What a great tax break crude oil’s decline has given to the average worker here in the U.S.. This cost savings has allowed the average American to have and enjoy a little more financial freedom, and has also helped consumer confidence numbers.

The contraction in crude oil prices felt as though it did more to stimulate the economy than all of the Federal Open Market Committee action over the past few years did. What this tells you is that a tax cut was necessary to stimulate spending. Clearly, flooring interest rates did not help the average wage earner at all. Alas, the Fed does not care a whit what I say.

As investors embrace this perk-up in sentiment and confidence, we must alert you to some not-so-good side effects. Much of the U.S.’s growth post financial disaster came from the energy industry. Jobs were created to expand drilling and the exploration of shale. The U.S. produced so much crude oil that it was thought that by 2020, we here in the U.S. would not need to import any crude oil and in fact could export crude oil, competing with OPEC.

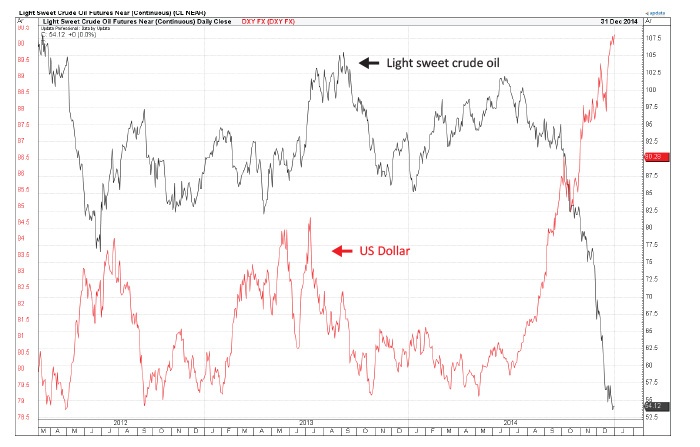

LIGHT SWEET CRUDE OIL VS. US DOLLAR

With crude oil prices plummeting, it is not likely that this growth in the energy sector will continue. Not only do the companies exploring for and recovering shale have huge debts to pay off in the way of bonds, but with crude oil under $65 a barrel, it makes little sense to continue to recover that oil. Thus, the permits for this activity have fallen off a cliff (lowest rig count in two years) and unfortunately, so will the jobs that were created. Ancillary businesses that supported those energy workers will also have trouble. The downside to cheap crude oil is a re-dependence on foreign oil.

So long as crude oil remains cheap and commodities remain under pressure, it is not likely that there will be inflation here in the U.S. When these items begin to firm up and advance, an increase in inflation will follow. To date, although the cost of food and other expenses have advanced, the depressed levels of crude have helped offset any cost increases.

As for the strong U.S. dollar, remember that it will impede our ability to compete globally with other countries. A strong U.S. dollar also makes commodities cheaper for us here in the U.S. and increases the demand for imported products, which will tilt our trade balance a bit more off-kilter. This increased demand for products should stimulate the eurozone and other markets that export their products to our shores.

This is an early notification that such stimulation could help restart global economies verging on recession. Naturally, countries with U.S. sanctions, such as Russia, are not in this picture. One final note is that with the U.S. shutting down its shale production, supply of crude will dwindle and this could have the effect of pushing prices higher.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

Jeanette Schwarz Young, CFP, CMT, CFTe, is the author of the Option Queen Letter, a weekly newsletter issued and published every Sunday, and "The Options Doctor," published by John Wiley & Son in 2007. She was the first director of the CMT program for the CMT Association (formerly Market Technicians Association) and is currently a board member and the vice president of the Americas for the International Federation of Technical Analysts (IFTA). www.optnqueen.com

Jeanette Schwarz Young, CFP, CMT, CFTe, is the author of the Option Queen Letter, a weekly newsletter issued and published every Sunday, and "The Options Doctor," published by John Wiley & Son in 2007. She was the first director of the CMT program for the CMT Association (formerly Market Technicians Association) and is currently a board member and the vice president of the Americas for the International Federation of Technical Analysts (IFTA). www.optnqueen.com

Recent Posts: