Were market valuations too stretched to confidently invest?

Were market valuations too stretched to confidently invest?

Bull market or bear, Wall Street always has a “wall of worry” to navigate. The discipline of active investment management may help.

Among the many investment methodologies used on Wall Street, there are two very popular yet diverse approaches to investment management, with sound data to support each. The first makes the case to purchase undervalued assets that are believed to have become mispriced by the market. Often this involves buying securities that have been beaten down by some event such as a merger or acquisition, a bankruptcy, a poor earnings or sales report, or a misinterpretation of future demand.

The second approach is more growth- and momentum-oriented, and could be classified as trend following. Where a value approach searches for laggards, the trend-following approach looks for winners. The philosophy of trend followers is that winners often continue to win, and whatever momentum was moving them upward will continue until there is a sign of a reversal. Value investors are skeptical of the additional appreciation potential of an asset that has already been bid up. They are looking for bargains and the margin of safety that they perceive comes from purchasing an asset at a discount.

To a value investor the acquisition cost is paramount. For trend followers, market momentum supersedes valuation. A trend follower operates with the belief that whatever led to an asset’s value being beaten down will continue.

Reconciling these two opposing philosophies is a challenge. On the one hand, science proves that a body in motion tends to stay in motion. This clearly supports the trend followers. However, science and math also clearly support the principle of a reversion to the mean. Applying this principle to investments suggests periods of lower returns are systematically followed by periods of higher returns and vice versa. This means that if a security, overall market index, or asset class has experienced a period of unusually high returns, it is likely to revert to the mean. This runs afoul of the mantra of trend followers.

So, who is right? And, moreover, are the two approaches mutually exclusive? I believe that they are mutually compatible and that the asset purchase price does, in fact, matter. I also believe a force in motion tends to become more energized while in motion. However, even the Energizer Bunny eventually runs out of steam.

The power behind momentum can result in trends continuing beyond reasonable expectations, causing valuations to dramatically inflate. At some point the momentum can move valuations beyond the tipping point. When market participants believe that valuations have extended beyond a tipping point, which can be triggered by external events unrelated to valuations, they cease bidding, thereby reversing the trend.

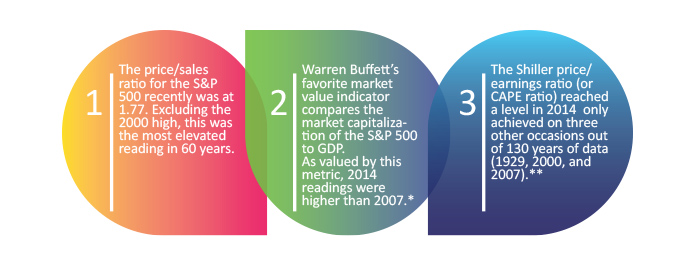

Market valuation metrics

* There should be a correlation between the stock market value and GDP. A strong stock market should correlate with strong GDP. A strong market with weak GDP indicates possible distortions.

** The Shiller cyclically adjusted price/earnings ratio (CAPE) averages annual earnings for the S&P 500 over a 10-year period to smooth out distortions that can occur in any particular year.

Recently, the Dow and S&P 500 were both trading around all-time highs. We’ve had a market that has reacted to negative economic data by surging higher, in anticipation of further stimulus—or a delay in the inevitable Fed raising of interest rates. Yet it rises on positive data as well. Regardless of whether it is central-bank-induced, manipulated, or irrationally exuberant, the fact is that the momentum has been strong enough to increase equity prices on both good and bad news. Momentum has been resilient in dismissing even the three market valuations metrics listed above.

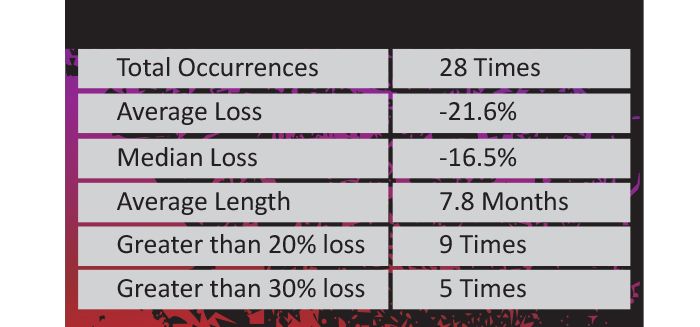

As wealth managers and students of behavioral finance, we know that clients often seek to increase and decrease risk at the worst times. In a bull market, a client might tell you that he or she can handle a 20% reduction in asset valuation. However, when the inevitable correction finally rears its head, you know that the client is likely to blame you and hold you responsible. This is the grand conundrum associated with managing clients’ money.

Those who adhere to the long-term trend-following models have historically been rewarded handsomely, particularly during the last two years. There is a huge debate as to whether today’s market is fairly valued or overvalued. Only time will tell. But, there are few who would argue that it is undervalued and that bargains abound.

If this momentum continues and prices continue their ascent, at some time an inflection point will surely come. We intuitively know this. And therein lies the rub. If we allocate offensively to capture ongoing upside potential, we risk either losing principal or embedded gains if that inflection point comes sooner rather than later. Yet, if we refrain from investing so as to limit risk and to keep our powder dry, we risk underperforming and alienating our clients as a result.

For me, the distortions in markets that have resulted from quantitative easing have become more extreme and harder to navigate than even the dot-com era. I fight the battle between momentum and fair valuation and fundamentals every single day. I believe that momentum has pushed prices too high, too fast, and beyond fair valuation. A similar situation occurred with house prices from 2000-2007, as they increased much longer than what was reasonable.

My point is that we should not be surprised by further significant market corrections, but none of us knows when they will occur and what will incite a specific inflection point. It’s questionable how much more runway can possibly exist for stocks and bonds. Yet, interest rates through traditional perceived safe havens, such as money markets or CDs, present a losing proposition even during this period of low inflation.

S&P 500 losses of 10% or more since 1950

Within this context, I am only comfortable allocating to actively managed strategies. I want managers who are nimble enough to act on data in real time and can respond accordingly. For me, this is not the time for buy-and-hold but rather buy-and-monitor investing. I seek active managers who are unconstrained, unbiased, and unemotional with an extensive toolbox that includes more than long-only stock and bond positions. I want that toolbox to include, in addition to equities and fixed income, other means of realizing positive performance in other asset classes.

With a stock market that has nearly tripled in five years, where fundamentals have been shrugged off and hope has been pegged to the indefinite continuation of monetary stimulus, criticism of active investment management is certainly in vogue. Right now, passive investing, as promoted by the herd (and the financial media), is said to be “winning.” However, there are many more innings, and the reasons for active management will once again be realized as the full market cycle completes.

When values capitulate and trends revert, active managers who stayed with their discipline will likely become vindicated once again. Now is the time to hold firm to our convictions and lead—as opposed to following the herd.

Gregory Gann is a registered representative with, and securities are offered through, LPL Financial, member FINRA/SIPC.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. The opinions expressed in this material do not necessarily reflect the views of LPL Financial or Proactive Advisor Magazine.

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com

Gregory Gann has been an independent financial advisor since 1989. He is president of Gann Partnership LLC, based in Baltimore, Maryland. Gann Partnership provides objective, unbiased financial planning and active investment management for individuals, families, and businesses. (Securities offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC.) Mr. Gann also serves clients as a certified divorce financial analyst. gannpartnership.com