Assets without fundamental value: How prepared are advisors?

Assets without fundamental value: How prepared are advisors?

Investors are speculating with new vehicles such as cryptos, NFTs, and fractional shares in collectibles. Whether you embrace them or not, you are likely to find yourself caught between your clients, your firms, and your long-held beliefs about investing.

Welcome to the new normal in investing. It is likely just getting started.

Advisors are faced with a growing challenge. New investment vehicles abound, but many are far riskier and more volatile than stocks. Some have not yet been sanctioned or regulated by broker-dealers and regulatory authorities. And many of them don’t fit the parameters of traditional investments as defined by classic financial analysis. Nonetheless, they are here, and investors are actively engaged in them.

Normally, new investment opportunities would be well received by advisors. They provide the ability to create additional value for clients, demonstrate advisor expertise, and distinguish advisors from competitors. The most recent major innovation was the ETF, and we all know how much of a game changer that’s been for advisors. But today’s newbie investments are far more complex and widely misunderstood. The game for advisors may be changing again, and this time it’s much more complicated.

Regardless of advisors’ personal or professional views regarding investments such as cryptos, collectibles, NFTs (nonfungible tokens), and crowdsourced investments, there are risks to embracing them as well as rejecting them. Either way, advisors or are not going to have the luxury of burying their heads in the sand forever without consequences to their practice. They can choose to confine their practice to more traditional asset classes or time-tested alternatives. But at the very least, they will have to reckon with clients who will raise questions and expect answers about the new alternatives.

