released its October 2019 NABE Outlook for 2019 and 2020, presenting the consensus macroeconomic forecast of a panel of 54 professional forecasters.

The organization summarized top-line findings as follows:

“‘NABE Outlook Survey panelists believe the U.S. economy will continue to expand into 2020, but they anticipate GDP growth will fall below 2% next year for the first time since 2016,’ said NABE President Constance Hunter, CBE, chief economist, KPMG. ‘The consensus forecast calls for real GDP growth to slow from 2.9% in 2018 to 2.3% in 2019, and then to 1.8% in 2020.’

“‘The panel turned decidedly more pessimistic about the outlook over the summer, with 80% of participants viewing risks to the outlook as tilted to the downside,’ added Survey Chair Gregory Daco, chief U.S. economist, Oxford Economics. ‘The rise in protectionism, pervasive trade policy uncertainty, and slower global growth are considered key downside risks to U.S. economic activity. While a small majority of panelists expects that any action by the Federal Reserve on interest rates will be on hold through year-end of 2019, over 40% anticipate at least one more rate cut. Three-quarters of respondents expect at least one rate cut by the end of 2020, and a third expects at least two further rate cuts by the end of next year.’”

According to MarketWatch’s analysis of the outlook, the panel of economists “saw a 7% chance of a recession starting in the second half of 2019. The odds increase steadily to 69% by early 2021.”

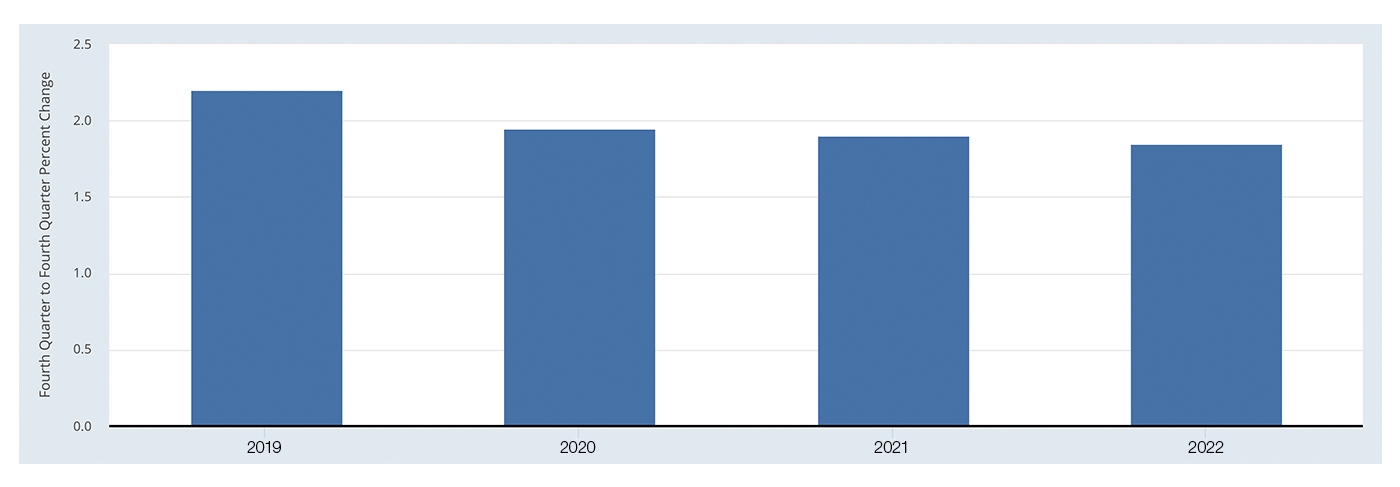

The GDP outlook presented by NABE is roughly equivalent to that of the Federal Reserve’s most recent “central tendency midpoint” for 2019–2020.

