Will the Federal Reserve’s second rate cut push the S&P 500 above 4,000? History suggests it will.

Initial rate cuts have proven to be positive for U.S. stock indexes in secular bull markets, which we are in today. But second rate cuts add even more fuel for a rising market.

Why? One-and-done rate cuts, while helpful to stock prices, turn out to be just that, a one-shot boost for the market. Multiple rate cuts indicate a more favorable longer-term atmosphere for lower interest rates—or, at a minimum, they likely take the scenario of rising rates off the table.

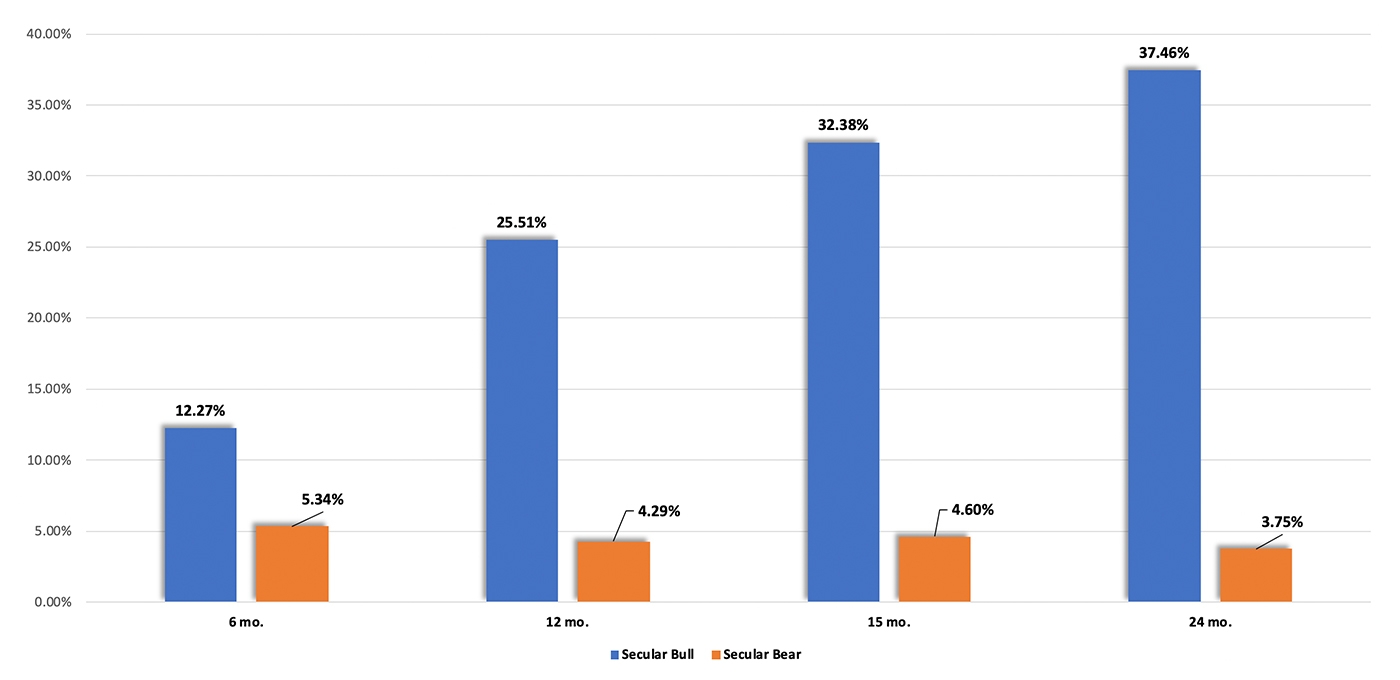

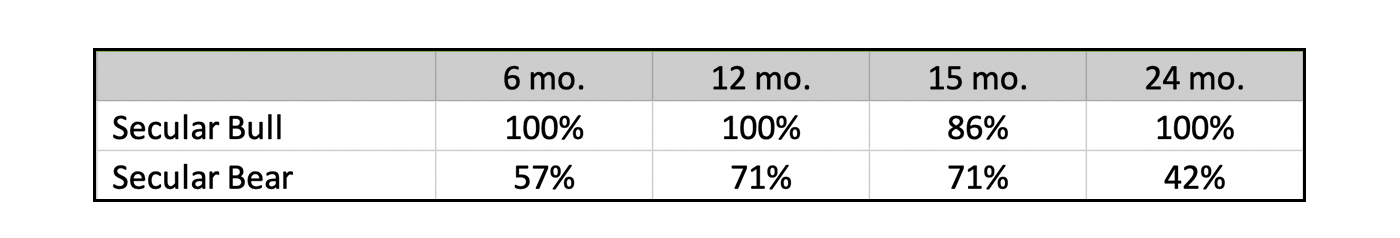

Looking at the past 70 years, we have had 14 cases of a second rate cut by the Federal Reserve. Instead of looking at just what has happened to the market after a second rate cut, a better analysis is to separate the cases by the market environment in which they occurred. Was the market in a secular bull (1949–1968, 1982–2000, and 2011–present) or a secular bear (1968–1982 and 2000–2011)?

