Weathering an investment perfect storm: How active strategies manage risk

One major point of criticism of a buy-and-hold strategy is its inability to react to potential and real downturns in the markets. Active management, on the other hand, truly shines in this area. Many active strategies manage risk—in fact, they were specifically designed for this purpose. But how does risk mitigation actually work? It is instructive to walk through several different concepts and see how they might be applied to a concrete, real-life situation.

Imagine you are invested in American insurance companies that can lose significant value if a severe hurricane strikes the U.S. How can you deal with this risk?

Buy-and-hold will literally ride out the storm, weather any drawdown, and pick up the remaining pieces of your investment in the aftermath. Sounds like fun, right?

In contrast to this roller-coaster ride, let’s take a look at the three most common risk mitigation techniques used by active management practitioners:

- Market timing

- Portfolio rotation

- Hedging

Before going further into the details, it’s important to note that these approaches are not limited to long-only strategies. They equally apply to holding inverse ETFs or outright short positions.

Market timing is focused on the decision of when to be invested in the market and when to stand on the sidelines holding cash, which is considered “risk-free” in the context of financial investments. With respect to our example, a manager might use discretion (and maybe the weather forecast) to move out of the insurance companies when there is anticipated trouble for that sector. A mechanical strategy (completely based on mathematical rules), on the other hand, might objectively gauge the performance of this market sector and sell once prices fall below a specified moving average. In either case, the position will be moved to cash either completely or partially depending on the desired level of risk exposure.

With their focus on defense, active managers have adopted numerous approaches to mitigate risk.

This concept has two main advantages. First, there are few costs involved, and second, investment-related risks can be avoided to the greatest extent possible (both the risk specific to insurance firms, but also the broader risk of U.S. companies or financial markets in general). The challenges lie in correctly identifying what could turn into volatile/losing periods: Not to be too late moving to cash, but also not to have too many false alarms, consequently missing out on a profitable investment opportunity.

Portfolio rotation can be summarized as repeatedly comparing alternatives from a limited universe of trading vehicles and then moving assets into the most favorable one(s). For our example, this could mean that the funds from the “U.S. insurance companies” position are shifted into other domestic stock market sectors, international equities, or even different asset classes. For further flexibility, most strategies and managers also add “cash” to the available alternatives, but liquid funds are typically kept at a much lower level than with market timing.

The main advantages of portfolio rotation are high exposure to investment opportunities and relatively low cost to transfer capital between positions. The flip-side is that the general market risk (all positions crashing simultaneously) is typically not avoided as well, although sector- or asset-class-specific risks can be mitigated significantly.

Hedging is based on holding a second position (called “hedge”) specifically selected to generate profits in the event the core investment decreases in value. During all other times, the hedge should preferably, of course, not lose as much as the main position gains. This requirement can be met through various alternatives. Options are one instrument that is applicable to many asset classes. They offer an unlimited profit potential (acting as protection), while confining the downside to the premium (option price). But more and different forms of hedges exist depending on the main investment. In our hurricane scenario, we might decide to hold a secondary position consisting of stocks like Wal-Mart or Home Depot that register increased sales due to preparation for and rebuilding after a storm. On the other hand, these stocks are not destined to drop simply because insurance companies soar. Constructing a hedge in this manner can also meet the objective of minimizing the performance drag on the main position.

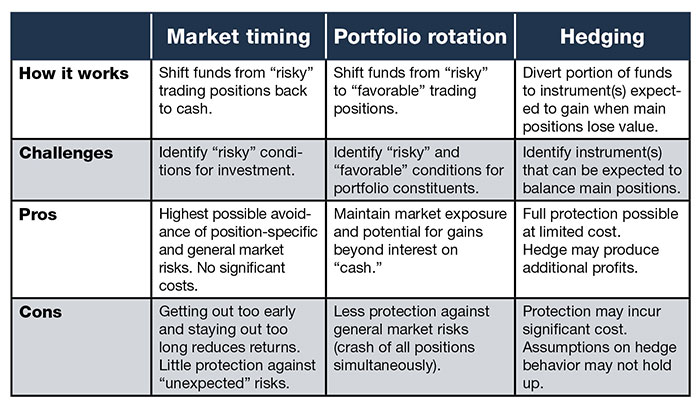

Overview of risk management approaches

The main advantage of hedging is its flexibility to cover a wide range from very strong protection at limited cost (through options) to effective risk mitigation that may even add to the overall profit. On the negative side, a hedge diverts capital from the main position, decreasing the desired exposure to market opportunities. Depending on the type of hedge, these funds may be lost completely and can be considered a “protection fee.” Conversely, hedges designed to lose as little as possible in value while the core position performs well are more difficult to find, and may be based on assumptions (e.g., Home Depot shares will rise before or after a hurricane) that may not turn out as expected.

With their focus on defense, active managers have adopted numerous approaches to mitigate risks. However, the majority can be boiled down to the three basic concepts, with numerous investment vehicles available to implement them. Understanding their characteristics as summarized in the table will help advisors assess third-party risk-management strategies and match them to their clients’ objectives.

Come rain or shine, clearly there are better ways to deal with significant market fluctuations than simply holding on and hoping for the best. With a variety of proven concepts at its disposal, active management can provide suitable risk-management solutions for any advisor and his or her clients—even when a major storm appears to be forming on the horizon.

Thomas Krawinkel, MBA&E, was a co-founder and partner at StatisTrade LLC, a trading strategy evaluation firm that worked with fund managers and family offices to evaluate and improve trading system performance using advanced statistical techniques. An engineer by training, Mr. Krawinkel has been active in the markets since the 1980s. He won the National Association of Active Investment Managers (NAAIM) 2011 Wagner Award for insights related to success factors for system performance.

Thomas Krawinkel, MBA&E, was a co-founder and partner at StatisTrade LLC, a trading strategy evaluation firm that worked with fund managers and family offices to evaluate and improve trading system performance using advanced statistical techniques. An engineer by training, Mr. Krawinkel has been active in the markets since the 1980s. He won the National Association of Active Investment Managers (NAAIM) 2011 Wagner Award for insights related to success factors for system performance.