Thomas Gilovich, a well-known professor of psychology at Cornell University, recently gave an interview to Bloomberg radio in the Barry Ritholtz series, Masters in Business. Gilovich has conducted research in social psychology and behavioral economics, with a focus on human biases in decision-making. One of his most popular books is “How We Know What Isn’t So: The Fallibility of Human Reason in Everyday Life.”

One of the themes of the interview explored why the human mind leads people to ignore some fundamental principles of mean reversion. Data over time will normally regress to the mean or average, yet people tend to remain “anchored” to what happened most recently.

Professor Gilovich says that we give too much credence to evidence that supports our beliefs and give too little credence to data that does not support our beliefs—confirmation bias is the “mother of all biases.”

What does this have to do with the market’s behavior over the past two trading weeks? Perhaps a lot.

While 1,000-point moves lower on the Dow Jones Industrial Average—and major index losses over 5% last week—certainly are attention-getting, in many ways, the markets have moved from an “abnormal” state to one that is regressing in several areas toward the mean.

MarketWatch recently wrote,

“But as Wall Street acclimatizes to the resurgence of volatility, some say investors are simply receiving shock treatment from a return back to ‘normal’ after years of easy monetary policy and sloshing liquidity changed how assets moved, and distorted the way investors went about filling their portfolios.

“‘I was talking to somebody today who said, “why are the markets acting so abnormal?” My response for the first time in a long time was that the markets are acting a bit normal,’ said Douglas Keebles, chief investment officer for AB Fixed Income.”

All of the following show some level of mean reversion:

- A move away from a period of unusually low volatility.

- Higher bond yields and real interest rates (though still historically low), reinforced by a perceived level of slightly more hawkishness on the part of the Fed as they move toward “rate normalization.”

- A pickup in wage growth from a long period of wage stagnation, feeding some belief that inflation will rise.

- The end, at least for now, of a one-way street higher both in the markets and in bullish sentiment among professional and individual investors. According to Barron’s, the S&P 500 had completed its 10th-straight monthly gain in January 2018, “the longest winning streak since the 11 months ended January 1959.”

Recent analysis from Bespoke Investment Group made two noteworthy points:

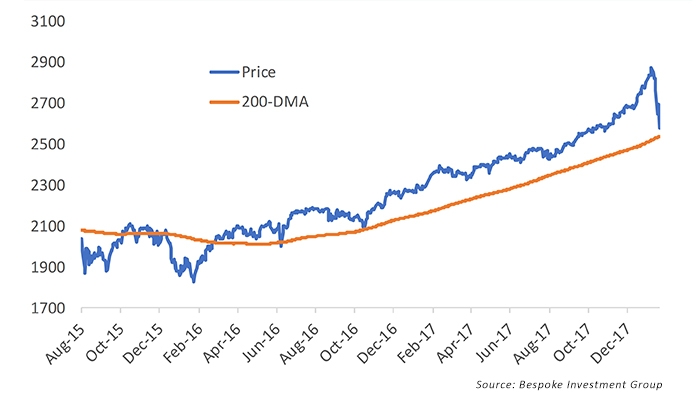

- Last Thursday (2/8/18), the S&P 500 closed 10% below its prior all-time high, ending the streak without a 10% correction at 715 calendar days.

- The S&P 500 dipped under its 200-day moving average (200-DMA) on Friday (2/9/18), but it still managed to close above it. That continues a streak of 409 trading days since the S&P last closed below its 200-DMA.

FIGURE 1: S&P 500—PRICE TREND VS. 200-DAY MOVING AVERAGE (SINCE AUGUST 2015)

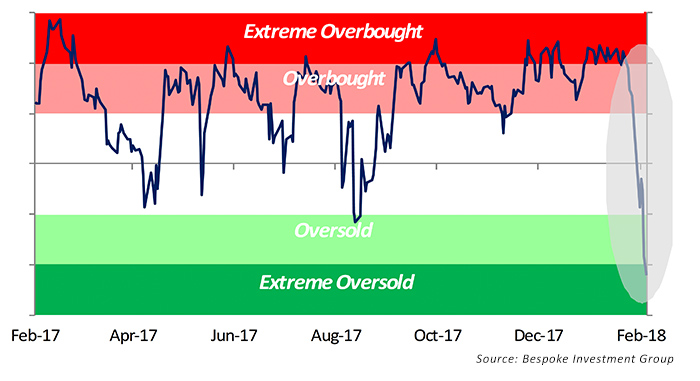

Volatility has obviously returned to the markets in a big way, in both directions for a change. Major spikes higher in the market after the 10% swift move down should not be unexpected. Bespoke points out that the S&P 500 went from a position of extremely overbought to extremely oversold very rapidly. They wrote this past weekend,

“Since 1928, the S&P has only gone from extreme overbought territory (>2 standard deviations above its 50-DMA) to oversold territory (>1 standard deviation below its 50-DMA) in two weeks or less on 21 prior occasions. That’s how rare a move like this is.”

FIGURE 2: S&P 500 50-DAY MOVING AVERAGE SPREAD

The question now is, will the market make a fast V-shaped recovery, back and fill for weeks or months, or head toward a deeper correction and possible bear market? While many theories abound in the financial press—and all are supported by at least some historical data—no one knows for sure, of course.