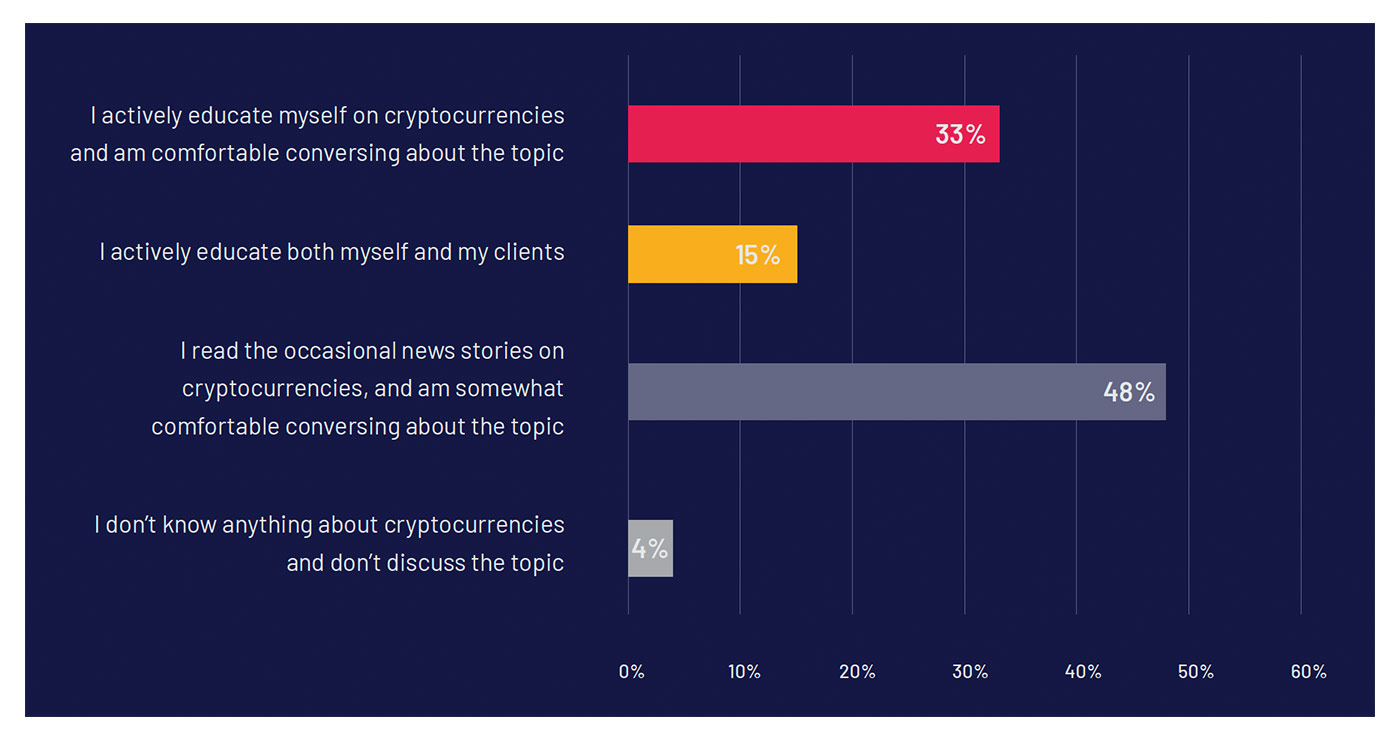

Surveys on cryptocurrencies highlight the problem. In the 2021 Trends in Investing Survey, conducted by the Journal of Financial Planning and FPA, 14% of surveyed advisors reported using or recommending cryptocurrencies (up from less than 1% in 2020), and 49% said clients had asked them about cryptocurrencies in the past six months (up from 17% a year earlier). More than a quarter of advisors in the recent study said they plan to increase their use or recommendation of cryptocurrencies in the next year. The momentum is undeniable.

At the same time, advisors have a long way to go to be truly educated about cryptocurrencies, according to the same study.

Source: The 2021 Trends in Investing Survey, conducted by the Journal of Financial Planning and the Financial Planning Association (FPA), fielded March 2021

Advisors represent just the tip of the iceberg in terms of interest in cryptos. In their recent survey of more than 1,000 consumers earning more than $50,000 per year, New York Digital Investment Group (NYDIG) reported that about 22% of advisory clients own bitcoin, though only 3.5% hold that bitcoin with their advisor. The standout statistic of the study for advisors was that 82% of respondents said they expect their advisors to be a knowledgeable source about bitcoin.

Meanwhile, held back by a lack of regulatory guidance, fundamental research, formal education, and approved products on cryptos, the industry is being exceptionally cautious, leaving a significant gap between the public’s demand and the industry’s ability to respond to it. While the U.S. government labors over whether bitcoin is a commodity, currency, security, or property, large numbers of clients are end-running their advisors to participate directly with online crypto platforms and exchanges.

This leaves advisors in an awkward position between their firms, industry regulations, client needs, and their core beliefs about investing. While advisors are certainly free to exclude any instruments from client portfolios that they don’t believe in, the mere existence of these instruments can affect the perceptions of a growing percentage of their clients. How an advisor acknowledges and communicates around them has taken on new importance in today’s environment.

This time really is different

The fact that investor risk appetites are once again surging is nothing new. Investor sentiment waxes and wanes with economic cycles, Fed and government policy, interest rates, global politics, technological innovation, and a host of other influences. As a result, the fact that risk appetites change over time is a given. What they will focus on next, however, is not.

It is no surprise that ultra-low interest rates, prospects for a booming economic recovery, and extra stimulus money from our beneficent uncle are propelling the broad markets to record highs and fueling extra frothiness in selected sectors. We have only to witness the ongoing frenzy in so-called meme stocks such as GameStop (GME) and AMC Entertainment (AMC) to see this in action.

In the case of the meme stocks, the economic conditions mentioned above have combined with several other influences such as commission-free trades, months of forced time at home, and an army of young individuals with an organized social media network, to present something of a perfect storm for speculative stock trading.

The meme-stock army, however, may not be representative of the typical advisory client. Your clients are more likely to be out buying bitcoin instead.

For crypto buyers, the conditions merely pushed them in a different speculative direction—toward a battery of innovative new investment alternatives. The problem now is that some of these people are likely to be your clients, and these new alternatives have a lot more momentum than a handful of meme stocks. Even if you believe that investor risk appetites are a natural outcome of current economic policy, and thus temporary, you cannot ignore the underlying generational changes that are occurring with regard to investment alternatives like bitcoin.

The problem, therefore, isn’t just that your clients have an itch to speculate—it’s that they are speculating in new forms of investing and doing so with instruments you don’t offer. The securities industry may not have seen anything quite like this in its entire history.

The current “risk-on” economic scenario may be a contributing factor to the growth of new speculative investments, but two major trends had already taken hold well before the pandemic hit. First is the introduction of digital assets, initially as cryptocurrencies and more recently as NFTs. Second is the JOBS Act of 2012, which was a landmark event for a whole new family of investment vehicles emanating from SEC-sanctioned funding portals, otherwise known as crowdfunders. Both of these trends have rooted themselves into the investment landscape, garnered big chunks of venture capital, and attracted legions of small investors.

Both are also the subject of considerable media and public attention, and are deserving of much deeper analysis than can be provided here. The point is that they can place advisors in a bind. Rejecting these assets is the safe play right now until there is more legal and regulatory guidance.

A survey of advisors by Incapital showed that more than half of advisors refuse to let their clients invest in cryptocurrencies, meme stocks, or the latest “hot” ETFs. The vast majority (89%) of advisors said their clients do not understand the volatility of these types of investments. However, the polarization in how advisors act on this belief reflects the complexities of taking a position either pro or con on these instruments.

Those who are refusing to sanction new instruments such as cryptos risk being unable to service a rapidly expanding desire on the part of clients. Will rejecting them cause your clients to perceive you as close-minded. Will it put you at a competitive disadvantage? Will you lose clients or assets as a result?

On the other hand, if you do endorse them, you have to deal with their volatility, the risk of them becoming totally worthless, and their lack of traditional fundamentals. How will you integrate these investments into the narratives about prudent, long-term investing that you’ve been espousing all along? Perhaps of even greater concern, how will you justify these investments if your clients lose money and then claim such investments were way too risky for them? (It happened a lot with options and can certainly happen here.)

The overriding question may therefore be whether there is a way to serve your clients without taking on the risks associated with either rejecting or embracing these assets outright. I believe the answer to that is yes, and it does not mean simply avoiding the question. What it will require are three things:

- A mindset that embraces the realities of behavioral markets.

- An acknowledgment that assets can potentially have sustainable value without any conventional fundamentals.

- An acceptance of the concept of a nonphysical asset.

First, advisors need to further their thinking outside the equities box, extending their perspective from a fundamentals-based market with occasional behavioral anomalies to markets for many alternative assets that will be almost entirely driven by behavioral factors. In these markets, the challenge won’t be to identify mispricings through fundamental analysis. Rather, it will be to identify mispricings through comparisons to prior or analogous behavior instead—a notion that flies in the face of classic investment training.

In addition, there may be an important message hidden in the action of meme stocks—that a significant number of investors in these stocks are in their 20s and 30s. This is consistent with studies that suggest different behavioral tendencies between generations, and it foretells that part of what is happening here may represent a generational shift in investment orientation. (That same InCapital study showed that 67% of advisors said their clients are confused by their adult children who are encouraging them to invest in cryptocurrencies, and/or meme stocks, and/or hot ETFs.)

The next step is for advisors to revisit their strict adherence to fundamentals as the primary way to value investments. If we have learned anything from behavioral finance, it is the fallibility of fundamentals to fully explain equity prices all the time.

We already know that other assets are often driven by sentiment more than fundamentals. Is it really that much of a leap to accept that the younger generations place value in assets, such as bitcoin, that do not have traditional fundamentals? Younger generations are captivated by the innovation, the anonymity, and the elegance of their decentralization. If 80%–90% of the value placed in GME is unjustified by fundamentals, then why can’t 100% of bitcoin’s value be as well?

Besides, cryptos may be unique in many ways, but they are certainly not the first asset without economic fundamentals to come along. Art has been functioning quite well as an asset with purely subjective value for centuries—based solely on how much another collector is willing to pay to own it.

The fact that we do not have tidy formulas or mathematical benchmarks for evaluating behavioral influences does not mean they don’t exist. With millions of U.S. investors owning cryptos, it may be time to stop dismissing these assets entirely and focus instead on developing better ways of valuing them.

Finally, advisors need to brace themselves for nonphysical assets. This, too, seems like a huge leap of faith for those of us who spent our entire lives oriented around physical investments and are still getting used to the idea that we no longer even have paper statements to verify what we own. What we own when we purchase a financial asset these days is represented electronically, and we place a great deal of trust in the ability of our banks, investment firms, and the internet to maintain those assets for us and provide access to them.

The issue, therefore, is not that new instruments like bitcoin are digital. Rather, it is that many people don’t fully understand what they represent, and there isn’t enough experience with them to trust that they are safe or will always be accessible. Younger generations are simply more willing to grasp this concept and establish the necessary trust. To denounce the magnitude of the digital revolution might be tantamount to denouncing the internet when it was at the same stage of its growth.

Ultimately, the industry and the regulatory bodies will weigh in on cryptos and other new investments. That may be down the road, though. Advisors need a game plan for new investments now. Once you have come to grips with the fact that such assets are part of the landscape, here are some suggestions:

-

Focus on education first and strategy second. Client studies suggest that it is more important for an advisor to be knowledgeable than to always be right. The one client need that you can fulfill right now is your knowledge. You can provide significant value by speaking intelligently about assets such as cryptos, explaining how they work and what they represent, and presenting the pros and cons of owning them.

Examine and explain their volatility and the potential risk involved with owning them. Use the resources of industry thought leaders, your investment managers, and your broker-dealer to fortify your research. Having the facts and understanding new investments provides several advantages. It reinforces your credibility and provides value to your clients. But perhaps most importantly, once you inform your client, they will more intelligently form their own opinion about whether such investments are right for them.

- Consider a behavioral approach to defining and valuing investments. To be clear, a behavioral perspective will not provide a target valuation for any asset. But at the very least, it recognizes that assets do exist without fundamentals that are defined in classic economic terms. Once you accept them as viable assets, you can apply other valuation techniques, using technical analysis, momentum, or proxy valuations from similar assets. Such valuation techniques, stacked up against long-term projections for more conventional assets can at least offer some perspective.

Discuss alternatives or proxies with clients. Many advisors have already discovered ways to satiate client desires to invest in new digital technologies without necessarily purchasing cryptos themselves. Investing in companies that will provide products and services to blockchain, decentralized finance (known as DeFi), or crypto entities may represent the ideal compromise for clients who are intrigued but who need to stay grounded in investments with a concrete business model.

There are also many opportunities in more established, yet innovative new technologies, such as companies or ETFs focused on robotics, artificial intelligence, cloud and quantum computing, or other “exponential technologies.” And, for clients seeking aggressive, higher-risk/higher-reward strategies for some portion of their portfolio, sophisticated third-party investment managers offer a range of risk-managed strategies that should capably meet this need.

- Be careful to separate your personal feelings from your professional guidance. Clients will want your opinion, but they will be much more accepting of an opinion derived from objective analysis than one based on emotions. It’s probably best to avoid statements like that of Berkshire Hathaway’s Charlie Munger, who has said about bitcoin, “The whole development is disgusting and contrary to the interests of civilization.”

- Take a proactive approach. An upfront statement to all your clients explaining your position could go a long way toward quelling client anxiety, temptation, and curiosity. This should be compatible with and reinforce your overall philosophy on risk management for client portfolios.

Hidden among these challenges are likely to be groundbreaking opportunities for advisors in the coming years. Walking the fine line between rejecting or embracing them may go a long way toward continually reinforcing your value to clients of all ages.

Richard Lehman is the founder/CEO of Alt Investing 2.0 and an adjunct finance professor at both UC Berkeley Extension and UCLA Extension. He specializes in behavioral finance and alternative investments, and has authored three books. He has more than 30 years of experience in financial services, working for major Wall Street firms, banks, and financial-data companies.

Richard Lehman is the founder/CEO of Alt Investing 2.0 and an adjunct finance professor at both UC Berkeley Extension and UCLA Extension. He specializes in behavioral finance and alternative investments, and has authored three books. He has more than 30 years of experience in financial services, working for major Wall Street firms, banks, and financial-data companies.