“If Santa Claus should fail to call, the bears may come to Broad and Wall.”

That’s the old saying in the financial markets, referring to the “Santa Claus rally” period, which consists of the last five trading days of the year plus the first two of the next year. Yale Hirsch first took on the task of quantifying this in his Stock Traders’ Almanac and in his book “Don’t Sell Stocks on Monday.”

The basic idea is that this period is usually an up one for the stock market, and my own research shows that it has been up 78% of the time since 1928. But if it goes against that usual bullish tendency, it is supposedly a bearish omen for the year to follow.

This year, we find that the official “Santa Claus rally” period did see the S&P 500 close up by 1.29%. That should mean an up year for 2019, if the omen is correct. But let’s look at the statistics, just so we can know how much faith to put into this market adage.

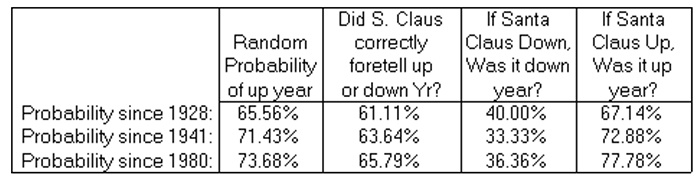

What Table 1 shows is that the random probability of an up year has been increasing over time. And so has the ability of the Santa Claus rally to correctly predict a coming up year.

TABLE 1: SANTA RALLY ‘FORECASTING’ SINCE 1928

Source: McClellan Financial Publications

But for an indicator to be worth anything, it must beat the random chance of an event, and this is where this particular omen is not all that prescient. Looking at the data more closely we find that the presence of a Santa Claus rally is just an OK predictor for an up year to follow, just barely beating the random probability.

But the absence of a Santa Claus rally is supposed to foretell trouble in the year to follow, and this is where this particular omen comes up wanting. Since 1980, the absence of a Santa Claus rally has only correctly forecast a subsequent down year 36% of the time.

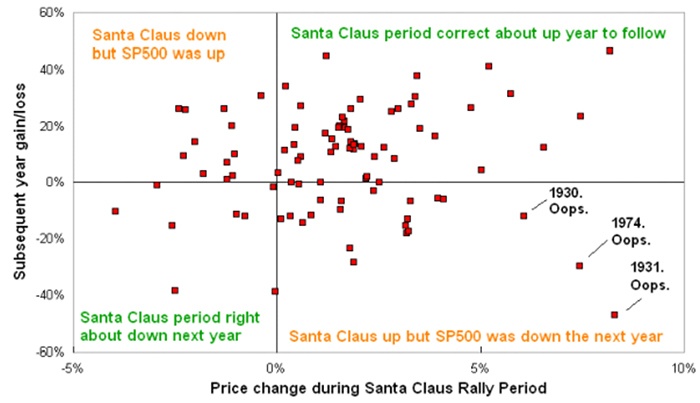

Here is a look at this relationship on a scatterplot chart (Figure 1).

FIGURE 1: PERFORMANCE OF SANTA RALLY VS. FOLLOWING YEAR’S MARKET

Source: McClellan Financial Publications

If the Santa Claus rally forecasting was correct all of the time, then we would see a uniform arrangement of the dots from lower left to upper right. The lower left quadrant is what the omen is really all about, referring to the times when the market is down in late December and how that is supposed to foretell a down year to come.

But instead, we find a lot more dots in the upper left quadrant, meaning that there were cases where the absence of a Santa Claus rally was followed by an up year for the S&P 500. In other words, it does not really live up to its billing as a bearish omen.

But it is a pretty good bullish signal when that period sees a gain. The presence of a Santa Claus rally has a slightly better than random track record of foretelling an up year to follow. I should emphasize slightly.

It would be great if we could have formulaic tendencies that predict the future, and even better if they would rhyme. Humans have a proven tendency to believe statements more if they rhyme. That is why traders believe in Wall Street sayings like “sell in May and go away.” In this case, however, the historical tendency is just better than random on the upside, and wholly deficient on the downside.

I thought you should know the facts.

The opinions expressed in this article are those of the author and do not necessarily represent the views of Proactive Advisor Magazine. These opinions are presented for educational purposes only.

A version of this article was first published by McClellan Financial Publications on Jan. 4, 2019.

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com

Tom McClellan is the editor of The McClellan Market Report newsletter and its companion, Daily Edition. He started that publication in 1995 with his father Sherman McClellan, the co-creator of the McClellan Oscillator, and Tom still has the privilege of working with his father. Tom is a 1982 graduate of West Point, and served 11 years as an Army helicopter pilot before moving to his current career. Tom was named by Timer Digest as the #1 Long-Term Stock Market Timer for both 2011 and 2012. mcoscillator.com