Source: Federal Reserve Bank of St. Louis

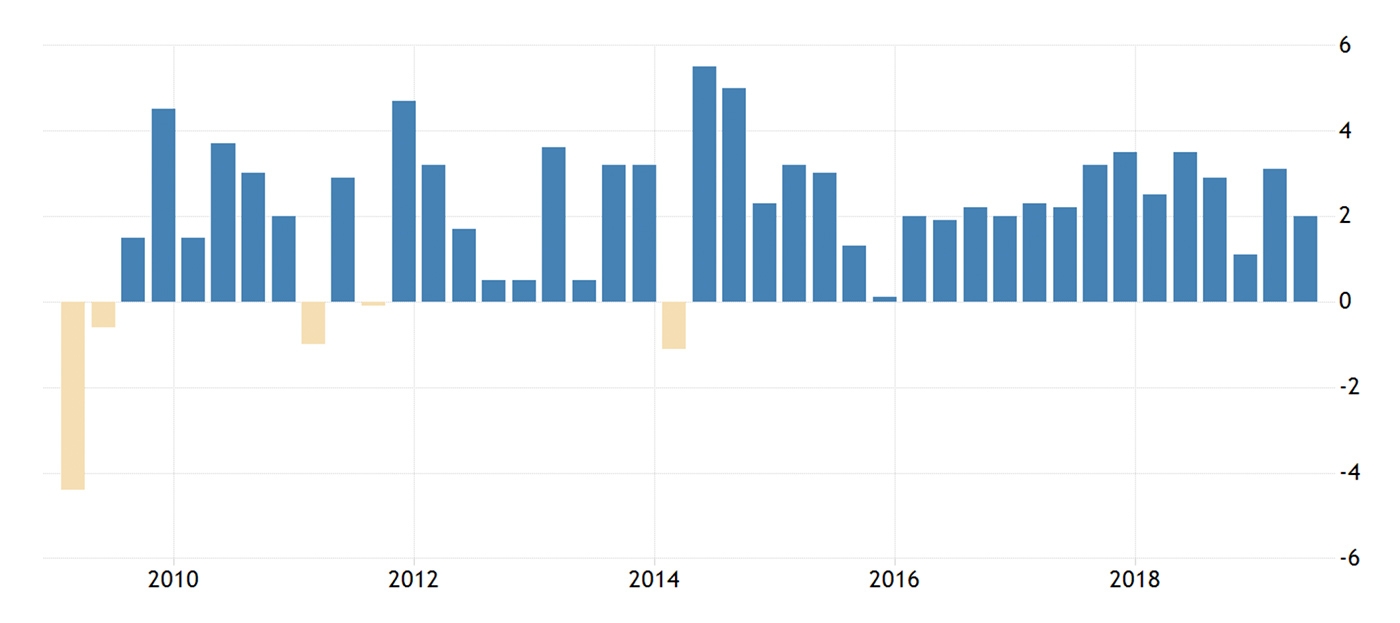

Figure 2 presents quarterly actual GDP growth by quarter for the past 10 years. According to Trading Economics, “the GDP growth rate in the United States averaged 3.21 percent from 1947 until 2019.” The outlook presented above is well below that historical trend.

Source: Trading Economics, U.S. Bureau of Economic Analysis

Key highlights of the NABE outlook include the following:

- Panelists expect economic growth, as measured by inflation-adjusted gross domestic product (real GDP) will continue to expand, but moderate in the second half of 2019 and into 2020. The median forecast calls for real GDP growth to average 2.3% in 2019, weaker than both the 2.9% growth in 2018 and the 2.6% gain expected for 2019 in the June survey. Respondents anticipate that GDP growth will register 1.8% in 2020, down from 2.1% forecast in the June survey.

- On a year-over-year basis, the median projection is for real GDP to rise 2.2% in the fourth quarter (Q4) of 2019, compared to 2.5% in Q4 2018 and 1.8% in Q4 2020. While no panelists predict a recession in 2020, the median of the five most pessimistic forecasts suggests real GDP will be flat in Q2 2020, and decline 0.3% in Q3 before increasing 0.4% in Q4 of next year.

- Four out of five panelists (81%) believe that risks to the economic outlook are weighted to the downside, an increase from the 60% who held this view in June. Only 8% believe risks are weighted to the upside—down from 10% in the June survey—while 10% of respondents report that risks are balanced.

- Trade policy is perceived as the dominant risk, with 53% of panelists citing it as the key downside risk to the economy through 2020. Roughly 12% of respondents consider slower global growth to be the main downside risk. Even smaller shares of respondents view the greatest risk to be financial market volatility (10%) or the risk of a geopolitical event (6%).

- Just over a third of respondents (35%) indicate reduced trade protectionism is the greatest upside risk to the economy, while a quarter of respondents (27%) views stronger wage growth as the main upside risk to the outlook. The other most commonly cited upside risks are infrastructure spending (10% of respondents), easier Fed policy (8%), and stronger global growth (6%).