Seven cases occurred in secular bull markets and seven in secular bears. The differences are startling. In secular bull markets, the second rate cut produces above-average double-digit gains, while in secular bear markets, the rate cuts produce only subpar returns.

Source: STIR Research

And it isn’t just a single outlier that is pushing the strong numbers in the secular bull cases. It is a very broad-based occurrence, where half the cases in each time period are outperforming the average.

In the secular bear market, the average gain is masking some very large losses. As examples, the second rate cut in 2001 was followed by a 33% decline over the next 24 months, and the second rate cut in October 2007 was little help for a falling market—it was off 47% 15 months later.

Source: STIR Research

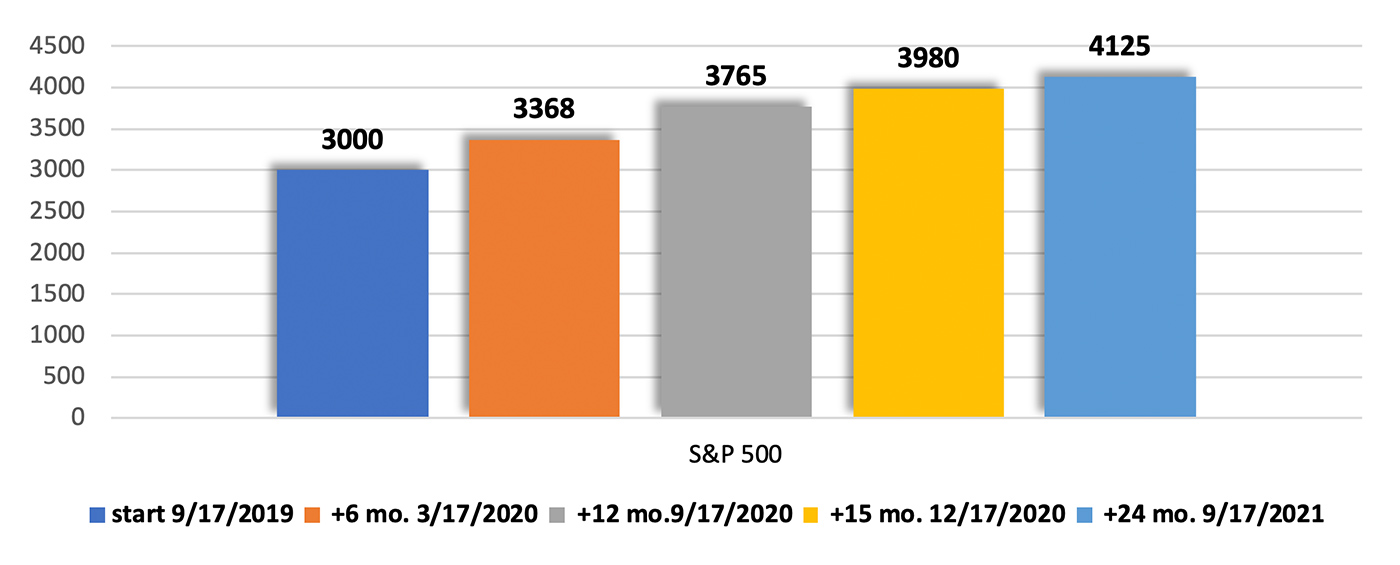

It is surprising, but in all seven cases of a second rate cut in a secular bull market, the S&P 500 had been at or near an all-time high at the time of the cut (possibly driven by optimism over the first rate cut).

This time is no different. The following chart illustrates the average S&P 500 gain after the second cut in rates. The 15-month time frame was picked because that falls on Dec. 18, 2020, thus providing a price target of close to 4,000 for 2020.

Source: STIR Research

20 months of treading water—time for a breakout?

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com

Marshall Schield is the chief strategist for STIR Research LLC, a publisher of active allocation indexes and asset class/sector research for financial advisors and institutional investors. Mr. Schield has been an active strategist for four decades and his accomplishments have achieved national recognition from a variety of sources, including Barron's and Lipper Analytical Services. stirresearch.com