- The vast majority of respondents—roughly 85%—have lowered their baseline outlook for growth in light of trade policy developments. Panelists expect the impacts to be greater in 2020, with 34% lowering their growth forecasts by more than 0.25 percentage points in 2019, and 61% lowering their forecasts by that much for 2020.

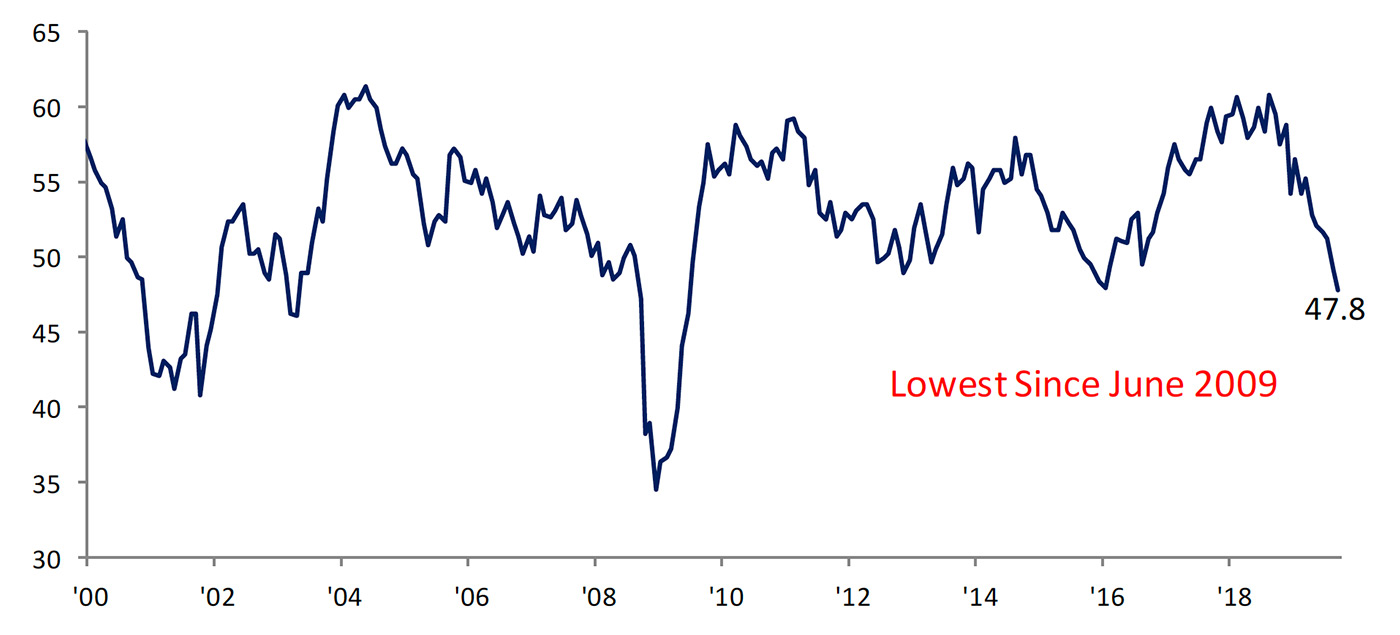

While the employment report last week showed modest jobs growth in September, the unemployment headline number dropped to 3.5%, the lowest level since December 1969. This came against a backdrop that showed weakness in U.S. manufacturing, heightening concerns over an economic slowdown in the U.S. According to The Wall Street Journal, “U.S. manufacturing activity indicated September growth was at its slowest pace since 2009.” The services sector, however, was still expanding, “albeit at the slowest rate in three years.”

While Barron’s points out that “what was lost in the frenzy over the ISM reports is that these are qualitative measures, as opposed to quantitative data such as the jobs numbers,” the slide below consensus forecasts did surprise the markets. It also, according to Barron’s, “raised the odds that the Federal Reserve will lower short-term interest rates at the end of October.”

Bespoke Investment Group said, “In addition to a disappointing start to the quarter for equities, ISM Manufacturing, the first economic report of the new quarter, came in weaker than expected falling from 49.1 down to 47.8, compared to expectations for a reading of 50.0. While a miss of fewer than 2.5 points versus consensus expectations isn’t huge, investors treated it that way as equities sold off dramatically.”

FIGURE 3: ISM MANUFACTURING (2000–2019)

Source: Bespoke Investment Group, Institute for Supply Management (ISM)